Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

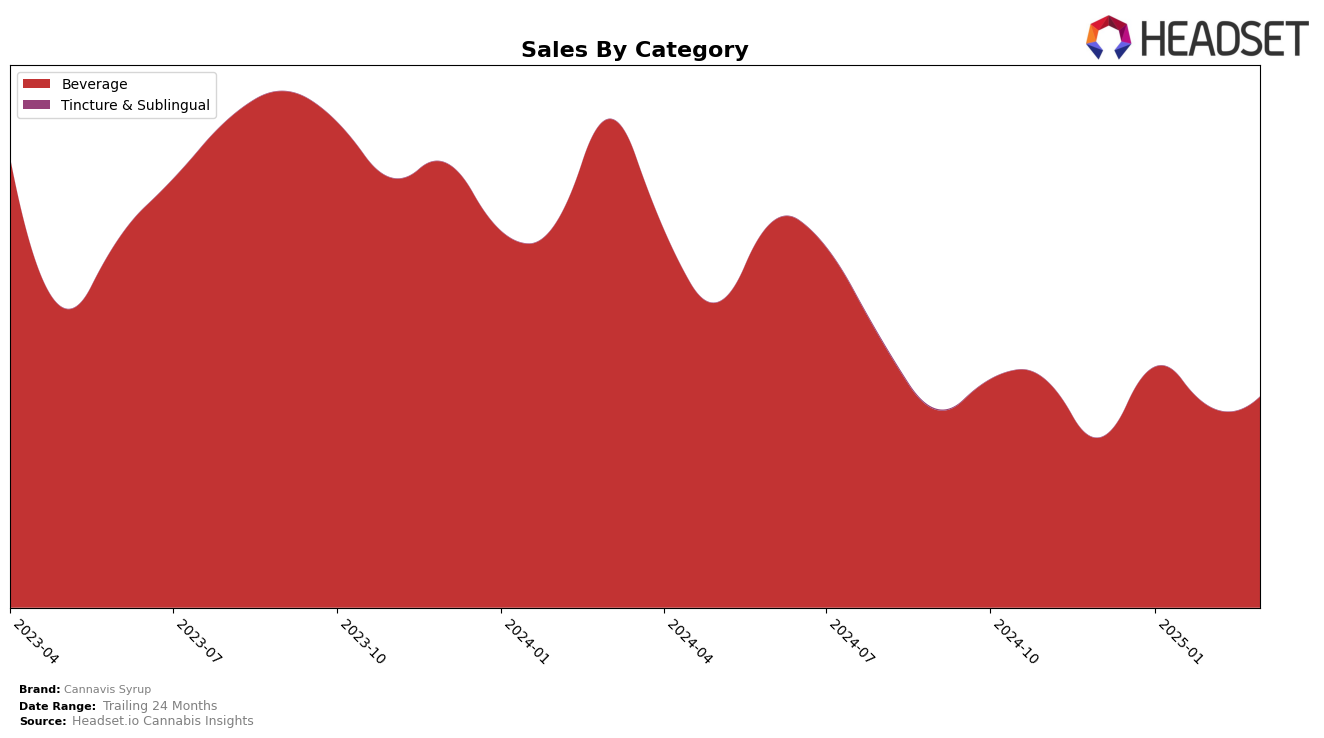

Cannavis Syrup has shown a consistent presence in the California beverage market, maintaining a spot within the top 15 brands over the past few months. Starting at 14th place in December 2024, the brand improved to 11th in January 2025, before experiencing a slight dip to 13th in February, and then stabilizing at 12th in March 2025. This fluctuation in rankings suggests a competitive landscape, but Cannavis Syrup's ability to remain in the top 15 indicates strong brand resilience. The significant jump in sales from December to January reflects a positive reception during the holiday season, although there was a slight decrease in February followed by a recovery in March.

While Cannavis Syrup's performance in California is noteworthy, it is important to highlight that their absence from the top 30 in other states or provinces suggests a limited geographical reach or varying market preferences. This absence could be seen as a challenge for the brand to expand its footprint beyond its current stronghold. The brand's consistent ranking in California's beverage category, however, underscores its appeal and potential for growth if it can replicate its success in other regions. Observers and stakeholders may find it useful to monitor future movements in both rankings and sales to assess Cannavis Syrup's strategic positioning and market expansion efforts.

Competitive Landscape

In the competitive California beverage market, Cannavis Syrup has shown a steady performance with its rank fluctuating between 11th and 14th from December 2024 to March 2025. Despite a notable increase in sales from December to January, Cannavis Syrup faces stiff competition from brands like Lime, which consistently holds the 10th rank and boasts significantly higher sales figures. Meanwhile, Sip Elixirs maintains a stable position just ahead of Cannavis Syrup, ranking 11th in March 2025, with sales peaking in the same month. Interestingly, High Power has shown a positive trend, climbing from 18th to 13th, potentially posing a future threat to Cannavis Syrup's market position. Conversely, Mary Jones experienced a decline, dropping to 14th in March, which may present an opportunity for Cannavis Syrup to capitalize on shifting consumer preferences. Overall, Cannavis Syrup's ability to maintain its rank amidst these dynamics highlights its resilience but also underscores the need for strategic initiatives to enhance its competitive edge in California's beverage sector.

Notable Products

In March 2025, the top-performing product from Cannavis Syrup was the Passion Fruit Extra Strength Syrup 2-Pack, which climbed to the number one spot with sales of 268 units. The Pineapple Syrup followed closely in second place, having dropped from its leading position in January. Blue Raspberry Extra Strength Syrup 2-Pack secured the third rank, showing a slight decline from its top rank in January. The Tropical Punch Extra Strength Syrup 2-Pack experienced a drop to fourth place, previously holding the second rank in February. Lastly, the Grape Extra Strength Syrup 2-Pack entered the rankings at fifth place, marking its first appearance in the top five.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.