Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

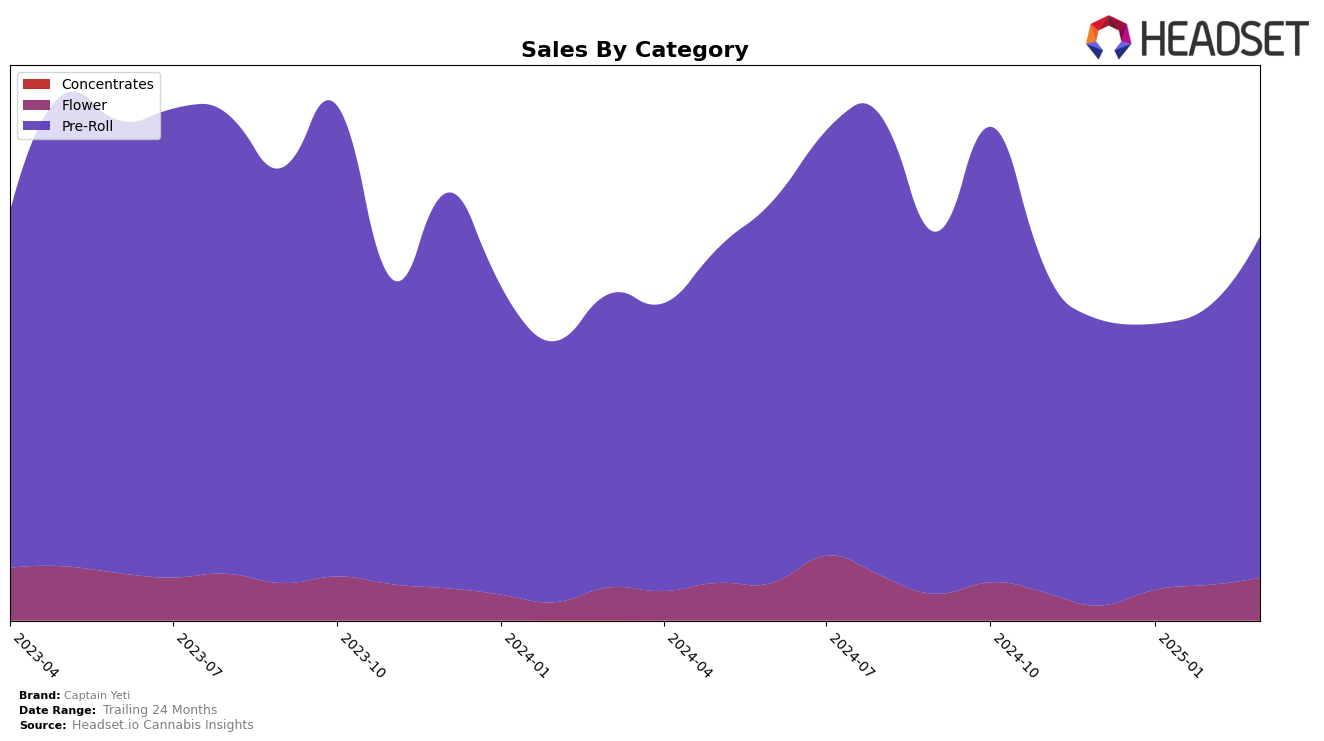

In the state of Washington, Captain Yeti has demonstrated a positive trajectory in the Pre-Roll category. The brand improved its ranking from 19th in December 2024 to 14th by March 2025. This upward movement is indicative of a strengthening market presence and potentially increasing consumer preference for their offerings. Notably, the sales figures in March 2025 reached a high of $244,086, reflecting a significant increase from previous months. Captain Yeti's consistent climb in the rankings suggests a growing reputation and effectiveness in capturing market share within the Pre-Roll segment in Washington.

However, it is important to note that Captain Yeti's presence in other states and categories remains undisclosed, which could imply varying levels of performance elsewhere. The absence of rankings in any other state or category suggests that Captain Yeti might not be in the top 30 brands in those areas, which could be a point of concern if they aim to expand their footprint beyond Washington. This limited visibility outside Washington might highlight a strategic focus on strengthening their position in a single market before expanding further. Observing how Captain Yeti navigates these challenges and opportunities will be crucial in understanding their overall growth strategy.

Competitive Landscape

In the Washington Pre-Roll category, Captain Yeti has demonstrated a notable upward trajectory in its ranking from December 2024 to March 2025. Starting at 19th place in December, Captain Yeti climbed to 14th by March, showcasing a significant improvement in market position. This ascent is particularly impressive given the competitive landscape, where brands like Forbidden Farms and Juicy Joints have experienced fluctuations, with Forbidden Farms dropping to 16th in March and Juicy Joints also moving to 15th. Meanwhile, Fire Bros. has shown a steady rise, reaching 12th place by March, while Legit (WA) has seen a slight decline to 13th. Captain Yeti's sales figures reflect this positive trend, with a notable increase in March, indicating a successful strategy in capturing market share and consumer interest amidst a dynamic competitive environment.

Notable Products

In March 2025, Captain Yeti's top-performing product was Surprise! I'm Stoned Hash Infused Pre-Roll (1g), which climbed to the number one rank with sales reaching 1747 units. This product showed significant improvement from its previous ranks, moving up from fourth place in February. Absolutely Vibing Hash Infused Pre-Roll (1g) maintained its strong performance, holding steady at the second rank with substantial sales. Calm The Fuck Down Hash Infused Pre-Roll (1g) rose to the third position, up from fifth in February, indicating growing consumer interest. Meanwhile, Red Wine Supernova Infused Pre-Roll (1g) and Fuck Around and Find Out Infused Pre-Roll (1g) rounded out the top five, with the latter experiencing a slight decline from its previous top spot in January and February.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.