Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

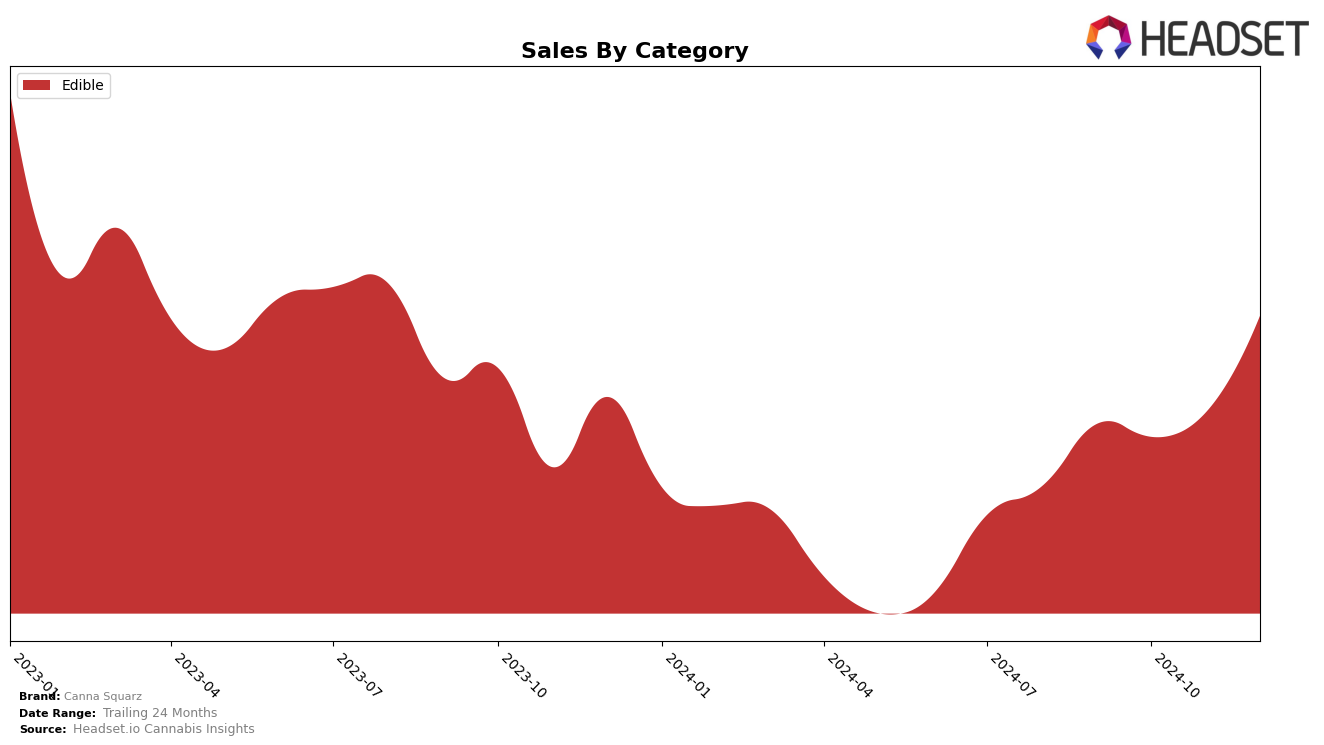

Canna Squarz has demonstrated notable fluctuations in its performance across different categories and regions, particularly in Alberta. In the Edible category, Canna Squarz saw a positive upward trend towards the end of 2024. Starting from a rank of 16 in September, the brand experienced a slight dip to 19 in October but recovered to rank 18 in November and further improved to 14 by December. This upward movement suggests a growing consumer preference for Canna Squarz's edible products, as evidenced by a significant increase in sales from October to December. Such trends may indicate successful marketing strategies or product offerings that resonate well with the local market.

While Canna Squarz has made strides in Alberta, it is important to note that the brand's presence in other states or categories isn't as prominent, given the absence of ranking data. This lack of visibility in the top 30 rankings outside of Alberta could suggest either a focused strategy on the Alberta market or challenges in penetrating other regions or categories. The data highlights the importance of regional strategies and the potential benefits of expanding successful strategies from Alberta to other markets. The brand's ability to climb the rankings in Alberta's edible category might serve as an encouraging sign for potential growth elsewhere if similar efforts and resources are allocated.

```Competitive Landscape

In the competitive landscape of the Edible category in Alberta, Canna Squarz has experienced a dynamic shift in its market position over the last few months. Starting from a rank of 16 in September 2024, Canna Squarz saw a dip to 19 in October, before climbing back to 14 by December. This fluctuation in rank suggests a competitive market environment, with brands like Wildflower and Lord Jones making significant strides. Notably, Wildflower improved its rank from 21 to 12, indicating a strong upward trend in sales and market presence. Meanwhile, Edison Cannabis Co experienced a decline from 6 to 11, which may have opened opportunities for Canna Squarz to regain its footing. The sales trends suggest that while Canna Squarz is holding its ground, the brand needs to strategize effectively to counter the rising competition and capitalize on the market's evolving dynamics.

Notable Products

In December 2024, Canna Squarz's top-performing product was Mini Doughnuts Full Spectrum White Chocolate (10mg), maintaining its number one rank for four consecutive months with a notable sales figure of 4,852 units. Orange Dreamsicle Full Spectrum White Chocolate Bite (10mg) continued to hold the second position, showing consistent performance since October. Rootbeer Float Full Spectrum Chocolate (10mg) secured the third spot, although its sales slightly decreased from November. Peanut Butter Full Spectrum Chocolate (10mg) rose to fourth place, showing a significant increase in sales compared to previous months. Meanwhile, Key Lime Pie Full Spectrum White Chocolate (10mg) remained in fifth place, experiencing a dip in sales since September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.