Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

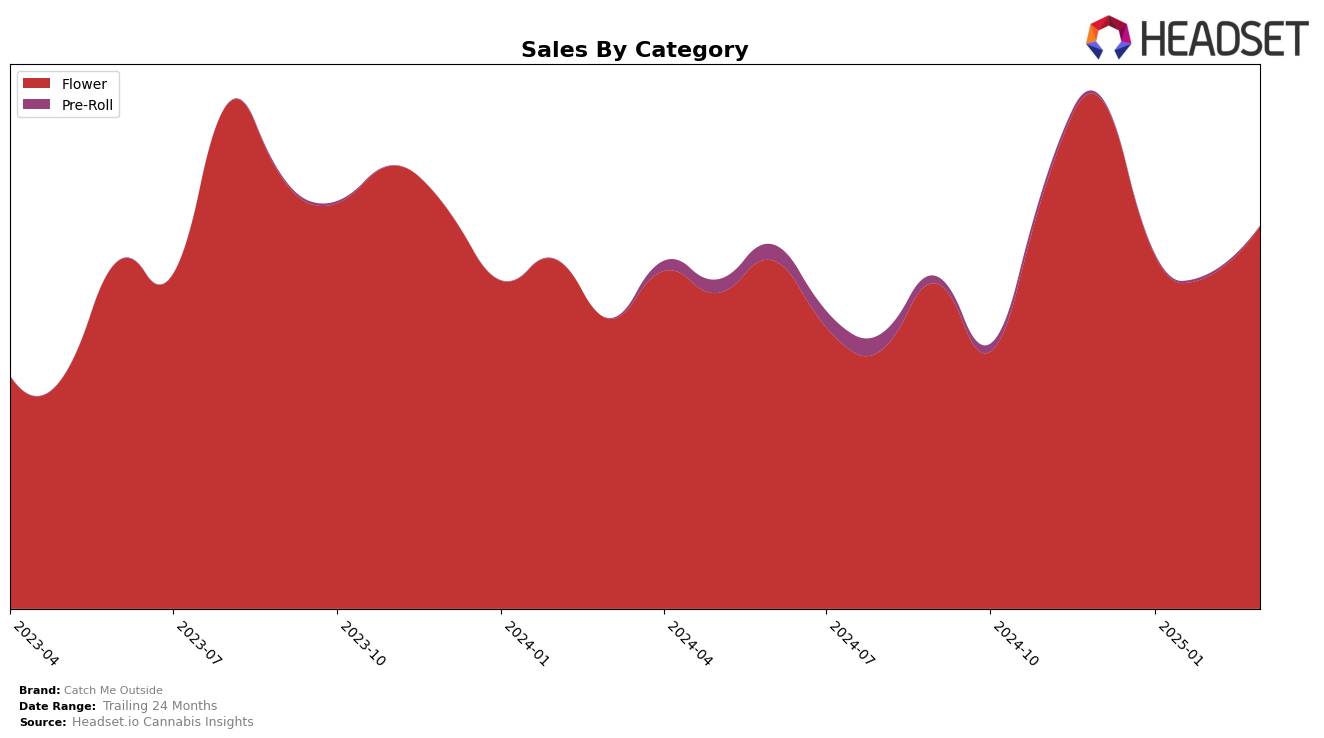

Catch Me Outside's performance in the Flower category across different regions shows a varied trajectory. In Ontario, the brand has consistently been outside the top 30 rankings from December 2024 to March 2025, indicating challenges in penetrating this competitive market. Despite not reaching the top 30, there was a slight improvement in March 2025 with a rank of 51, up from 55 in February. This upward movement, albeit modest, suggests a potential for growth if the trend continues. In terms of sales, the brand experienced a dip in January and February but saw a rebound in March, which could signify a recovery phase or a response to strategic adjustments.

In contrast, Saskatchewan presents a more positive outlook for Catch Me Outside. The brand improved its position from rank 39 in December 2024 to breaking into the top 30 by March 2025, reaching rank 29. This ascent into the top 30 highlights a successful penetration and growing consumer acceptance in Saskatchewan's Flower category. Sales figures corroborate this upward trend, with a notable increase from December to March, peaking at over 40,000 units sold in March. The brand's trajectory in Saskatchewan could serve as a model for improving performance in other regions like Ontario.

Competitive Landscape

In the competitive landscape of the Flower category in Ontario, Catch Me Outside has experienced fluctuating rankings, moving from 47th in December 2024 to 51st by March 2025. This shift indicates a competitive market where brands like PIFF and Coterie have shown upward momentum, with PIFF improving its rank from 55th to 50th and Coterie making a notable leap from 81st to 49th during the same period. Catch Me Outside's sales figures reflect a similar trend, with a decline in early 2025 but a slight recovery in March, suggesting potential challenges in maintaining market share amidst aggressive competition. Meanwhile, San Rafael '71 and Common Ground have also experienced rank fluctuations, with San Rafael '71 dropping from 36th to 54th and Common Ground showing a more stable trajectory, ending at 52nd. These dynamics highlight the need for Catch Me Outside to innovate and strategize effectively to regain and enhance its competitive position in the Ontario Flower market.

Notable Products

In March 2025, Catch Me Outside's top-performing product was Couch Potato (3.5g) in the Flower category, maintaining its number one rank with sales of 4,327 units. Rooster Call (3.5g) held steady at the second position, while Farmer's Market (28g) consistently ranked third. Couch Potato (14g) and Rooster Call (14g) remained in fourth and fifth places, respectively. Notably, the rankings for all these products have remained unchanged since December 2024, reflecting a stable preference among consumers for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.