Nov-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

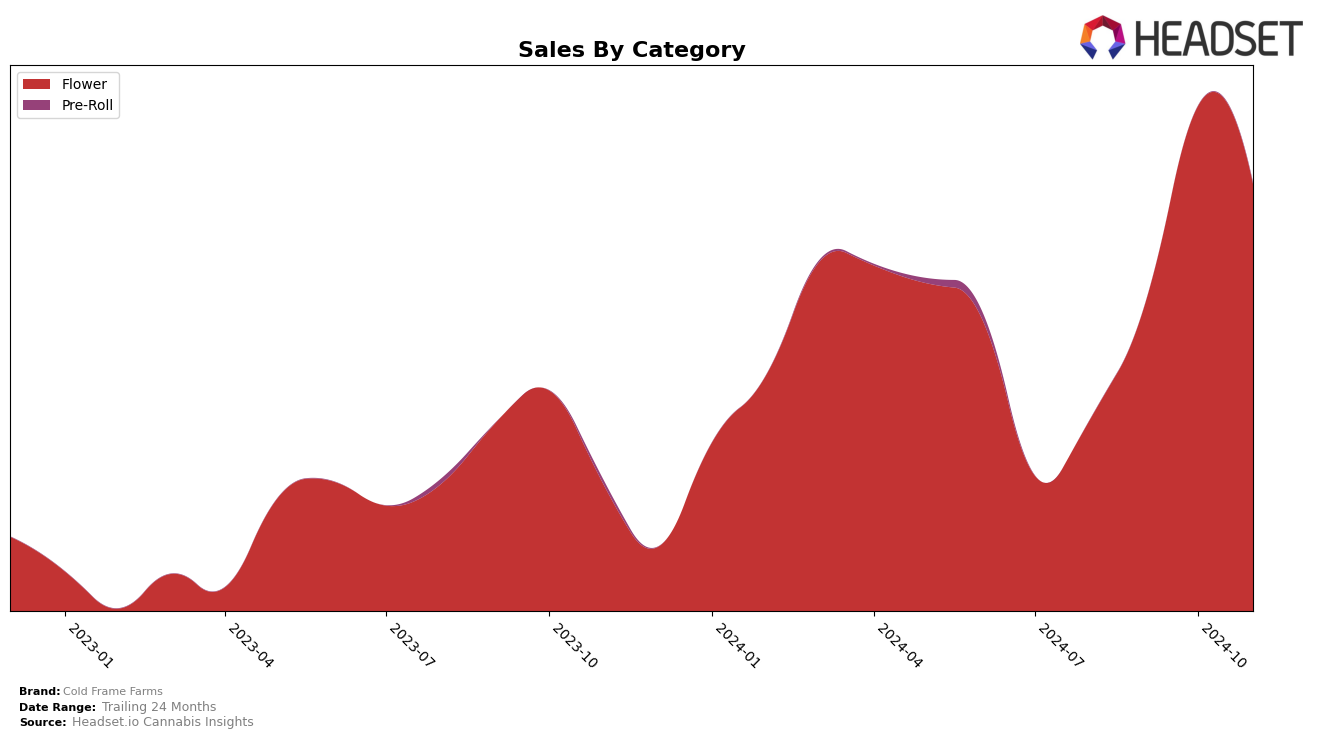

Cold Frame Farms has demonstrated a notable performance in the Flower category within Oregon. The brand has shown significant improvement in its rankings over the months, climbing from 67th place in August 2024 to a peak of 19th place in October 2024. This upward trend indicates a strong market presence and growing consumer preference in the state. However, the brand experienced a slight dip in November, falling to 27th place, which suggests potential volatility or increased competition within the category. Despite this, the overall trajectory remains positive, with substantial growth in sales, especially between August and October.

Interestingly, Cold Frame Farms did not appear in the top 30 rankings in any other state or province for the Flower category during this period. This absence highlights the brand's concentrated success in Oregon, but also points to potential opportunities for expansion or improvement in other markets. The brand's focused performance in Oregon could serve as a strategic foundation for entering new regions or strengthening its foothold in existing ones. Observing how Cold Frame Farms navigates this landscape in the coming months will be key to understanding its broader market strategy and potential for growth beyond Oregon.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Cold Frame Farms has demonstrated significant fluctuations in rank and sales over the past few months. Notably, Cold Frame Farms achieved its highest rank in October 2024, climbing to 19th place, a substantial improvement from its 67th position in August. This upward trajectory in rank coincides with a peak in sales during October, highlighting a successful period for the brand. However, by November, Cold Frame Farms experienced a slight decline to 27th place, indicating increased competition. Cultivated Industries showed a similar pattern, peaking at 24th in October before dropping to 28th in November, while Frontier Farms and Garden First both saw a gradual decline in rank over the same period. Interestingly, Juicy Farms made a remarkable leap from being outside the top 20 in August to securing 26th place in November, suggesting a potential emerging competitor. These dynamics underscore the competitive pressure Cold Frame Farms faces in maintaining its position and sales momentum in the Oregon flower market.

Notable Products

In November 2024, Black Patronus (Bulk) emerged as the top-performing product for Cold Frame Farms, reclaiming the number one spot with impressive sales of 2875 units. Super Runtz (Bulk) followed closely in second place, having dropped from its previous position as the top product in October 2024. Sherb Cake (Bulk) made its debut in the rankings at third place, indicating a strong market entry. Black Patronus (1g) also appeared in the rankings for the first time, securing fourth place. Rufios (Bulk) maintained its fifth position from October, showing consistent performance over the months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.