Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

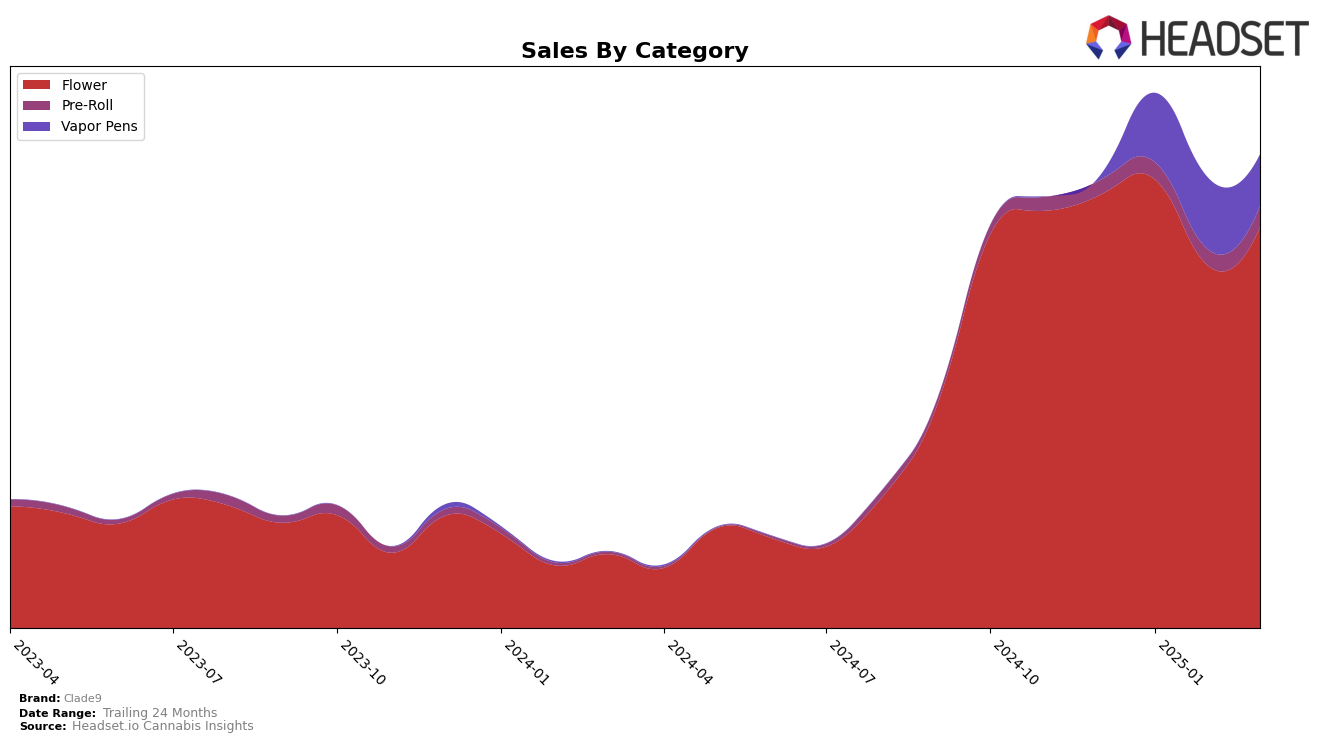

Clade9 has shown notable performance in the New Jersey market, especially in the Flower category. From December 2024 to March 2025, Clade9 maintained a strong presence, fluctuating slightly but consistently remaining within the top 10 brands. The brand ranked 8th in December 2024 and improved to 6th in January 2025, before settling at 9th in both February and March 2025. This indicates a stable demand for their Flower products despite some fluctuations in sales figures. However, it is worth noting that their Vapor Pens did not make it into the top 30 brands as of December 2024, but saw an upward trajectory starting from January 2025, suggesting a growing consumer interest in this category.

In the Pre-Roll category, Clade9's performance in New Jersey has been gradually improving. They were ranked 36th in December 2024 and climbed to 31st by March 2025. While this category does not yet see Clade9 in the top 30, the upward trend is a positive indicator of their growing market presence. The steady increase in sales from January to March 2025 reflects a rising consumer preference for their Pre-Roll offerings. This suggests that while Clade9 is not yet a dominant player in the Pre-Roll category, there is potential for growth if they continue to capitalize on market opportunities and consumer preferences.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Clade9 has demonstrated resilience and adaptability, maintaining a consistent presence in the top 10 rankings from December 2024 to March 2025. Despite a slight dip from 6th to 9th place between January and February 2025, Clade9's sales figures indicate a robust performance, particularly when compared to competitors like Verano and Pete's Farmstand, both of which have shown fluctuating ranks and sales. Notably, Triple Seven (777) has emerged as a formidable competitor, climbing to 10th place in March 2025 with a notable sales surge, while (the) Essence has maintained a strong position, often outperforming Clade9 in sales. This dynamic market environment underscores the importance for Clade9 to leverage its strengths and address areas for growth to enhance its competitive edge and sustain its market position.

Notable Products

In March 2025, the top-performing product from Clade9 was Orange Push Pop (3.5g) in the Flower category, reclaiming its position from December 2024 with sales reaching 5149 units. Diamond Bar (3.5g) maintained its second-place ranking, consistent with its performance in January and February. J1 (3.5g) held steady in third place across the months, showcasing stable demand. Fig Bar (7g) improved its rank to fourth in March, while Diamond Bar (7g) entered the top five for the first time. Overall, March saw a resurgence in sales figures, particularly for Orange Push Pop (3.5g), indicating a strong market preference for this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.