Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

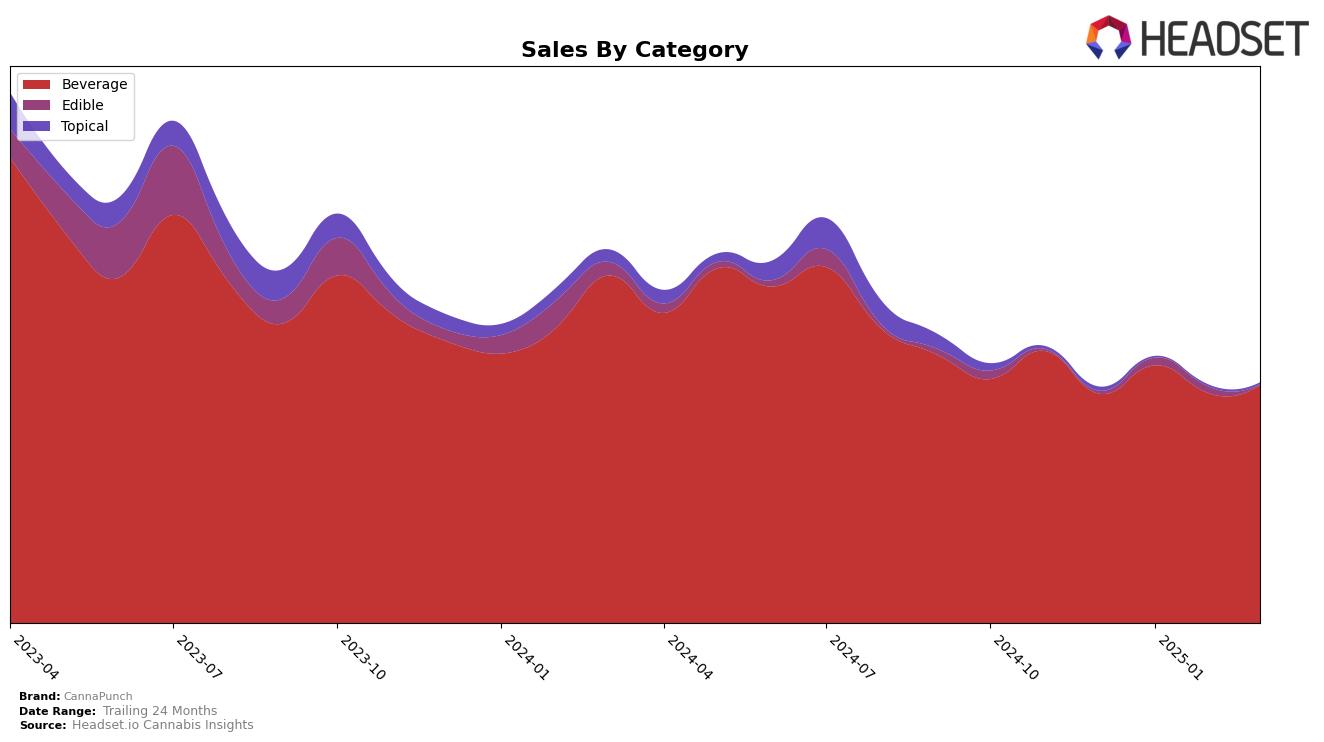

In the state of Colorado, CannaPunch has shown a consistent performance in the Beverage category. Ranking at 6th place in December 2024, the brand improved its position to 4th in January and February 2025, before slightly dropping to 5th in March. This slight dip in March should not overshadow the brand's overall upward trajectory, as evidenced by the increase in sales from December to January. The ability to maintain a top 5 position for three consecutive months indicates a strong foothold in the Colorado beverage market, suggesting a solid consumer base and effective market strategies.

It's noteworthy that CannaPunch does not appear in the top 30 rankings for any other states or provinces during this period, which could imply a concentrated focus on the Colorado market or potential challenges in expanding their reach. This absence from other markets, while potentially limiting in scope, allows CannaPunch to dedicate resources and strategies towards maintaining and potentially improving their position within Colorado. The brand's singular focus on the Colorado beverage sector could be a strategic decision to capitalize on market familiarity and consumer loyalty, but it also highlights an area for potential growth and expansion into other states.

Competitive Landscape

In the competitive landscape of the beverage category in Colorado, CannaPunch has demonstrated a resilient performance, maintaining a strong presence among the top brands. As of March 2025, CannaPunch ranks 5th, a slight dip from its 4th place position in January and February 2025. This fluctuation in rank is notably influenced by the consistent performance of Dixie Elixirs, which has held a steady 3rd place throughout the same period, indicating a robust market position with higher sales figures. Meanwhile, Ript has shown a positive trend, climbing to 4th place in March 2025, surpassing CannaPunch. Despite these shifts, CannaPunch's sales have shown a healthy upward trend from December 2024 to March 2025, suggesting a stable consumer base and effective marketing strategies. The absence of Major and Dialed In Gummies from the top ranks in recent months further highlights the competitive edge maintained by CannaPunch in this dynamic market.

Notable Products

In March 2025, CannaPunch's top-performing product was Black Cherry Fusion (100mg) in the Beverage category, maintaining its number one rank from the previous month with sales of 782 units. Grand Daddy Grape Zero Punch Drink (100mg) held steady in the second position, showing a slight improvement in sales from February. Pineapple Mango Drink (100mg) climbed to the third rank, up from fourth in February, indicating a positive trend in customer preference. Blue Raspberry Sour Punch Drink (100mg) remained in the fourth spot, despite a decrease in sales compared to earlier months. Hybrid Watermelon Nectar (100mg) maintained its fifth position, showing a consistent pattern over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.