Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

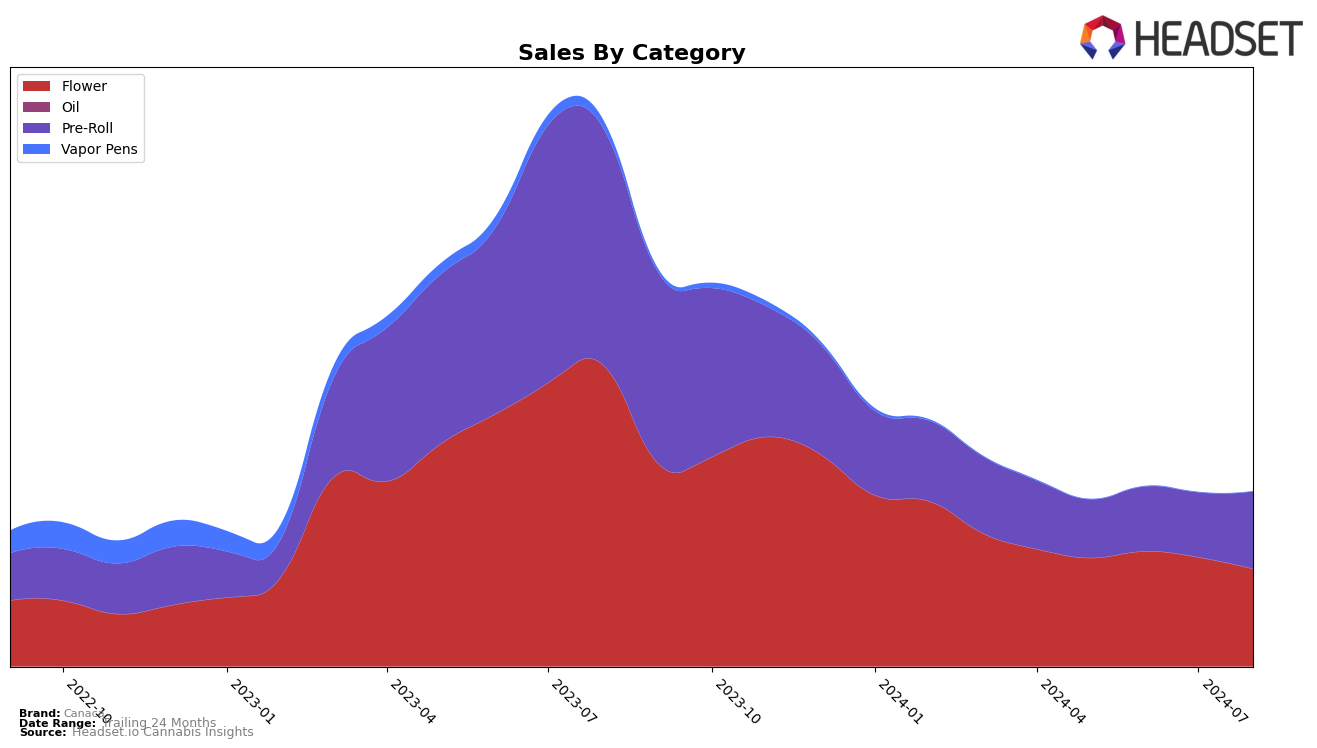

Canaca's performance across Canadian provinces shows a mix of stability and fluctuation in different categories. In Alberta, Canaca's Flower category has seen a gradual decline in rankings from 23rd in May 2024 to 27th by August 2024, accompanied by a consistent decrease in sales figures. This downward trend is mirrored in the Pre-Roll category, where Canaca did not make it into the top 30 rankings, indicating a potential area of concern. In contrast, in British Columbia, the Flower category showed a positive trajectory, improving from 73rd in June to 51st in August, suggesting a growing market presence despite not being in the top 30 in May. The Pre-Roll category in British Columbia also demonstrated resilience, maintaining relatively stable rankings with minor fluctuations.

In Ontario, Canaca's Flower category maintained a consistent presence within the top 40, fluctuating slightly but remaining in the 32nd position in both May and August 2024. The Pre-Roll category in Ontario showed promising growth, climbing from 42nd in May to 33rd in August, with a notable increase in sales figures in the latter month. Meanwhile, in Saskatchewan, Canaca's Flower category managed to stay within the top 40 rankings in May and June but did not rank in July and August, indicating a potential drop in market competitiveness or sales. These trends highlight Canaca's varying performance across different regions and categories, offering insights into potential areas for strategic focus and improvement.

Competitive Landscape

In the Ontario Pre-Roll category, Canaca has shown a fluctuating performance in terms of rank over the past few months, moving from 42nd in May 2024 to 33rd in August 2024. This upward trend in rank is indicative of a positive shift in market presence, although Canaca still trails behind competitors such as FIGR and Common Ground, which consistently rank higher. Notably, Shatterizer has also shown a significant improvement, climbing from 43rd to 31st within the same period. Despite the competitive landscape, Canaca's sales have seen a substantial increase, particularly in August 2024, where they reached 437,223 CAD, reflecting a strong market demand. This positive sales trajectory suggests that Canaca is effectively capturing consumer interest, although continued strategic efforts will be necessary to further elevate its rank and compete more closely with higher-ranking brands like Sheeesh!, which also experienced a notable rise in sales and rank.

Notable Products

In August 2024, the top-performing product for Canaca was Darts - Fruitsplosion Pre Roll 10-Pack (4g), maintaining its first-place ranking for four consecutive months with sales reaching 19,167 units. Blueberry Donuts (7g) held steady in second place, despite a slight drop in sales from July to August. Darts - Berries & Cream Pre Roll 10-Pack (4g) consistently ranked third over the same period, showing a recovery in sales with 4,763 units sold in August. Darts - Magic Mochaccino Pre-Roll 10-Pack (4g) climbed back to fourth place after briefly dropping to fifth in July. Blend 14 Pre-Roll 3-Pack (1.5g) entered the top five in July and maintained its fifth position in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.