Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

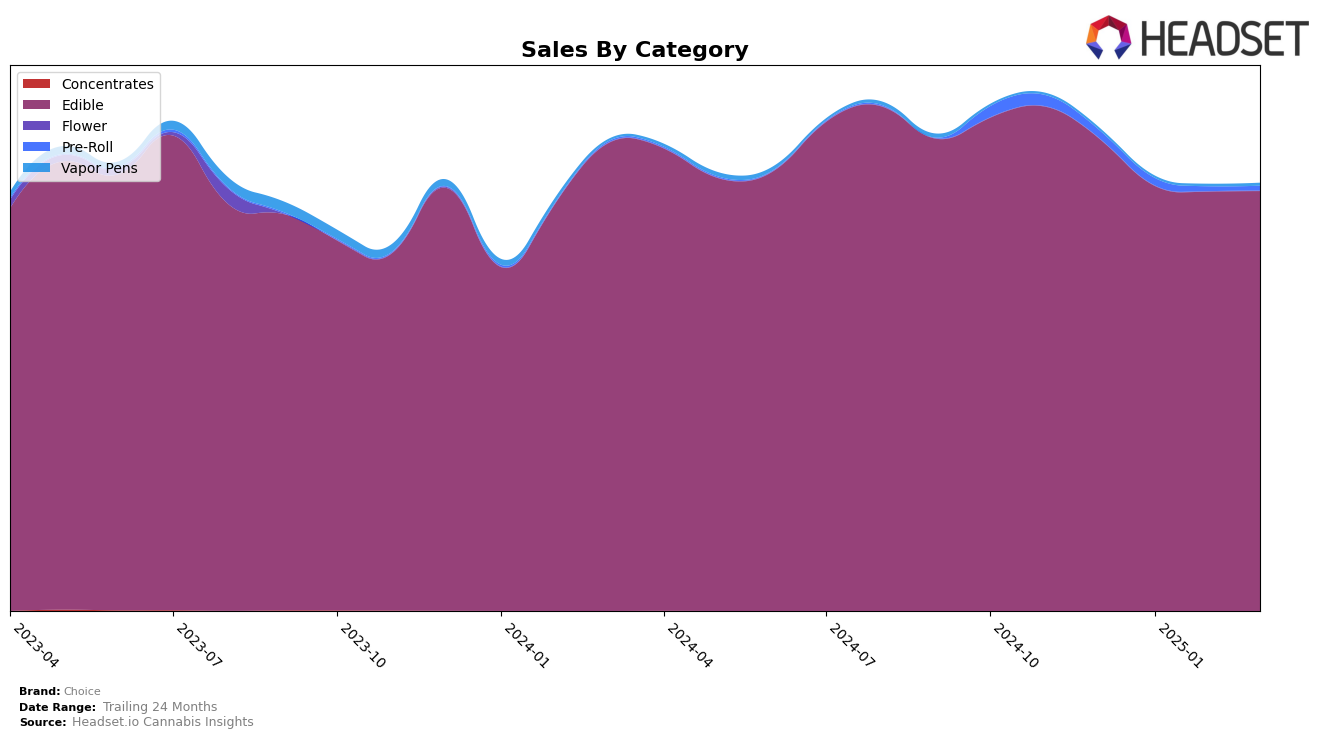

In the Michigan market, Choice has maintained a strong position in the Edible category, consistently ranking at number 2 from December 2024 through March 2025. This stability is indicative of a solid consumer base and effective market strategies in this state. Despite a slight dip in sales in January 2025, Choice rebounded in February and March, suggesting effective promotional efforts or seasonal demand factors at play. The ability to maintain a top position amidst fluctuating sales figures highlights the brand's resilience and adaptability in a competitive market.

Conversely, in Massachusetts, Choice experienced a slight decline in its Edible category ranking, moving from 6th place in December 2024 to 7th in March 2025. This downward trend, coupled with decreasing sales figures, may signal increased competition or changing consumer preferences in the state. Notably, the brand was unable to break into the top 5, suggesting potential areas for growth and strategy refinement. The absence from higher rankings in Massachusetts could be seen as a call to action for Choice to reassess its market approach and explore new avenues to bolster its presence and performance.

Competitive Landscape

In the Michigan edible cannabis market, Choice has consistently maintained its position as the second-ranked brand from December 2024 through March 2025. Despite not surpassing the leading brand, Wyld, Choice has demonstrated stability in its market position, which suggests a strong brand loyalty and effective market strategies. While Wyld remains the top competitor with a consistent first-place rank, Choice's sales figures show a positive trend, particularly in March 2025, indicating a potential narrowing of the gap between the two brands. Meanwhile, MKX Oil Company holds the third position consistently, and Monster Xtracts has shown notable improvement, climbing from seventh to fourth place over the same period. This competitive landscape highlights Choice's resilience and potential for growth amidst a dynamic market environment.

Notable Products

In March 2025, the top-performing product for Choice was Red Raz Haze Gummies 10-Pack (200mg) in the Edible category, consistently maintaining its number one rank from December 2024 through March 2025 with a sales figure of $53,809. Sativa Blue Razz Dream Gummies (200mg) climbed to the second position, showing a notable increase from its fourth place in December 2024, with a steady rise in sales over the months. Indica Granddaddy Grape Gummies 10-Pack (200mg) made a strong debut at the third position in March 2025. Granddaddy Grape Soft Chews 10-Pack (200mg) returned to the rankings in the fourth position after being absent in February 2025. Chronic Cherry Berry Soft Chews 10-Pack (200mg) saw a decline, dropping to fifth place from its second position in January and February 2025, reflecting a decrease in sales.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.