Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

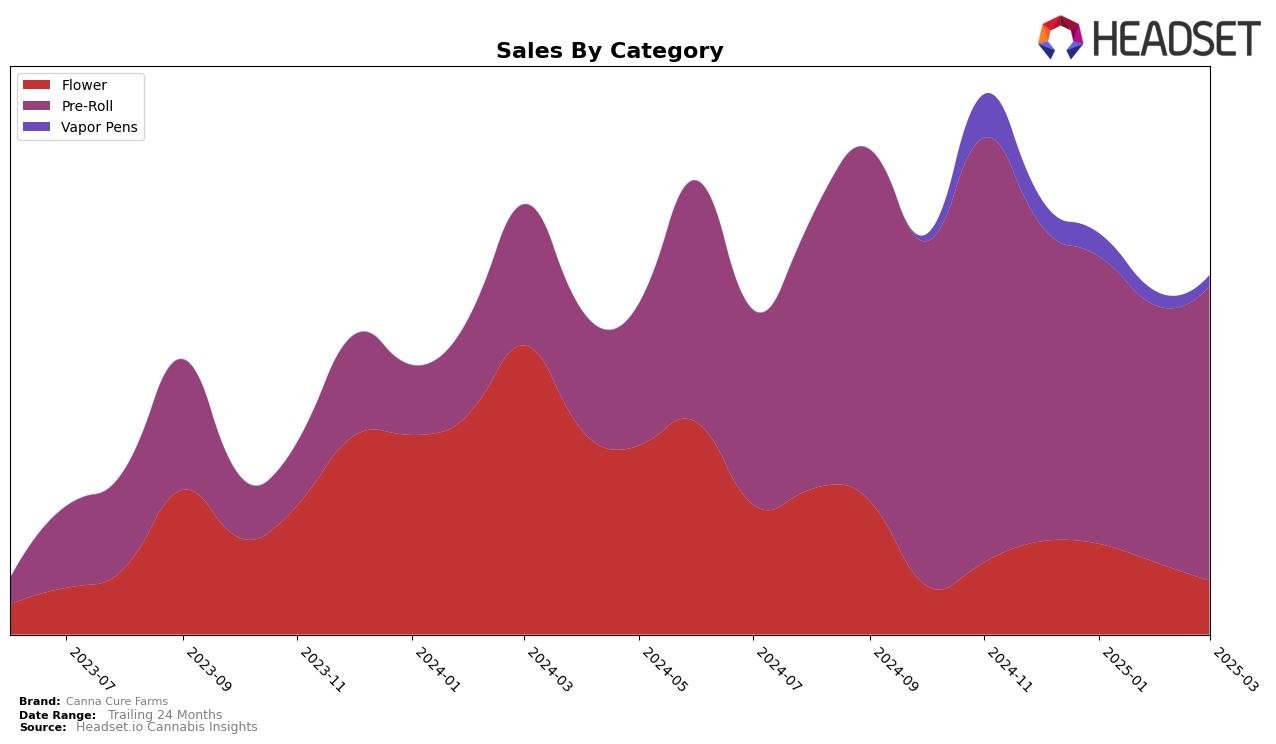

In the competitive landscape of cannabis brands, Canna Cure Farms has exhibited varied performance across different categories in New York. In the Flower category, the brand did not manage to break into the top 30, with rankings slipping from 48th in December 2024 to 74th by March 2025. This downward trend in rankings is mirrored by a notable decline in sales over the same period. In contrast, the Pre-Roll category paints a more stable picture, where Canna Cure Farms consistently maintained a position within the top 11, despite a slight dip from 8th to 11th between January and February 2025. This indicates a strong foothold in the Pre-Roll market, even as other categories show volatility.

For Vapor Pens, Canna Cure Farms faced challenges in maintaining a competitive position, with rankings hovering just outside the top 60 and eventually declining to 76th by March 2025. This category shows a consistent drop in sales, reflecting perhaps a need for strategic adjustments to regain momentum. The brand's absence from the top 30 in both the Flower and Vapor Pens categories suggests potential areas for growth or reevaluation. However, the steady performance in the Pre-Roll category might provide a foundation upon which Canna Cure Farms can build and expand its influence in other segments of the New York cannabis market.

Competitive Landscape

In the competitive landscape of the New York pre-roll market, Canna Cure Farms has experienced notable fluctuations in its ranking and sales performance over the past few months. Starting from December 2024, Canna Cure Farms held a solid 9th position, but by February 2025, it had slipped to 11th, where it remained in March 2025. This decline in rank coincided with a decrease in sales, contrasting with competitors like Ayrloom, which improved its rank from 10th to 8th and saw an upward sales trend. Meanwhile, Toast maintained a relatively stable position, fluctuating between 8th and 10th, while Heady Tree showed a similar pattern to Canna Cure Farms, ending March 2025 in 12th place. Supernaturals New York remained outside the top 10, indicating a less competitive threat. These dynamics suggest that Canna Cure Farms needs to strategize effectively to regain its competitive edge and enhance its market position.

Notable Products

In March 2025, Strawberry Runtz Pre-Roll (1g) maintained its position as the top-selling product for Canna Cure Farms, demonstrating consistent performance with sales figures reaching 6,903 units. Black Cherry Guava Pre-Roll (1g) also held steady at the second spot, reflecting stable consumer preference. Blue Zushi Pre-Roll (1g) experienced a notable rise to third place from its fifth position in February, indicating growing popularity. Bee Jelly Pre-Roll (1g) entered the rankings in March, securing the fourth position, while Colorado Chem Pre-Roll (1g) dropped from third to fifth place, showing a slight decline in sales momentum. Overall, the Pre-Roll category continues to dominate the sales landscape, with minor shifts in product rankings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.