Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

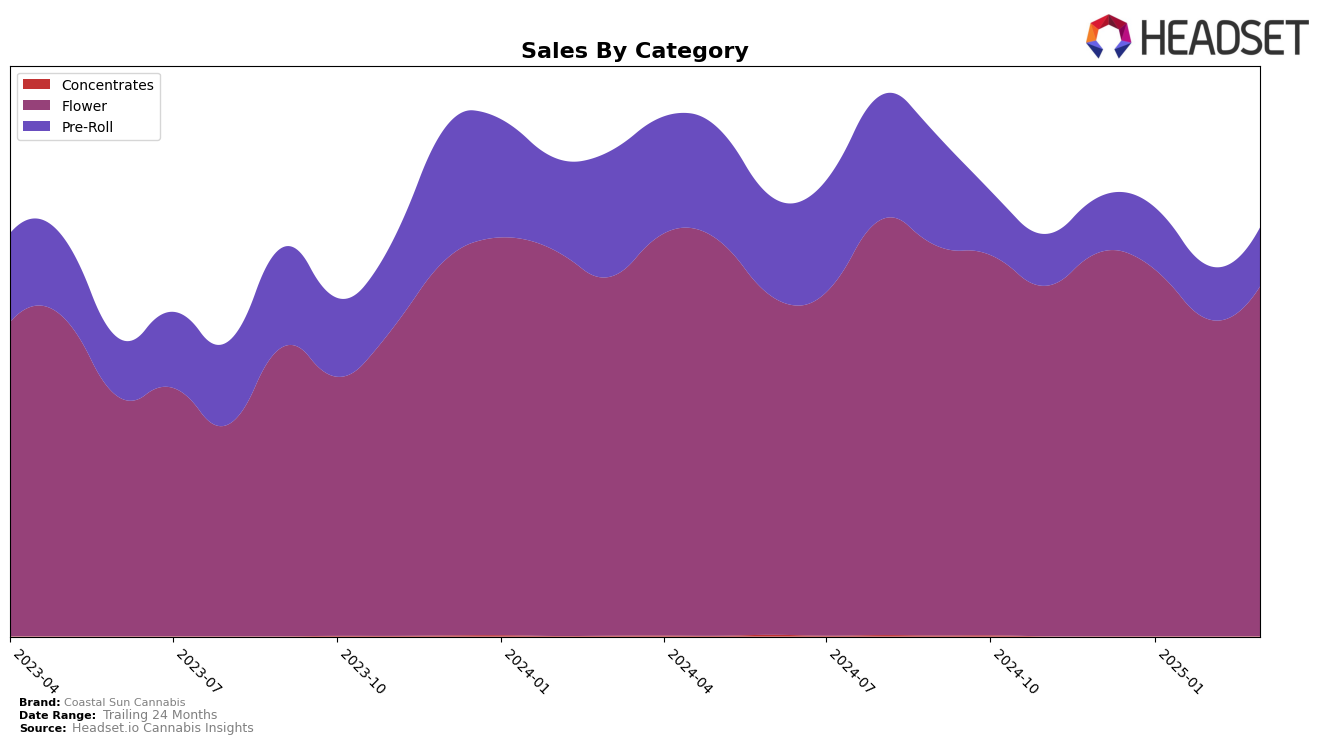

In the state of California, Coastal Sun Cannabis has shown a consistent presence in the Flower category, maintaining its position within the top 20 brands. Notably, the brand improved its rank from 20th in December 2024 to 17th in February 2025, before a slight dip to 19th in March 2025. This fluctuation suggests a competitive yet stable market presence. The sales figures support this trend, with a noticeable drop in February followed by a recovery in March. However, it's important to note that Coastal Sun Cannabis did not make it into the top 30 for the Pre-Roll category, indicating a potential area for growth or increased competition in that segment.

Despite not ranking in the top 30 for Pre-Rolls in California, Coastal Sun Cannabis experienced a positive movement from 54th to 45th between December 2024 and January 2025, although it settled at 49th in both February and March 2025. This suggests some volatility but also potential opportunities for improvement in this category. The sales data reflects a similar pattern, with a peak in January followed by fluctuations in the subsequent months. These insights highlight the dynamic nature of the cannabis market in California and suggest that while Coastal Sun Cannabis has a strong foothold in the Flower category, there is room for strategic growth in Pre-Rolls.

Competitive Landscape

In the competitive landscape of the California flower category, Coastal Sun Cannabis has shown a notable upward trend in its ranking, moving from 20th in December 2024 to 17th by February 2025, before slightly dropping to 19th in March 2025. This improvement in rank suggests a positive reception in the market, although the brand remains behind competitors like Dime Bag (CA) and Eighth Brother, Inc., which consistently maintained higher positions. Despite a dip in sales in February, Coastal Sun Cannabis managed to recover in March, indicating resilience and potential for growth. Meanwhile, West Coast Cure and Connected Cannabis Co. experienced a decline in their rankings, falling out of the top 20 by February and March respectively, which could present an opportunity for Coastal Sun Cannabis to capture more market share if these trends continue.

Notable Products

In March 2025, GMO Garlic Cookies (3.5g) continued to dominate the sales charts for Coastal Sun Cannabis, maintaining its first-place ranking for the fourth consecutive month with sales of 6198 units. Banjo (3.5g) held steady in the second position, showing a recovery from a dip in February. Moroccan Peaches (3.5g) remained in third place, although its sales decreased compared to the previous month. Pink Certz (3.5g) emerged in fourth place, marking its first appearance in the rankings. Tangie Cookie Burger (3.5g) slipped from fourth to fifth place, indicating a slight decline in popularity.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.