Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

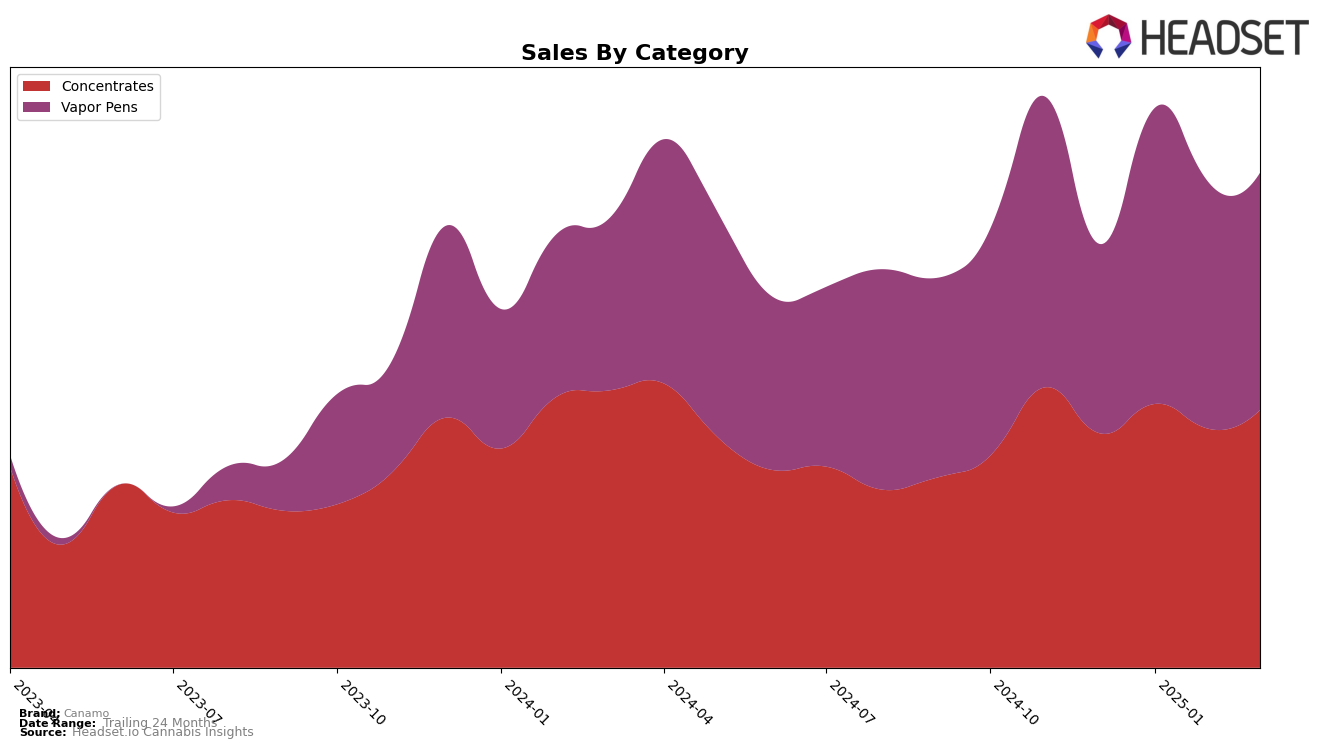

Canamo has shown a strong and consistent performance in the Concentrates category in Arizona, maintaining a steady rank of 2nd place from December 2024 through March 2025. This stability indicates a solid foothold in the market, suggesting that their product offerings in this category continue to resonate well with consumers. However, in the Vapor Pens category within the same state, Canamo's ranking has seen slight fluctuations, moving from 12th place in December 2024 to 10th in January and February 2025, then slightly dipping back to 11th in March 2025. These movements suggest a competitive landscape where Canamo is managing to stay within the top ranks but faces challenges in climbing higher.

While Canamo's performance in Arizona is noteworthy, the absence of their ranking in other states or provinces could be interpreted in various ways. The lack of presence in the top 30 brands in categories outside of Arizona might indicate areas where the brand is either not active or not yet competitive enough to make a significant impact. This could be seen as a potential opportunity for growth if Canamo decides to expand their market reach. Their ability to maintain a top position in Arizona's Concentrates category, despite fluctuations in Vapor Pens, suggests that with strategic focus, there might be potential for similar success in other regions.

Competitive Landscape

In the competitive landscape of the concentrates category in Arizona, Canamo has consistently maintained its position as the second-ranked brand from December 2024 through March 2025. Despite the stronghold of Mohave Cannabis Co. in the top position, Canamo's steady rank indicates a solid market presence and customer loyalty. However, the brand faces increasing competition from Drip Oils + Extracts, which has improved its rank from fifth in December 2024 to third by March 2025, and IO Extracts, which fluctuated between third and sixth place during the same period. These shifts suggest a dynamic market where Canamo must continue to innovate and differentiate to maintain its standing and potentially challenge the leading position of Mohave Cannabis Co.

Notable Products

In March 2025, Superboof Shatter (1g) emerged as the top-performing product for Canamo, securing the first rank in the Concentrates category with sales of 1571 units. Following closely, Greasy Garlic Shatter (1g) and Sour Diesel Badder (1g) took the second and third positions, respectively. Rainbow Gelato Live Badder (1g) ranked fourth, while Wedding Cake Liquid Live Resin Disposable (1g) led the Vapor Pens category at fifth place. Notably, these products were not ranked in the previous months, indicating a significant rise in popularity and sales for March. This shift highlights a potential trend in consumer preference towards these specific concentrates and vapor pens.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.