Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

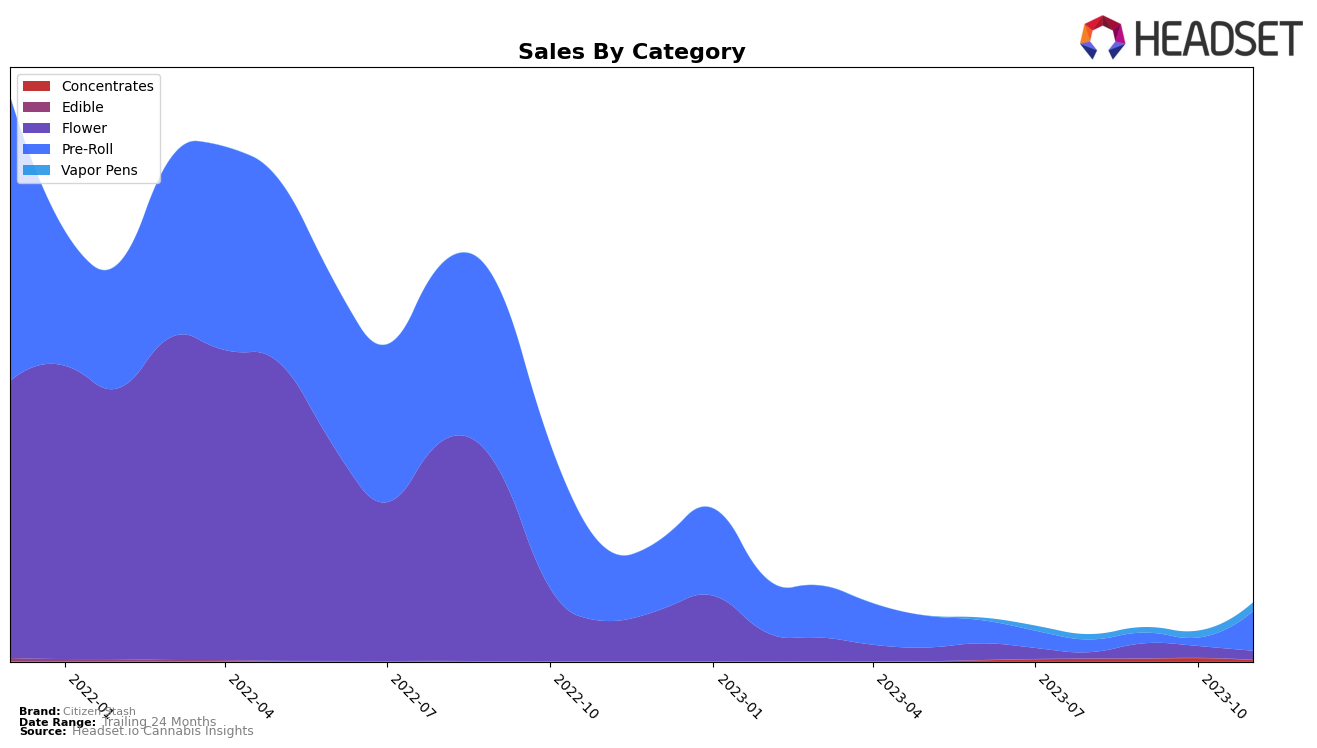

In the Vapor Pens category, Citizen Stash has shown a steady performance in Alberta over the months of August to November 2023. Although the brand's ranking fluctuated, moving from 82nd in August to 86th in November, the brand managed to remain within the top 100. This is indicative of a stable presence in the market, despite not breaking into the top 20. Interestingly, sales showed an upward trend from September to November, hinting at growing consumer interest.

Meanwhile, in British Columbia, Citizen Stash's performance in the Concentrates category remained consistent, maintaining a ranking in the 30s over the four-month period. However, it's worth noting that the brand didn't manage to improve its position or break into the top 20. In Ontario, Citizen Stash's Vapor Pens made a notable entry in September and showed a promising improvement by November. The brand's Pre-Roll category in Saskatchewan also deserves a mention, securing a spot in the top 20 in November, which suggests a strong potential for future growth.

Competitive Landscape

In the Pre-Roll category in Saskatchewan, Citizen Stash has seen some fluctuation in its competitive standing. While the brand did not rank in the top 20 for August through November 2023, it did manage to secure a spot in November, indicating a potential upward trend. Competing brands such as Bold and Shred have shown inconsistent performance, with both brands dropping in rank over the same period. BZAM, on the other hand, has steadily climbed the ranks, indicating a strong competitive threat. OHJA, despite a slight drop in rank, remains a top 10 brand, demonstrating its strong market presence. These dynamics suggest a competitive market with opportunities for Citizen Stash to improve its position.

Notable Products

In November 2023, the top-performing product from Citizen Stash was the Mac 1 Pre-Roll 3-Pack (1.5g), with an impressive sales figure of 4421 units. This product saw a significant jump in its ranking, moving from 5th place in August and October to 1st place. The Ape Tape Pre-Roll 3-Pack (1.5g) debuted in the rankings at 2nd place. The Oreoz (3.5g) dropped from 1st place in September and October to 3rd place in November. The CBG Blueberry Haze Distillate Cartridge (1g) consistently maintained a place in the top five, ranking 5th in November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.