Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

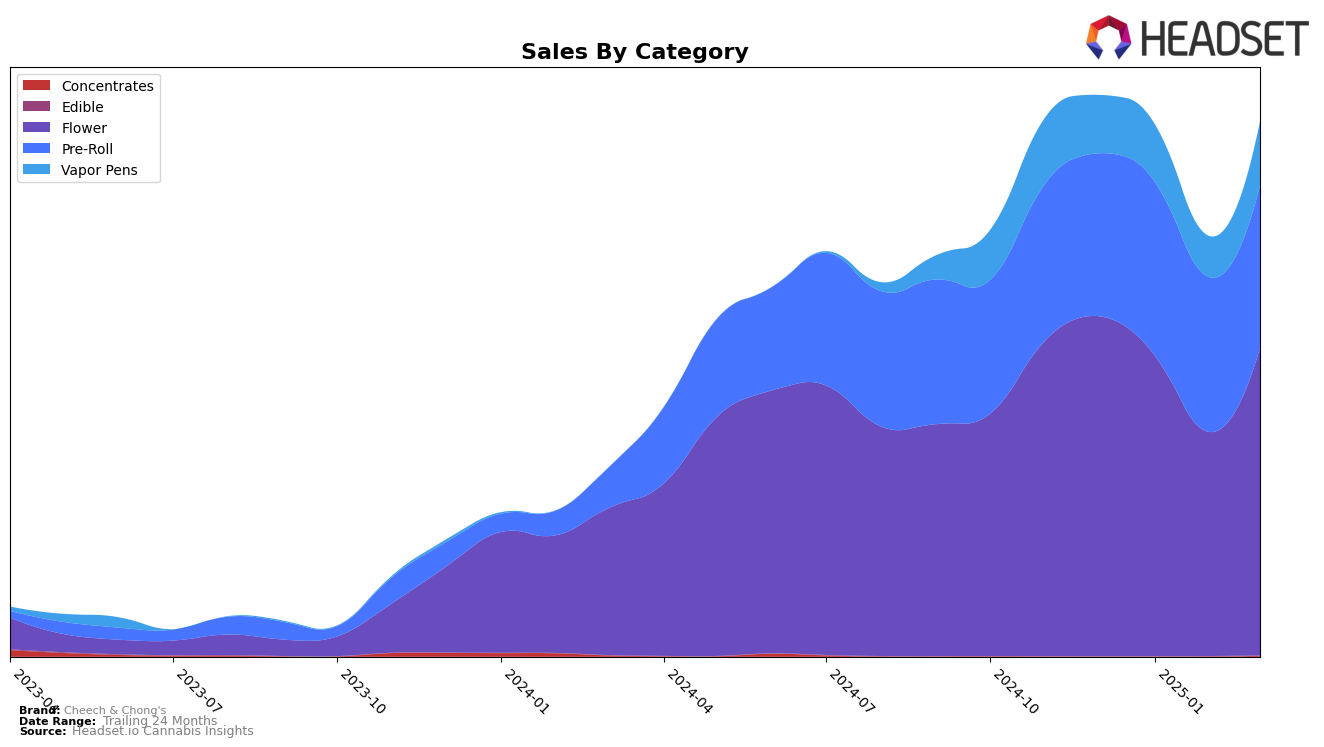

Cheech & Chong's has demonstrated varied performance across different states and product categories. In Arizona, the brand has maintained a strong presence in the Flower category, although there was a slight decline from the third position in December 2024 to the fifth position by March 2025. Despite this, their sales figures saw a resurgence in March, indicating potential recovery. Meanwhile, in the Pre-Roll category, Cheech & Chong's managed to improve their ranking from fourth to third place by March 2025, suggesting a steady hold in the market. In contrast, Illinois presents challenges for Cheech & Chong's in the Vapor Pens category, where they failed to rank in the top 30 in February 2025, reflecting a need for strategic adjustments in this market.

In Massachusetts, the brand's performance in the Flower category remained stable, with rankings oscillating between 17th and 19th positions. The Pre-Roll category showed a promising trajectory, climbing from the 40th position in December to the 29th in March. Meanwhile, Michigan presented a mixed picture; while the Flower category saw a drop from 36th to 58th place, the Vapor Pens category showed improvement, with a significant leap from 64th to 42nd position by March. Lastly, in New York, the Pre-Roll category saw consistent improvement, advancing from 46th to 33rd place, indicating growing consumer interest in their offerings. Overall, Cheech & Chong's exhibits a dynamic market presence with opportunities for growth in specific regions and categories.

Competitive Landscape

In the competitive landscape of the Flower category in Arizona, Cheech & Chong's has experienced some fluctuations in its ranking and sales performance over the months from December 2024 to March 2025. Initially holding a strong position at rank 3 in December 2024, Cheech & Chong's saw a slight decline to rank 5 by March 2025. This shift can be attributed to the dynamic movements of competitors such as Shango, which consistently maintained a top 3 position, and Connected Cannabis Co., which made a significant leap from rank 14 in January to rank 5 in February. Meanwhile, High Grade experienced a notable dip to rank 17 in February before rebounding to rank 4 in March, indicating a volatile market environment. Despite these competitive pressures, Cheech & Chong's sales figures remained relatively robust, with a notable increase from February to March, suggesting resilience and potential for regaining higher ranks in the future.

Notable Products

In March 2025, the top-performing product for Cheech & Chong's was Don Mega Pre-Roll (1g) in the Pre-Roll category, securing the number one spot with sales of 26,214 units. Following closely, Jack Herer Infused Pre-Roll (1.2g) ranked second, having dropped from its previous first place in February. Berry White Infused Pre-Roll (1.2g) took the third position, maintaining a consistent presence in the top ranks. Drooler Pre-Roll (1g) was fourth, showing strong sales for the month. Drooler - Don Mega (3.5g) in the Flower category slipped from first place in December to fifth in March, indicating a shift in consumer preference towards smaller pre-rolls.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.