Oct-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

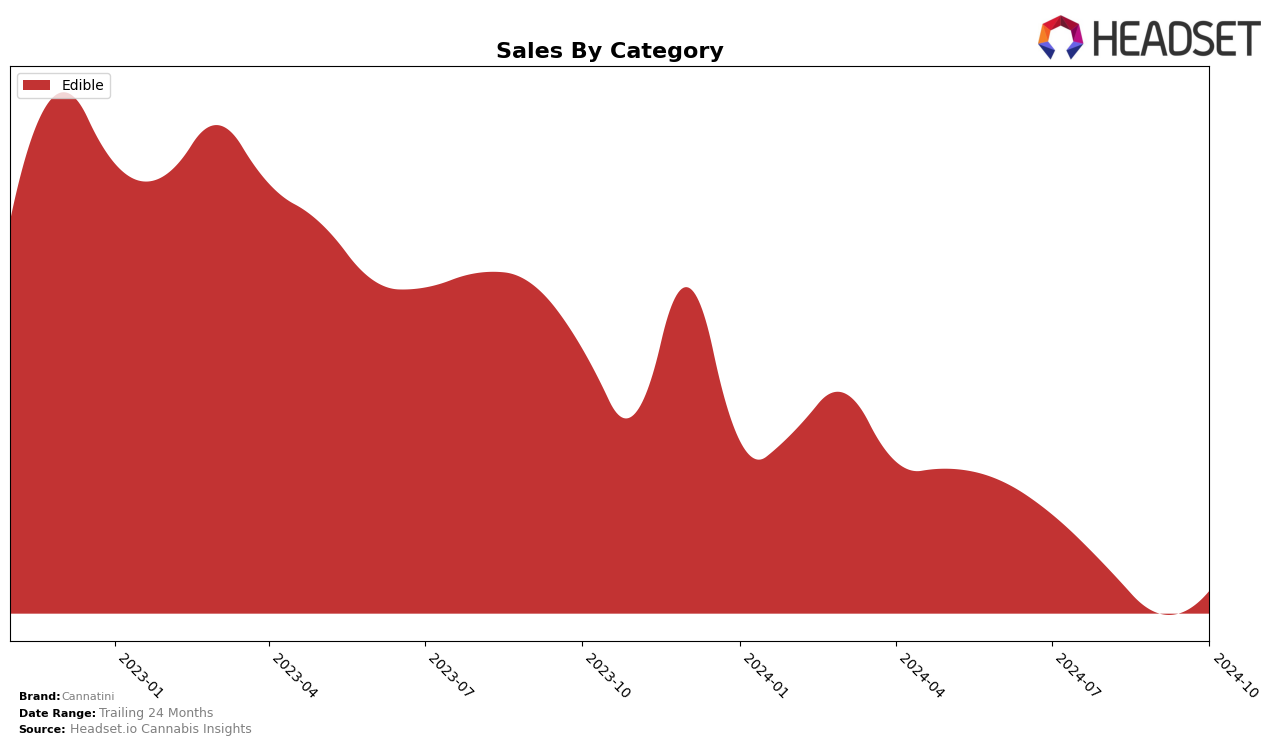

In the edible category, Cannatini has shown fluctuating performance in Massachusetts over the past few months. Starting in July 2024, they held the 18th position, but by October 2024, they had slipped to 22nd. This downward trend in ranking reflects a decline in sales, with the most notable drop occurring between July and September. Despite this, Cannatini managed to regain some ground in October, indicating potential for recovery. However, their absence from the top 30 in any given month would signal a need for strategic adjustments to regain competitiveness in the Massachusetts market.

While Cannatini's performance in Massachusetts is mixed, it is crucial to consider how their brand presence might differ across other states or provinces. Analyzing their movements in other regions could provide insights into their overall market strategy and identify areas of strength or weakness. The edible category remains competitive, and Cannatini's ability to navigate these changes will be essential for maintaining and improving their market position. Observing their performance trends across various states could reveal whether their current strategies are effective or if they require recalibration to adapt to the evolving cannabis market landscape.

Competitive Landscape

In the Massachusetts Edible category, Cannatini has experienced notable fluctuations in its market position over the past few months. Starting from a rank of 18 in July 2024, Cannatini saw a decline to 21 in August, further slipping to 23 in September, before slightly improving to 22 in October. This downward trend in rank is mirrored by a decrease in sales from July to September, though there was a modest recovery in October. In contrast, Bite has maintained a relatively stable presence, consistently ranking around the 20th position, with sales peaking in September. Meanwhile, Joygum and I Am Edible have shown resilience, with Joygum breaking into the top 20 by October and I Am Edible maintaining a steady rank close to Cannatini. The competitive landscape suggests that while Cannatini is facing challenges in maintaining its rank, there is potential for recovery if the October sales uptick continues, especially as competitors like Harbor House Collective remain slightly behind in rank.

Notable Products

In October 2024, Cannatini's Sativa Tropical White Sangria RSO Fruit Chews 20-Pack (100mg) maintained its position as the top-performing product, consistent with its number one rank from previous months, with sales of 739 units. Indica Sour Grape Sangria RSO Chews 20-Pack (100mg) climbed to second place, improving from its September rank of fifth, with notable sales growth. Indica Sour Grape Sangria RSO Gummies 20-Pack (100mg) held steady at the third position, showing consistent performance over the past three months. The THC/THCV 1:1 Sativa Peach Tequila Sunrise RSO Chews 20-Pack (100mg THC, 100mg THCV) remained at fourth place, experiencing a slight dip in sales compared to September. A new entry, Sativa Tropical White Sangria RSO Chews 20-Pack (100mg), debuted at fifth place, adding variety to the top rankings for October.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.