Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

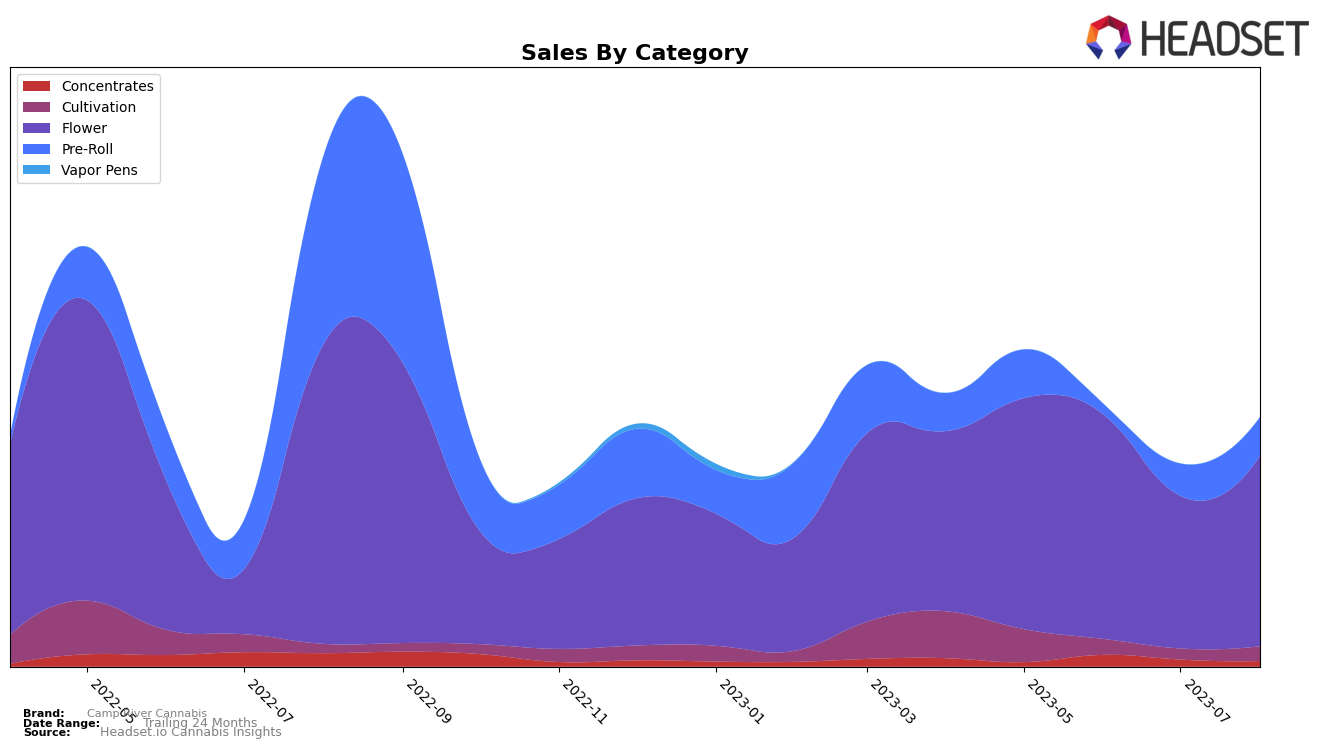

August 2023 saw some interesting movements across categories for BC-based brand, Camp River Cannabis. In the Concentrates category, the brand climbed from a rank of 45 in May to 41 in August, indicating a steady improvement in performance. However, the brand's rank in the Flower category fluctuated, peaking at 55 in June and July, before falling to 56 in August. Notably, the brand did not rank in the top 20 for the Pre-Roll category in August, which could indicate a potential area for improvement.

In other provinces, Camp River Cannabis showed varied performance. Over in ON, the brand held steady in the Concentrates category, ranking 80 in August, while in the Cultivation category, the brand maintained a strong position, consistently ranking 4 from May through August. Most impressively, in SK, Camp River Cannabis dominated the Cultivation category, maintaining the top rank from May through August. This consistent high performance could indicate a strong demand for the brand's cultivation products in SK.

Aug-2023 Rank

Concentrates

Flower

Pre-Roll

Cultivation

BC

41

56

⊝

⊝

ON

80

⊝

⊝

4

SK

⊝

⊝

⊝

1

Competitive Landscape

In the Flower category within BC, Camp River Cannabis has experienced a fluctuating rank over the past few months. In May and June 2023, it maintained a steady rank at 55, but saw a significant drop to 71 in July before rebounding to 56 in August. In comparison, Twd. has been steadily increasing in rank, while Mood Ring experienced a significant jump in rank from 96 in June to 48 in August. Carmel has been fairly consistent in its ranking, but Organnicraft has seen a slight increase in rank. In terms of sales, Camp River Cannabis saw a dip in July 2023, but has since recovered in August. This is in contrast to Mood Ring, which saw a significant increase in sales, and Twd., Carmel, and Organnicraft, which have seen more consistent sales figures.

Notable Products

In August 2023, the top-performing product from Camp River Cannabis was 'Animal Cookies (3.5g)', maintaining its top ranking from previous months and achieving sales of 1708 units. The second-best selling product was 'Animal Cookies Milled (7g)', also maintaining its ranking from the previous months. 'Gorilla Breath Pre-Roll 3-Pack (1.5g)' climbed up one spot from the previous month to secure the third position. 'Lemon Meringue (3.5g)' dropped one spot from July to August, ranking fourth. The fifth rank was taken by the 'Licorice Kush Pre-Roll 3-Pack (1.5g)', a new entrant in the top five list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.