Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

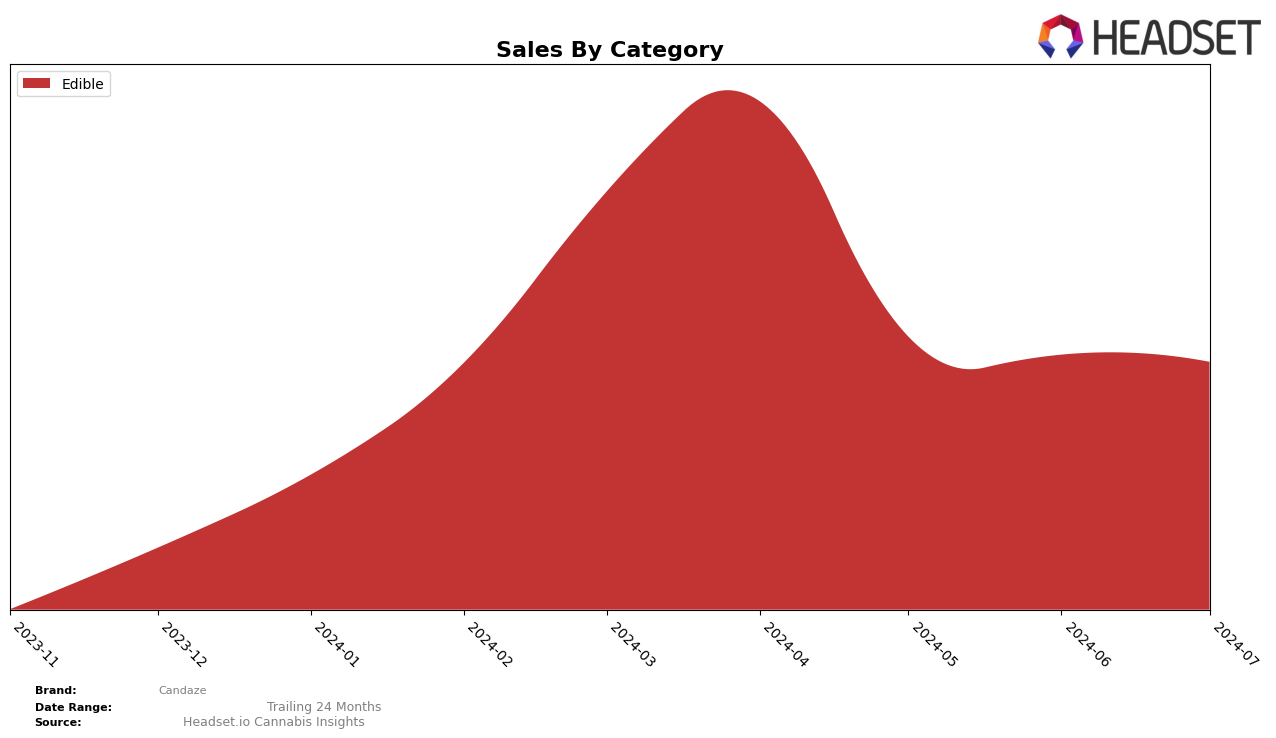

Candaze has experienced notable fluctuations in its performance across various states and categories in recent months. In Colorado, the brand's ranking in the Edible category has seen a downward trend, slipping from 21st in April to 30th by July. This decline is indicative of a challenging market environment or increased competition within the state. Despite this, Candaze managed to maintain its presence within the top 30 brands, which suggests a resilient brand awareness and consumer base in Colorado.

On a broader scale, the absence of Candaze from the top 30 rankings in other states and categories could be seen as a significant area for improvement. This lack of presence highlights potential opportunities for market expansion and brand growth outside of Colorado. The sales figures in Colorado also reflect a consistent, albeit slight, decrease over the months, which could be a signal for the brand to reassess its strategies to bolster its standing and sales performance. The trend indicates a need for strategic adjustments to regain momentum and improve rankings in the competitive cannabis market.

Competitive Landscape

In the competitive landscape of the Colorado edible cannabis market, Candaze has experienced notable fluctuations in its rank and sales over the past few months. Despite a strong start in April 2024 with a rank of 21, Candaze saw a decline to 30 by July 2024. This drop in rank is significant when compared to competitors such as Dutch Girl and Olio, which have shown more stable or improving trends. For instance, Dutch Girl, while not in the top 20, maintained a relatively consistent position around the 27-30 range, and Olio even saw a notable improvement from 36 in May to 26 in June. Additionally, Spinello Cannabis Co. improved its rank from 33 in April to 28 by July, indicating a positive trend. These shifts suggest that while Candaze remains competitive, it faces strong pressure from other brands that are either stabilizing or improving their market positions. Understanding these dynamics can provide valuable insights for strategic adjustments to regain and maintain a higher rank in the market.

Notable Products

In July 2024, the top-performing product for Candaze was Dipz - Orange Dream Rosin Gummies 10-Pack (100mg), maintaining its first-place ranking from June with sales of 536 units. Dipz - Chocolate Cherry Rosin Gummies 10-Pack (100mg) held steady in second place, consistent with its ranking from May and June. Sub Zero Live Rosin Gummies 10-Pack (100mg) made an impressive debut at third place with 296 units sold. Dipz - Caramel Apple Rosin Gummies 10-Pack (100mg) remained in fourth place, showing a slight increase in sales from 190 units in June to 207 units in July. Lastly, Dipz - Berries & Cream Rosin Gummies 10-Pack (100mg) entered the rankings in fifth place with 197 units sold in July.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.