Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

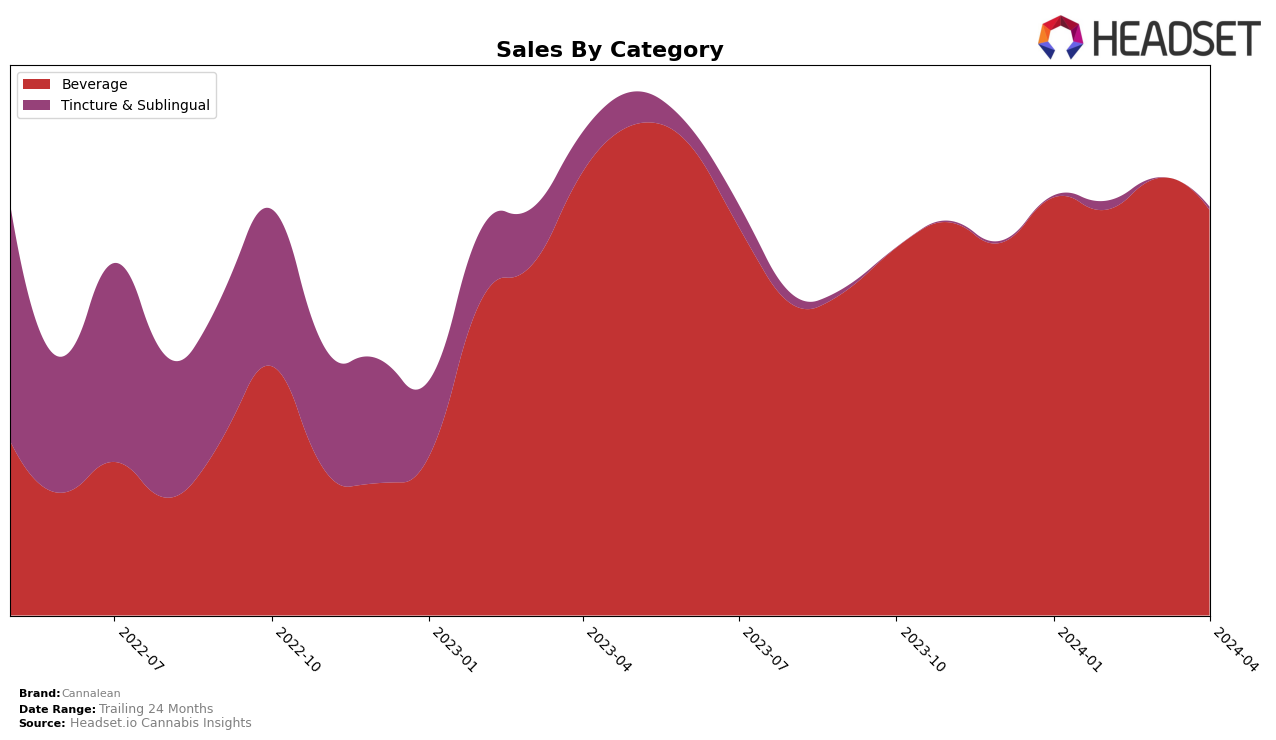

In California, Cannalean has shown a consistent performance in the Beverage category, maintaining a top 10 presence throughout the first quarter of 2024. Starting the year at rank 6 in January and holding steady through March indicates a stable demand for their products among consumers. A slight dip to rank 7 in April could suggest a minor shift in consumer preferences or an increase in competition within the category. Notably, their sales in January began at 232,125.0 dollars, demonstrating significant market traction. This stability in ranking, coupled with a sales peak in March to 250,998.0 dollars, suggests that Cannalean has effectively maintained its market share amidst the dynamic landscape of California's cannabis market.

However, the absence of Cannalean in the top 30 brands across other states or provinces for the same period indicates a focused or limited market presence. The consistent rankings within California's Beverage category highlight Cannalean's strong positioning within this specific market segment. Yet, the lack of visibility in other regions could be viewed as an area for potential growth or an indication of strategic market concentration. The slight ranking decrease in April, while minimal, could signal the need for Cannalean to innovate or adjust strategies to continue competing effectively in the highly competitive California market. This observation, combined with their sales trends, provides a nuanced view of their current standing and potential areas for strategic adjustments.

Competitive Landscape

In the competitive landscape of the beverage category in California, Cannalean has shown a consistent performance, maintaining its position in the middle of the pack among the top 20 brands. Notably, Cannalean ranked 6th in January, February, and March of 2024, before slightly dropping to 7th in April. This slight shift in rank comes amidst varying performances from its competitors. For instance, Manzanita Naturals has seen a steady rise, maintaining the 5th position from February through April, indicating a stronger hold in the market with higher sales figures compared to Cannalean. On the other hand, Lagunitas, which started stronger in January, experienced a dip in February and March but managed to climb back above Cannalean by April. Meanwhile, Almora Farms and Not Your Father's Root Beer have shown significant upward mobility, closing the gap and threatening Cannalean's position with their rapid rise in ranks and sales. This competitive analysis underscores the importance of monitoring both rank and sales trends, as Cannalean's stable rank belies the dynamic shifts and pressures from rising competitors in the California beverage market.

Notable Products

In Apr-2024, Cannalean's top-performing product was Xtreme- OG Syrup (1000mg THC, 2oz, 60ml) in the Beverage category, maintaining its number one rank across the previous months with sales of 2743 units. Following closely, Xtreme -Watermelon Syrup (1000mg THC, 60ml, 2oz) secured the second rank, climbing one position from the previous month. The third spot was taken by Canna Lean x Don Primo - Sugar Free Syrup (1000mg THC, 200ml, 7oz), showing a slight improvement in its ranking from fourth to third. Xtreme- Grape Syrup (1000mg THC,60ml, 2oz) came in fourth, experiencing a slight dip from its previous second-place ranking. Notably, all top products belong to the Beverage category, indicating a strong market preference within this segment for Cannalean.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.