Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

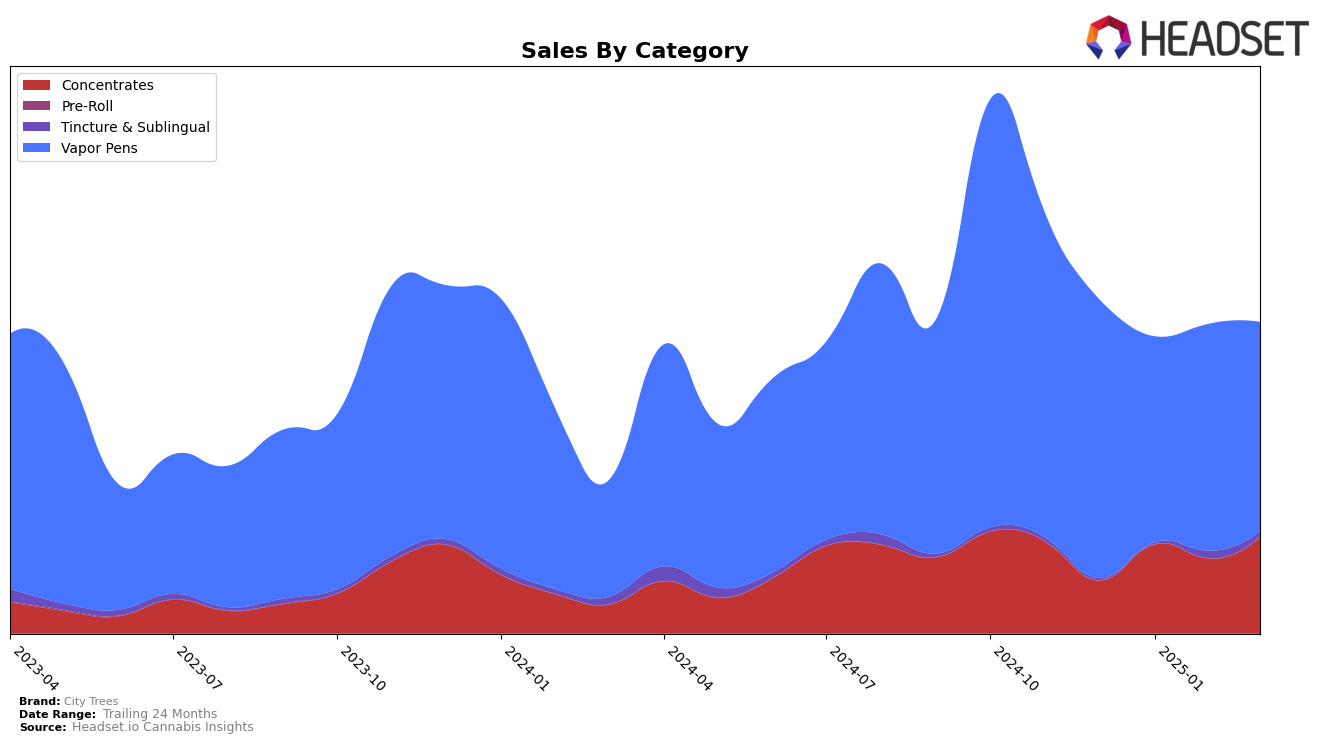

City Trees has demonstrated a strong performance in the Nevada market, particularly in the Concentrates category, where it has consistently ranked within the top 5 brands from January to March 2025. This upward trajectory is notable, with a significant jump from 8th place in December 2024 to 3rd place in January 2025, maintaining a stable position thereafter. The Tincture & Sublingual category, however, presents a contrasting picture, with City Trees not appearing in the top 30 until a sudden rise to 4th place in March 2025. This suggests a potential strategic focus on expanding their presence in this category, possibly driven by changing consumer preferences or effective marketing strategies.

In the Vapor Pens category, City Trees showcases a mixed performance across different states. In Nevada, the brand experienced fluctuations, reaching as high as 7th place in December 2024 but dropping to 11th in January 2025, before stabilizing around the 9th and 10th positions in subsequent months. This indicates a competitive market landscape, requiring consistent efforts to maintain a stronghold. Meanwhile, in New York, City Trees struggled to break into the top 30, with rankings hovering outside this range, culminating in an absence from the top 30 by March 2025. This disparity highlights the challenges of penetrating new markets and the varying consumer behaviors across states, underscoring the need for targeted strategies tailored to each market's dynamics.

Competitive Landscape

In the competitive landscape of vapor pens in Nevada, City Trees experienced notable fluctuations in its ranking from December 2024 to March 2025. Initially ranked at 7th place in December 2024, City Trees saw a decline to 11th in January 2025, before recovering slightly to 9th in February and settling at 10th in March. This period of volatility contrasts with the steady ascent of INDO, which improved its rank from 10th to 7th, and Provisions, which climbed from 14th to 9th. Meanwhile, AiroPro maintained a relatively stable position, hovering around the 8th to 11th ranks. The sales performance of City Trees, while robust, faced pressure from these competitors, particularly as Alternative Medicine Association / AMA showed significant sales growth, moving up from 18th to 12th place. These dynamics suggest that City Trees must strategize to regain its competitive edge and stabilize its market position amidst the shifting ranks of its competitors.

Notable Products

In March 2025, the top-performing product from City Trees was the Gasolina Distillate Disposable (1g) in the Vapor Pens category, securing the first rank with sales of 2548 units. The Peach Ringz Distillate Disposable (1g) climbed to the second position, showing a significant increase from its previous unranked status in February. Frozen Grapes Cured Resin Sugar (1g) in the Concentrates category ranked third, marking its debut in the top rankings. The Blue Dream Distillate Cartridge (0.9g) slipped to fourth place, previously being unranked, while Glitter Bomb Cured Resin Shatter (1g) rounded out the top five with its first appearance. Overall, March saw new entries and shifts in rankings, highlighting dynamic changes in consumer preferences for City Trees products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.