Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

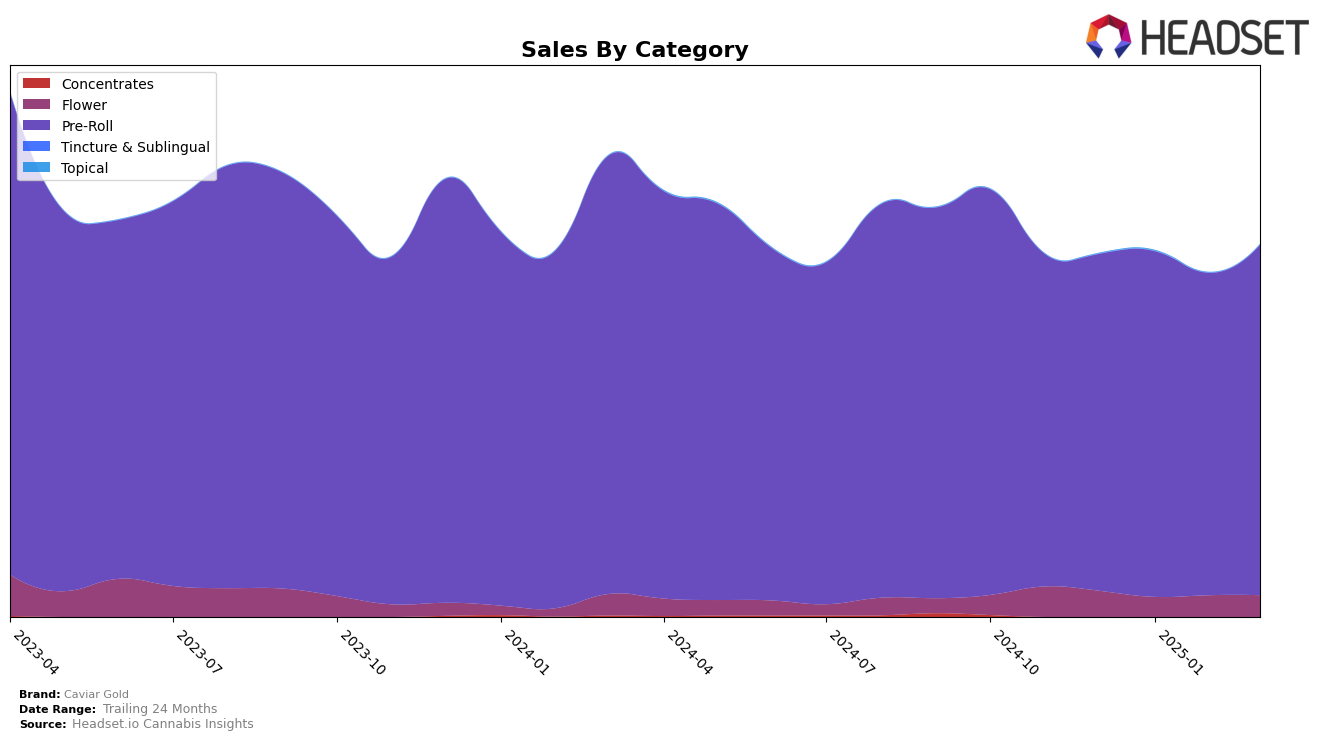

Caviar Gold has shown varied performance across different states in the Pre-Roll category. In Arizona, the brand experienced some fluctuations, starting in the 28th position in December 2024, moving to 27th in January 2025, dropping out of the top 30 in February, and then re-entering at 30th in March. This indicates a struggle to maintain a consistent presence within the top rankings in Arizona. On the other hand, California has been a stable market for Caviar Gold, where it consistently held the 12th position from January to March 2025, after a slight improvement from 14th in December 2024. This highlights California as a stronghold for the brand, maintaining a solid position in a competitive market.

In Michigan, Caviar Gold's presence in the Pre-Roll category was notably absent from the top 30 rankings in December 2024 and February to March 2025, with only a 77th place ranking in January 2025. This suggests a significant challenge for the brand in penetrating the Michigan market effectively. Across these states, Caviar Gold's sales figures also reflect the brand's fluctuating market positions, with a notable sales volume in California, indicating a particularly robust consumer base there. The brand's performance across these states underscores the importance of regional strategies to maintain and grow its market share.

Competitive Landscape

In the competitive landscape of the California pre-roll market, Caviar Gold has maintained a steady position, consistently ranking 12th from January to March 2025, after climbing from 14th in December 2024. This stability is noteworthy, especially as competitors like Heavy Hitters experienced a decline from 10th to 14th place over the same period. Meanwhile, Quickies Prerolls demonstrated a significant upward trend, moving from 19th to 10th, indicating a potential threat to Caviar Gold's position if this growth continues. Time Machine and Sparkiez have shown fluctuations, with Time Machine slightly outperforming Caviar Gold in March 2025. Despite these dynamics, Caviar Gold's sales saw an encouraging increase in March, suggesting effective strategies in place to maintain its market share amidst a competitive environment.

Notable Products

In March 2025, the top-performing product from Caviar Gold was the Cavi Cone - Apple Drip Infused Pre-Roll 3-Pack, which rose to the number one rank from second place in February, achieving sales of $6,087. The Cavi Cone - Lightning OG Infused Pre-Roll improved its position to second place from fourth in February. Meanwhile, the Cavi Cone - Strong Berry Infused Pre-Roll, which had consistently held the top rank from December to February, fell to third place. Cavi Cone - King Cavi OG Infused Pre-Roll maintained a steady presence in the rankings, ending March in fourth place. A newcomer to the list, Cavi Cone - Monster Cookies Infused Pre-Roll, entered the rankings in fifth place, indicating a strong debut.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.