Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

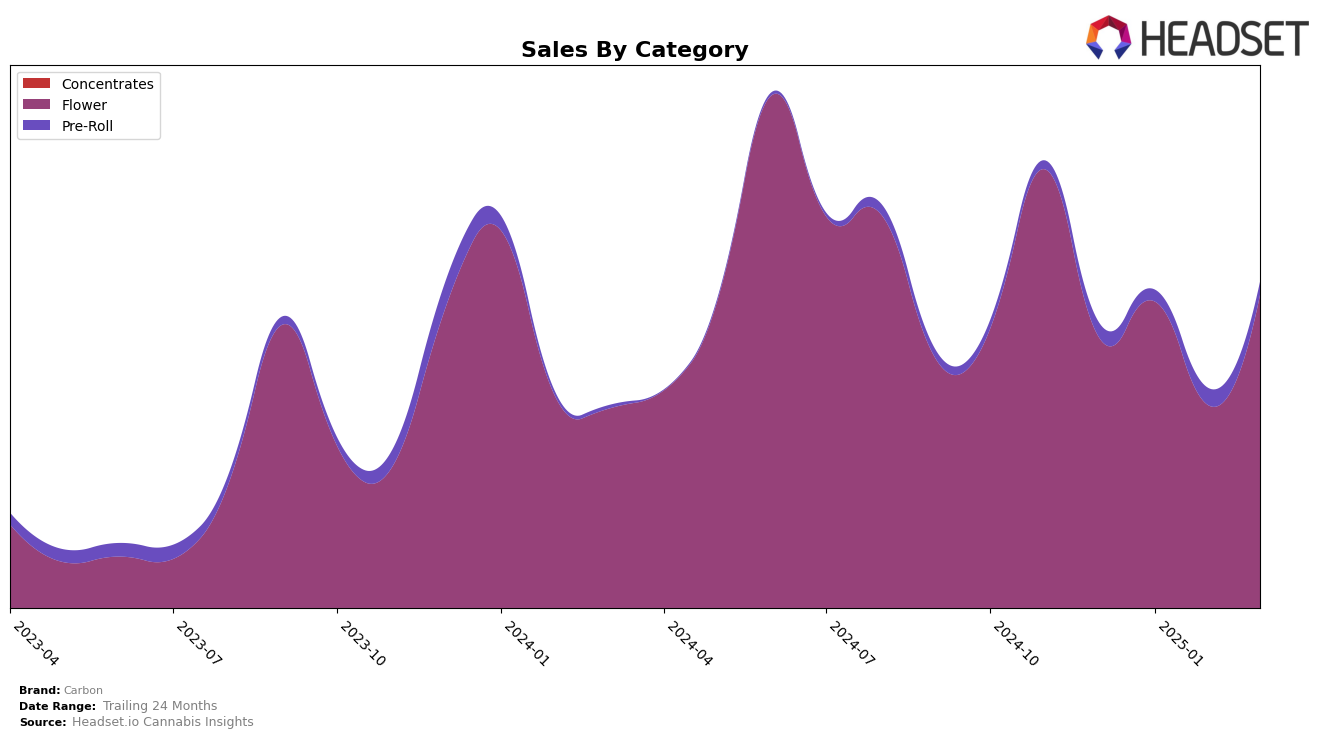

In the state of Michigan, Carbon has shown a fluctuating performance in the Flower category. Starting from a rank of 29 in December 2024, the brand improved its position to 24 in January 2025, only to drop out of the top 30 in February. However, by March, Carbon managed to regain a spot, ranking 30th. This volatility is mirrored in their sales figures, with a noticeable dip in February but a recovery in March. The Pre-Roll category presents a different story; Carbon was not ranked in the top 30 for December through February, but made a notable entry at rank 96 in March, suggesting a potential area of growth or increased market penetration.

In Nevada, Carbon's performance in the Flower category has shown a steady upward trend. While the brand began at rank 55 in December 2024, it improved to 51 in January and climbed to 39 by February. However, there was a slight decline to rank 43 in March. Despite this minor setback, the sales figures indicate a consistent increase over the months, suggesting strong consumer demand. The absence of Carbon in the top 30 for other categories in Nevada implies either a strategic focus on Flower or a need for diversification to capture more of the market.

Competitive Landscape

In the competitive landscape of the Michigan flower category, Carbon has experienced fluctuations in its ranking, reflecting the dynamic nature of the market. In December 2024, Carbon was ranked 29th, but it climbed to 24th in January 2025, indicating a positive trend in sales performance. However, by February 2025, Carbon's rank dropped to 39th, before slightly recovering to 30th in March 2025. This volatility highlights the competitive pressure from brands like Euphoria, which maintained a relatively stable position, ranking between 25th and 28th during the same period. Meanwhile, Peninsula Cannabis and NOBO showed significant rank improvements in March 2025, potentially impacting Carbon's market share. Notably, Light Sky Farms demonstrated a remarkable rise from 60th in December 2024 to 32nd by March 2025, suggesting a growing competitive threat. These shifts underscore the importance for Carbon to strategically enhance its market positioning to maintain and grow its sales amidst fierce competition.

```

Notable Products

In March 2025, Carbon's top-performing product was Don Mega (3.5g) in the Flower category, securing the number one rank with notable sales of 11,477 units. Frozen Peaches (3.5g), also in the Flower category, followed closely as the second best-seller. GMO Pre-Roll (1g) in the Pre-Roll category saw a decline, dropping to the third position from its previous first-place ranking in February. Bahama Peel Pre-Roll (1g) maintained a steady performance, ranking fourth after previously being second in February. Spritzer (3.5g) experienced a significant drop, now ranking fifth compared to its top position in December 2024.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.