Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

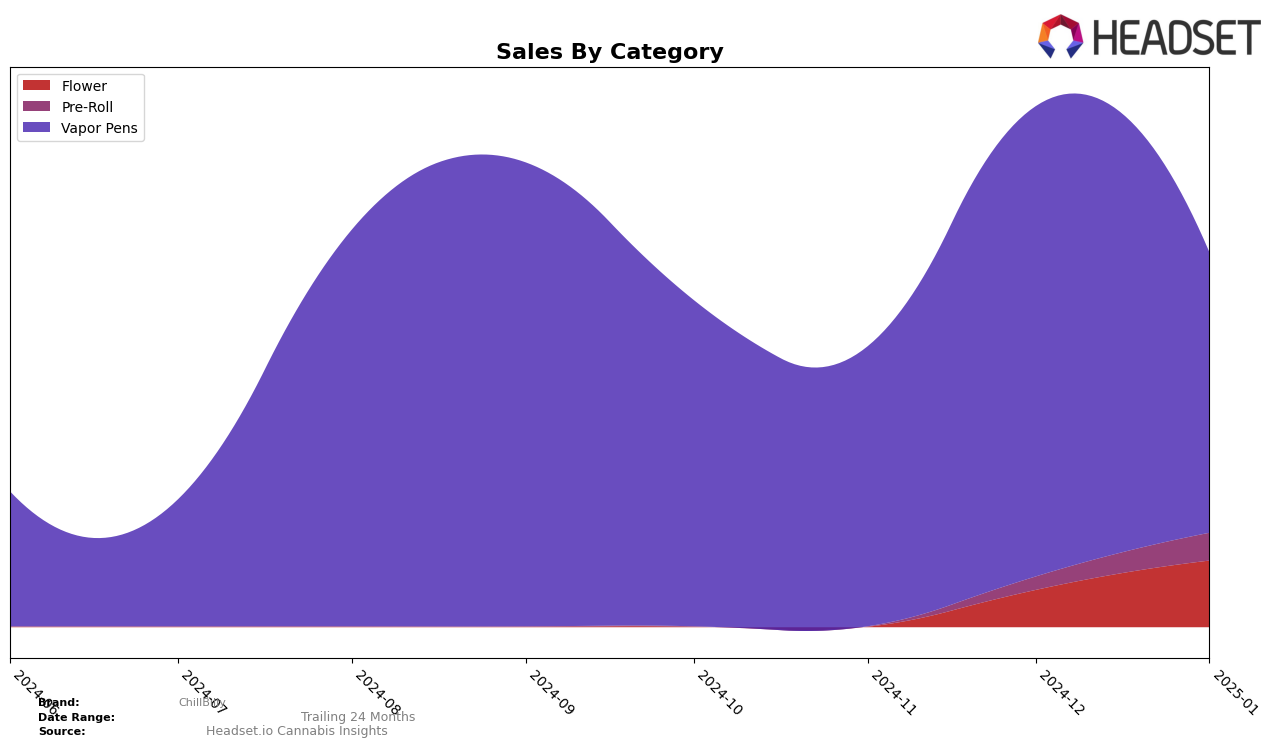

ChillBilly's performance across various categories and states demonstrates a mixed trajectory in recent months. In the Alberta market, their presence is notable in the Vapor Pens category, where they held a consistent ranking within the top 30 until January 2025, when they slipped to 34th place. This decline suggests a potential challenge in maintaining market share against competitors. Conversely, their Flower category in both Alberta and British Columbia did not make it into the top 30 rankings, indicating room for growth or a need for strategic adjustments to increase visibility and sales in these regions.

In Ontario, ChillBilly showed impressive movement in the Vapor Pens category, climbing from 60th in October 2024 to 31st in December 2024, before dropping to 50th in January 2025. This fluctuation highlights a period of strong growth followed by a decline that may warrant further analysis to understand the underlying causes. Meanwhile, in Saskatchewan, ChillBilly entered the top 30 in the Vapor Pens category by January 2025, indicating a positive trend and growing consumer acceptance. However, the absence of ChillBilly in the top 30 for other categories across these provinces suggests that while they have strongholds in certain areas, there is significant potential for expansion and increased market penetration in others.

Competitive Landscape

In the competitive landscape of vapor pens in Alberta, ChillBilly has experienced notable fluctuations in its market position from October 2024 to January 2025. Initially ranked 22nd in October 2024, ChillBilly saw a decline to 34th by January 2025. This downward trend in rank is mirrored by a decrease in sales over the same period. Competitors such as Foray and Ness have shown varying trends, with Foray maintaining a relatively stable rank around the 30s, while Ness improved its position from 43rd in October to 30th in January, indicating a potential shift in consumer preferences. Meanwhile, Glacial Gold and Dab Bods have not consistently ranked in the top 20, suggesting they face similar challenges in gaining market traction. These dynamics suggest that ChillBilly may need to reassess its strategies to regain its competitive edge in Alberta's vapor pen market.

Notable Products

In January 2025, ChillBilly's top-performing product was the Gator Blood Blammo Distillate Cartridge (1g) in the Vapor Pens category, maintaining its consistent first-place ranking from previous months with sales of 4214 units. The Triple Berry Truckin' Blammo Distillate Cartridge (1g) also held steady at the second position, showing a slight decline in sales compared to previous months. The Jack Herer (3.5g) in the Flower category remained in third place since its debut in December 2024, with a notable increase in sales to 1309 units. The Jack Herer Jamboree Smiggies Pre-Roll 7 (3.5g) and Cobra Chicken Budskis (7g) maintained their fourth and fifth positions respectively, both showing positive sales growth from December. Overall, the rankings for ChillBilly's top products remained stable from December to January, with consistent performances across the board.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.