Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

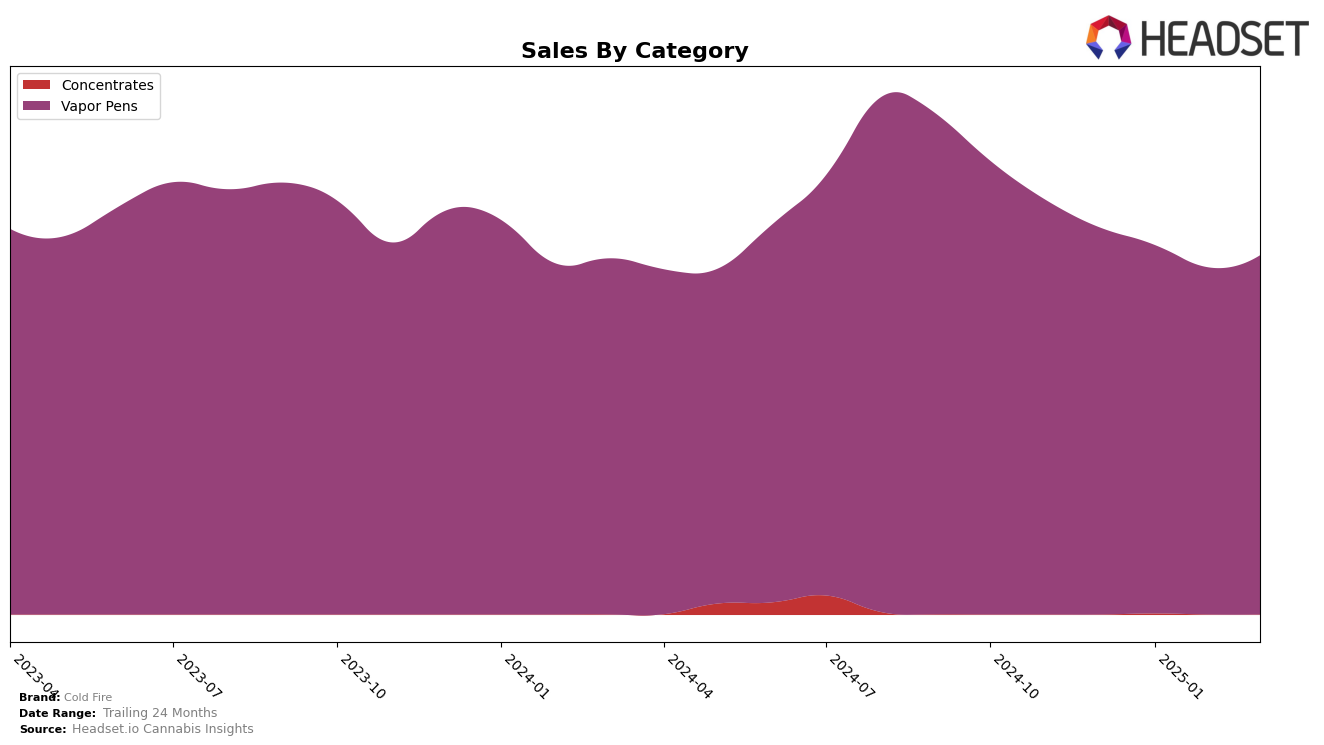

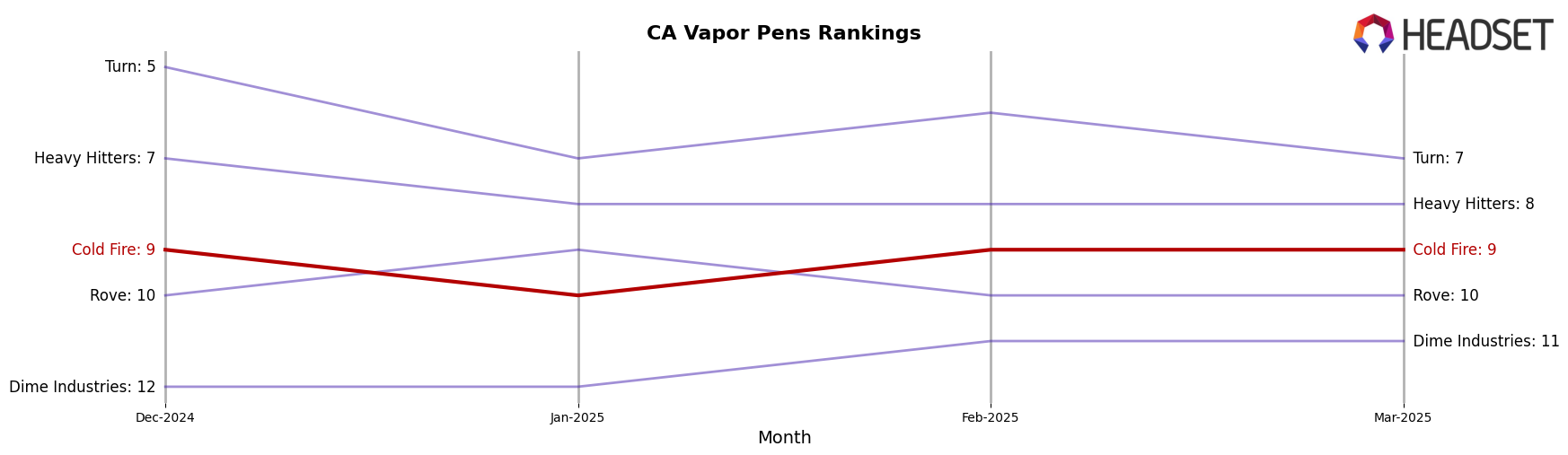

Cold Fire has demonstrated a consistent performance in the Vapor Pens category within California. The brand maintained a steady ranking, holding the 9th position in December 2024, February 2025, and March 2025, with a slight dip to the 10th position in January 2025. This stability in ranking suggests a loyal customer base and effective market penetration in the state. However, the sales figures show a downward trend from December 2024 to February 2025, with a slight recovery in March 2025. This indicates that while the brand remains popular, there might be external factors affecting sales, such as market saturation or seasonal variations.

In other states, Cold Fire's absence from the top 30 brands in similar categories might be a point of concern or an opportunity for strategic growth. Not being ranked in certain markets could imply either a lack of presence or insufficient market share to make a significant impact. This highlights potential areas for expansion or increased marketing efforts to capture more of the market. The brand's performance in California serves as a benchmark for what could be achieved in other regions if similar strategies are employed effectively.

Competitive Landscape

In the competitive landscape of vapor pens in California, Cold Fire has shown a consistent presence, maintaining a rank of 9th in December 2024 and February 2025, with a slight dip to 10th in January 2025. This stability in ranking suggests a resilient market position amidst fluctuating sales figures, which saw a decrease from December to February before a slight recovery in March. Competitors like Rove and Dime Industries have maintained similar rankings, with Rove consistently ranking just below Cold Fire, while Dime Industries has remained outside the top 10. Meanwhile, Heavy Hitters and Turn have consistently outperformed Cold Fire, with Turn notably maintaining a top 7 position throughout the period. This indicates that while Cold Fire holds a solid mid-tier position, there is potential for growth if it can leverage its stability to capture market share from higher-ranked competitors.

Notable Products

In March 2025, the top-performing product from Cold Fire was the ColdFire x Blem - Unruly OG Cured Resin Juice Cartridge (1g), maintaining its first-place rank for four consecutive months with impressive sales of 4935 units. The ColdFire x Dubz Garden - Coconut Horchata Cured Resin Juice Cartridge (1g) climbed back to second place after a dip to fourth in February, showcasing a strong recovery. The ColdFire x Blem - Rail Up Cured Resin Juice Cartridge (1g) made its debut in March, securing the third position. Meanwhile, the ColdFire x Blem - Graype Cured Resin Juice Cartridge (1g) dropped from third to fourth place, indicating a slight decrease in popularity. The ColdFire x Lumpy's - Benanimal Haze Cured Resin Juice Cartridge (1g) entered the rankings at fifth, rounding out the top five for March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.