Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

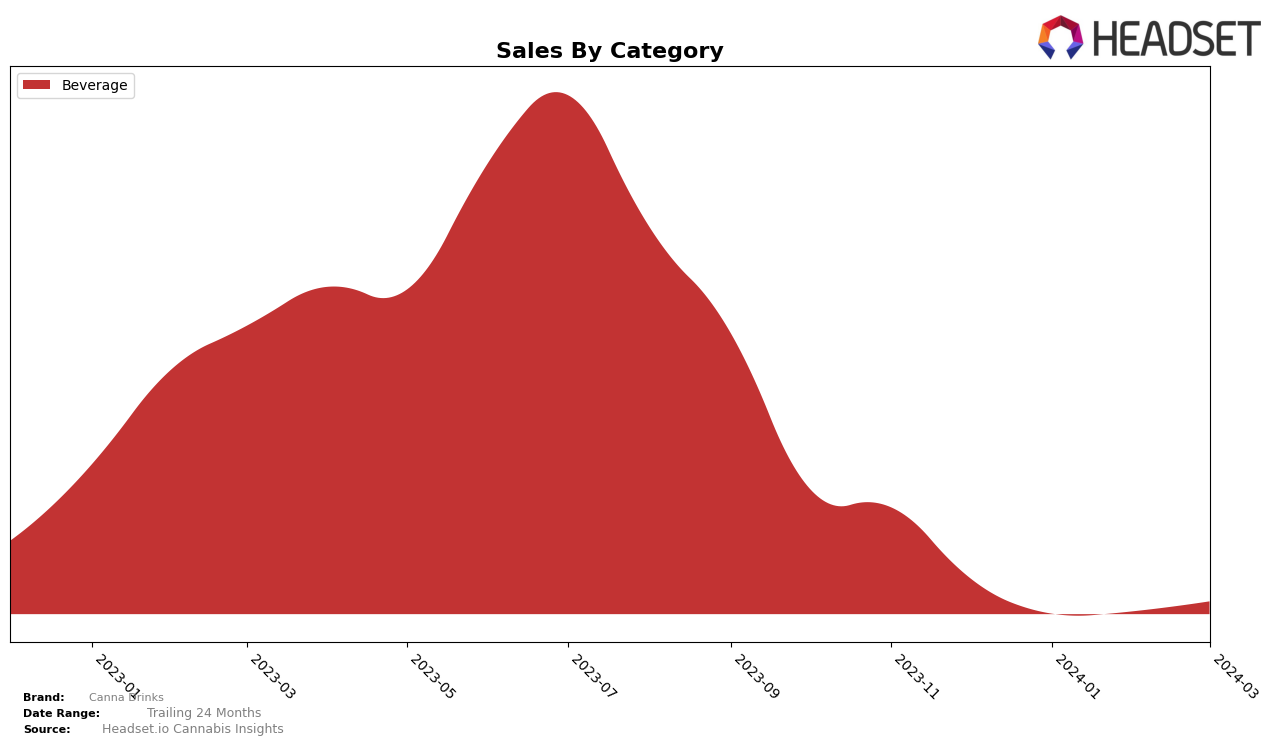

In the competitive landscape of cannabis-infused beverages, Canna Drinks has shown a noteworthy performance in Massachusetts, navigating through the fluctuations inherent in the market. Starting from December 2023 and moving into March 2024, Canna Drinks experienced a slight dip in its ranking within the top 30 brands, dropping from 27th to 30th place before making a commendable recovery to 24th position by March. This trajectory indicates a resilience and potential for growth amidst the highly competitive beverage category. The sales figures underscore this narrative, with a notable increase from 118 units sold in January 2024 to 1116 units by March, suggesting an effective strategy or campaign that significantly boosted its market share during this period.

However, the journey of Canna Drinks in the Massachusetts market also highlights areas of concern and opportunity. The initial drop in rankings from December 2023 to February 2024, where they nearly fell out of the top 30, signals a potential vulnerability or a need for adjustment in their market approach. This period of fluctuation could reflect several factors, including consumer preferences, competitive actions, or operational challenges. Despite this, the significant sales rebound in March 2024, without disclosing specific figures, suggests that Canna Drinks managed to effectively address these challenges, possibly through marketing efforts, product innovation, or improved distribution strategies. This performance is a clear indicator of the brand's adaptability and potential for further growth in the evolving cannabis beverage sector in Massachusetts.

Competitive Landscape

In the competitive landscape of the Beverage category in Massachusetts, Canna Drinks has experienced notable fluctuations in its ranking over the recent months, indicating a volatile position within the market. Starting at the 27th position in December 2023, it dropped to 28th in January 2024, further descended to 30th in February, before making a slight recovery to 24th in March 2024. This trajectory suggests a struggle to maintain a consistent market share amidst fierce competition. Notably, Upstate Elevator Operators has shown a stronger performance, maintaining higher ranks and showcasing a more stable sales trend, which could indicate a more solid market positioning. Similarly, Ocean Breeze and MXR have demonstrated resilience, with Ocean Breeze making a significant recovery in March. In contrast, NectarBee, despite entering the rankings only in March, has shown promising initial sales figures. Canna Drinks' fluctuating performance, especially in comparison to these competitors, highlights the challenges it faces in securing a stronger foothold in the Massachusetts beverage market.

Notable Products

In March 2024, Canna Drinks saw Blackberry Zinger Soda (5mg) securing the top spot in sales within the Beverage category, with a notable sales figure of 351 units. This product climbed from the third position in December 2023 to first in March 2024, showcasing significant growth in popularity. Previous top performers like Cannajito - THC Infused Mojito Mocktail and Cannarita - THC Infused Watermelon Flavored Margarita Mocktail, which were leading in earlier months, did not make it to the top ranks in March. Interestingly, Cannacolada - THC Infused Pina Colada Mocktail, which was fourth in December 2023, also did not rank in March 2024. This shift highlights a dynamic change in consumer preferences within the Beverage category of Canna Drinks, emphasizing the rising demand for Blackberry Zinger Soda.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.