Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

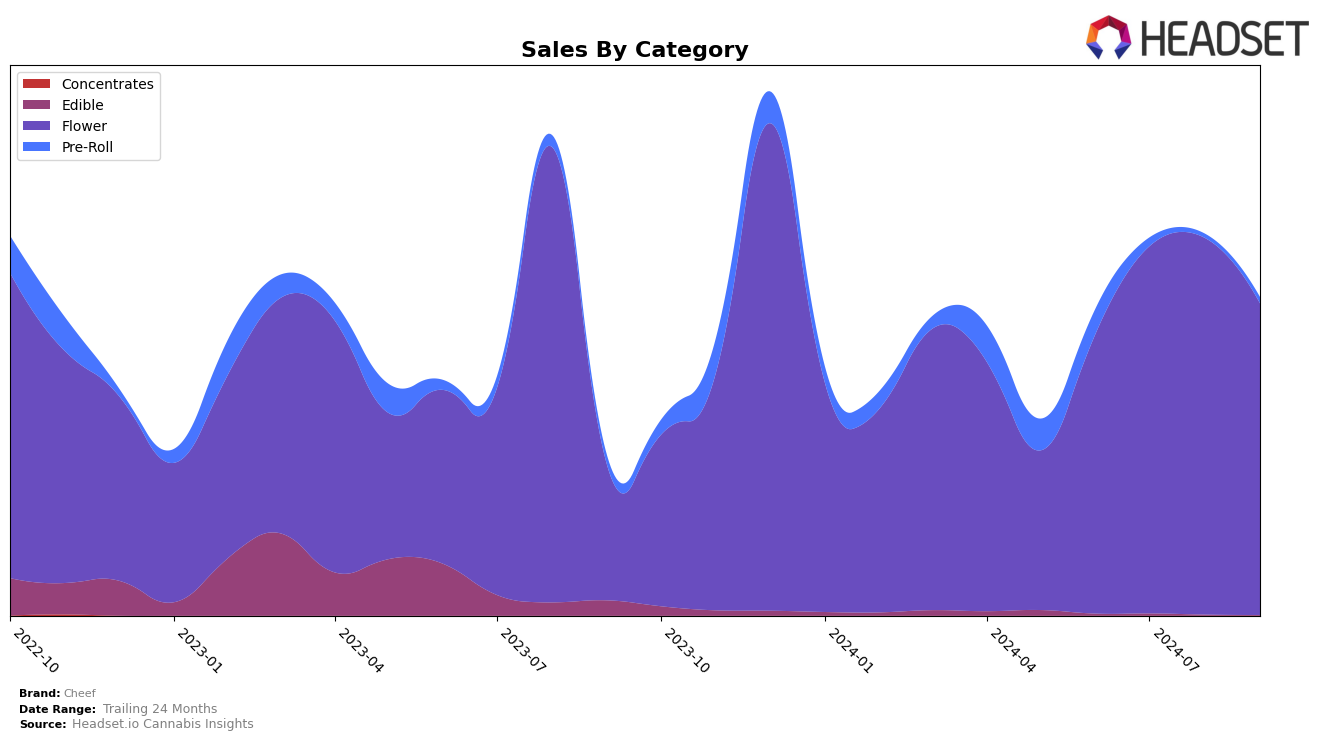

Cheef has demonstrated a notable performance trajectory in the Washington market, particularly in the Flower category. Over the recent months, Cheef's ranking has shown a significant improvement. In June 2024, the brand was not even in the top 30, ranking at 46th, but by July, it had surged to 21st place. This upward momentum continued, with a slight dip in August to 27th, before climbing back to 20th in September. This indicates a strong and growing presence in the Washington Flower market, suggesting effective strategies in product offerings or marketing that resonate with consumers.

While Cheef has made impressive strides in Washington, the absence of their ranking in the top 30 in other states for the Flower category could be a point of concern or an opportunity for growth. Their ability to break into the top 30 in Washington suggests potential, but it also highlights the competitive nature of the market across different states. The brand's sales figures in Washington have shown a consistent increase, moving from approximately $194,706 in June to $293,492 in September, which is a promising sign of consumer acceptance and brand strength in this particular state. However, their performance in other states could benefit from similar strategies to replicate this success.

Competitive Landscape

In the competitive landscape of the flower category in Washington, Cheef has demonstrated a notable improvement in rank over the past few months, climbing from 46th in June 2024 to 20th by September 2024. This upward trajectory is indicative of a significant increase in market presence and consumer preference, as evidenced by the substantial rise in sales from June to September. In contrast, SubX and SKÖRD have experienced fluctuations in their rankings, with SubX dropping from 16th to 18th and SKÖRD declining from 14th to 19th over the same period. Meanwhile, Sweetwater Farms has shown a consistent improvement, moving from 34th to 21st, which suggests a competitive push that Cheef must continue to monitor. Freddy's Fuego (WA) has seen a decline, falling out of the top 20 by September, which could present an opportunity for Cheef to capture some of their market share. Overall, Cheef's recent performance highlights its potential to further solidify its position in the Washington flower market.

Notable Products

In September 2024, Black Forest Cake Popcorn (8g) maintained its top position as the leading product for Cheef, with sales reaching 4122 units. White Widow Micro Buds (8g) held steady in second place, demonstrating a consistent upward trend from June, with September sales of 3814 units. Mimosa Popcorn (8g) remained in third place, showing stable performance across the months. Rude Boi OG Micro Buds (8g) improved its ranking to fourth in September, up from fifth in August, indicating a positive sales trajectory. Finally, Rudeboi OG Micro Buds (8g) dropped to fifth place, reflecting a decrease in sales compared to previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.