Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

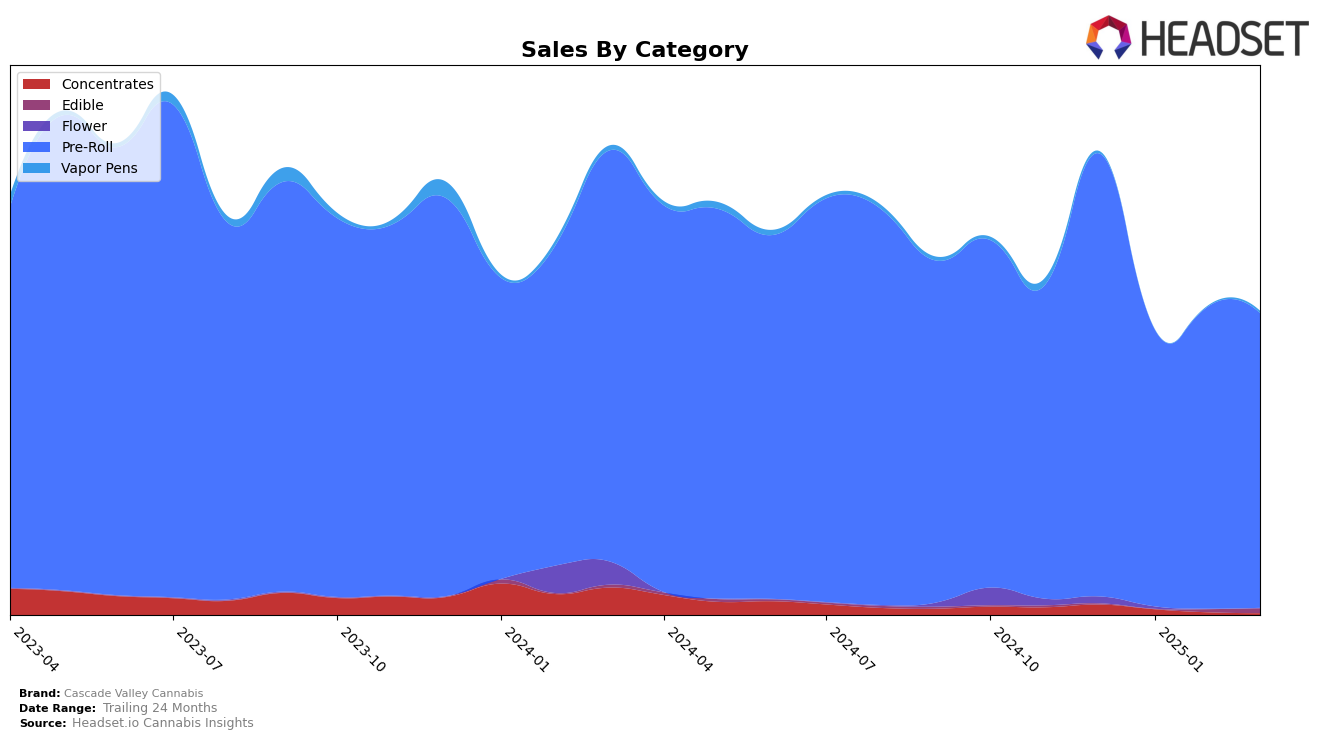

Cascade Valley Cannabis has experienced notable fluctuations in its performance across various categories and states. In the Oregon market, the brand's Pre-Roll category saw a dip in rankings from December 2024 to January 2025, moving from 10th to 20th place. This decline was followed by a slight recovery in February 2025, where it climbed back to 15th place, before settling again at 20th in March 2025. Despite these ranking shifts, the brand demonstrated resilience in its sales figures, with January 2025 sales showing a decrease but a subsequent recovery in February and March, indicating an ability to rebound after initial setbacks.

It's important to note that Cascade Valley Cannabis did not consistently maintain a top 10 position in the Pre-Roll category in Oregon throughout the observed months. This inconsistency could be viewed as a challenge for the brand to address in order to strengthen its foothold in the market. The absence of the brand in the top 30 for any month, if it were to occur, would be a cause for concern, signaling a need for strategic adjustments. The brand's performance trajectory in Oregon reflects a dynamic competitive landscape, where maintaining and improving rank positions require continuous effort and adaptation to market trends.

Competitive Landscape

In the competitive landscape of Oregon's pre-roll category, Cascade Valley Cannabis has experienced fluctuating rankings over the past few months, indicating a dynamic market presence. Starting from a strong position at rank 10 in December 2024, the brand saw a decline to rank 20 by January 2025, before slightly rebounding to rank 15 in February and then returning to rank 20 in March. This pattern suggests a competitive struggle, particularly with brands like Entourage Cannabis / CBDiscovery, which mirrored Cascade Valley Cannabis's movements closely, ranking 19 in January and March. Meanwhile, Bigfoot Bud Co and Piff Stixs showed more stability, with Bigfoot Bud Co consistently maintaining a presence in the top 20, except for March. Interestingly, Feel Goods demonstrated a notable dip in February, falling out of the top 20, which may have temporarily alleviated competitive pressure on Cascade Valley Cannabis. These shifts underscore the importance of strategic positioning and market responsiveness for Cascade Valley Cannabis to maintain and improve its standing in Oregon's pre-roll market.

Notable Products

In March 2025, the top-performing product from Cascade Valley Cannabis was the Flight Pack - 5 Strain Variety Pre-Roll 10-Pack (5g), maintaining its first-place rank consistently from December 2024 to March 2025, with sales reaching 1231 units. The Sour Tangie Pre-Roll (0.5g) climbed to second place from fourth in February, showing a notable increase in popularity. Jelly Donuts Infused Pre-Roll 5-Pack (5g) debuted in March at third place, indicating strong initial consumer interest. Baby Yoda Infused Pre-Roll 5-Pack (3.5g) entered the rankings at fourth place, while the CBD Blueberry Hibiscus Gummy (100mg CBD) secured the fifth position. This reshuffling in the rankings suggests a dynamic market with shifting consumer preferences towards infused and variety pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.