Nov-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

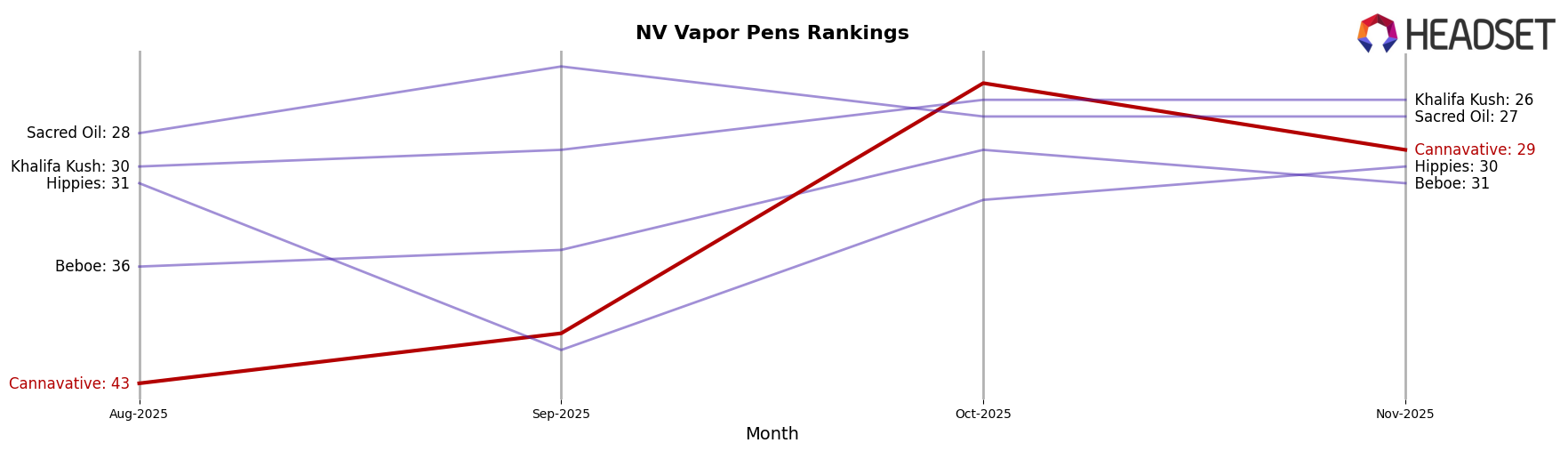

In the state of Nevada, Cannavative has shown notable fluctuations in its performance across different product categories. In the Pre-Roll category, the brand made a significant leap from being ranked 46th in August 2025 to 21st by October, before slightly dropping to 27th in November. This indicates a promising upward trend, although the dip in November suggests potential challenges or increased competition. Meanwhile, in the Vapor Pens category, Cannavative improved its ranking from 43rd in August to 25th in October, with a slight decline to 29th in November. This pattern mirrors their performance in Pre-Rolls, highlighting a consistent struggle to maintain top rankings despite initial gains. Such movements suggest that while Cannavative is making strides in penetrating the market, maintaining a stronghold remains a challenge.

Despite these fluctuations in rankings, Cannavative's sales figures tell an intriguing story. The brand experienced an impressive increase in sales for both Pre-Rolls and Vapor Pens from August to October, with Pre-Roll sales nearly doubling during this period. However, a decline in sales in November for both categories suggests that the brand may need to reassess its strategies to sustain growth and stabilize its market position. Notably, the absence from the top 30 in both categories in August highlights the brand's initial struggle to capture market share, yet their subsequent rise into the top 30 by September reflects a successful strategic shift. The challenge moving forward will be to convert these gains into consistent, long-term performance.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, Cannavative has demonstrated notable improvements in its market position from August to November 2025. Initially ranked 43rd in August, Cannavative climbed to 25th place by October, before slightly dropping to 29th in November. This upward trend in rank is mirrored by a significant increase in sales, particularly in October where sales nearly doubled compared to August. This improvement positions Cannavative favorably against competitors like Beboe, which, despite a higher rank in August, saw a less dramatic sales increase and ended November ranked 31st. Meanwhile, Khalifa Kush maintained a steady rank around the mid-20s, with sales consistently higher than Cannavative, indicating a stable market presence. Sacred Oil also maintained a stable rank in the mid-20s, but experienced a decline in sales from August to November. Cannavative's ability to improve its rank and sales amidst these dynamics highlights its growing influence in the Nevada vapor pen market.

Notable Products

In November 2025, the top-performing product for Cannavative was Resin8 - Blueberry Distillate Cartridge (0.8g), which climbed to the number one rank in the Vapor Pens category, maintaining strong sales with 480 units sold. Ice Cream Cake Pre-Roll (1g) slipped to the second position from its previous top rank in October, showing a notable decrease in sales figures compared to the previous month. White Widow Pre-Roll (1g) entered the rankings for the first time at position three in the Pre-Roll category, indicating a positive reception. Motivator - Space Admiral Infused Pre-Roll (1g) and Resin8 - Pineapple Distillate Cartridge (0.8g) both made their debut at rank four in their respective categories. This shift in rankings highlights a dynamic change in consumer preferences towards new and existing product lines.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.