Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

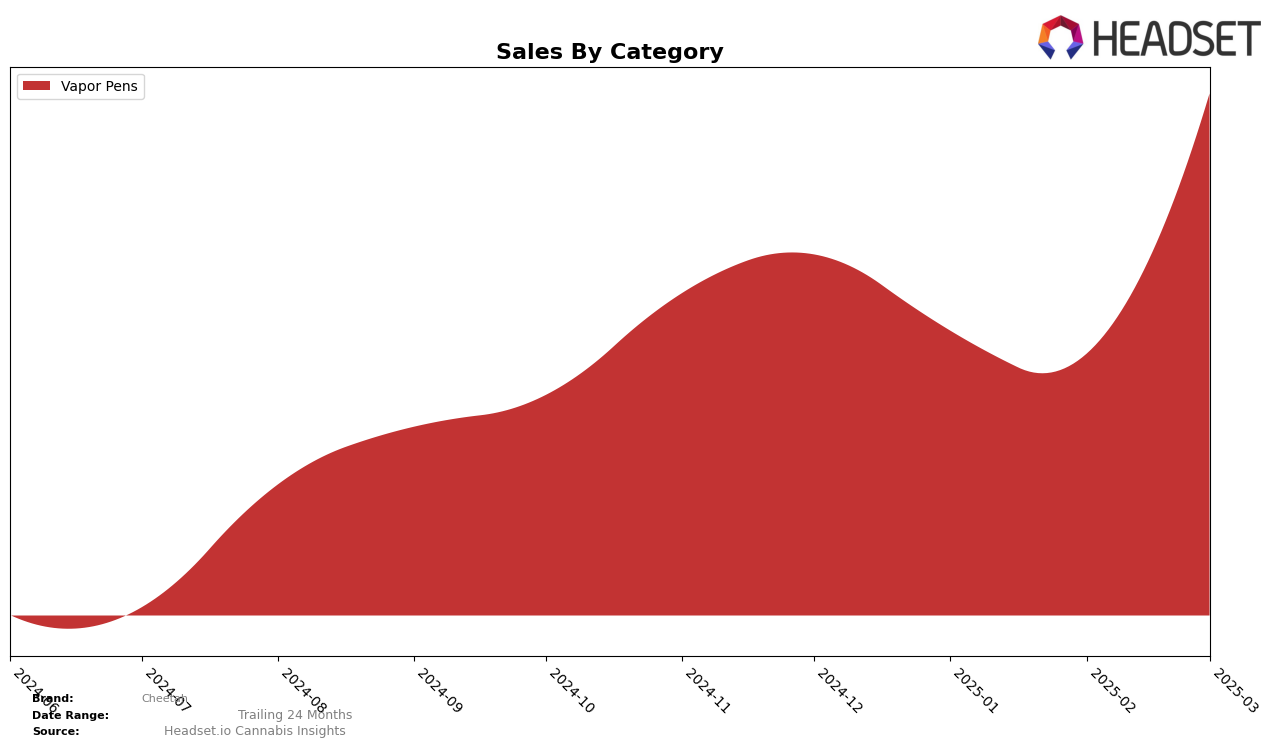

In the state of Illinois, Cheetah has shown a notable performance in the Vapor Pens category. Starting from a rank of 31 in December 2024, Cheetah experienced a slight dip in January 2025, falling to 34, but then managed to climb back up to 31 by February and reached the top 30 in March 2025. This upward trend, despite the fluctuations, indicates a positive momentum for Cheetah in the Illinois market. The sales figures reflect a similar pattern, with a dip in January followed by a recovery in March, suggesting a resilience in consumer demand and brand strength in this category.

Meanwhile, in New Jersey, Cheetah made its debut in the top 30 Vapor Pens brands by March 2025, securing the 29th position. This indicates a significant breakthrough for Cheetah, as it wasn't ranked in the top 30 in the preceding months. The entry into the rankings in New Jersey could signal a successful expansion strategy or increased brand recognition in this state. The sales data for March supports this positive development, showing a substantial figure that underscores Cheetah's growing presence in the New Jersey market.

Competitive Landscape

In the competitive landscape of vapor pens in Illinois, Cheetah has experienced fluctuating rankings over the past few months, indicating a dynamic market position. Starting from December 2024, Cheetah was ranked 31st, but dropped to 34th in January 2025 before recovering to 31st in February and improving slightly to 30th by March. This volatility contrasts with competitors like Kushy Punch, which maintained a steady climb from 33rd to 29th, and Generic IL, which consistently held a higher rank, only slipping from 24th to 28th. Despite these rank changes, Cheetah's sales have shown resilience, with a notable increase from February to March, suggesting potential for growth amidst stiff competition. Meanwhile, Breeze Canna and Mozey Extracts experienced more significant rank fluctuations, indicating a more unstable market presence. These insights highlight the importance for Cheetah to leverage strategic marketing and product differentiation to enhance its competitive edge in the Illinois vapor pen market.

Notable Products

In March 2025, the top-performing product for Cheetah was Lemon Triangle Kush Live Resin Disposable (1g) in the Vapor Pens category, which climbed to the first rank with impressive sales of 856 units. Gorilla Glue #4 Live Resin Disposable (1g) slipped to the second position after leading for three consecutive months. London Pound Mints Live Resin Disposable (1g) maintained its third position, showing consistent sales growth over the months. Kush Cake Live Resin Disposable (1g) held steady in the fourth spot, while Macnanna Live Resin Disposable (1g) re-entered the rankings at fifth, after being unranked in February. This reshuffling highlights a dynamic shift in consumer preferences within the Vapor Pens category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.