Jan-2026

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

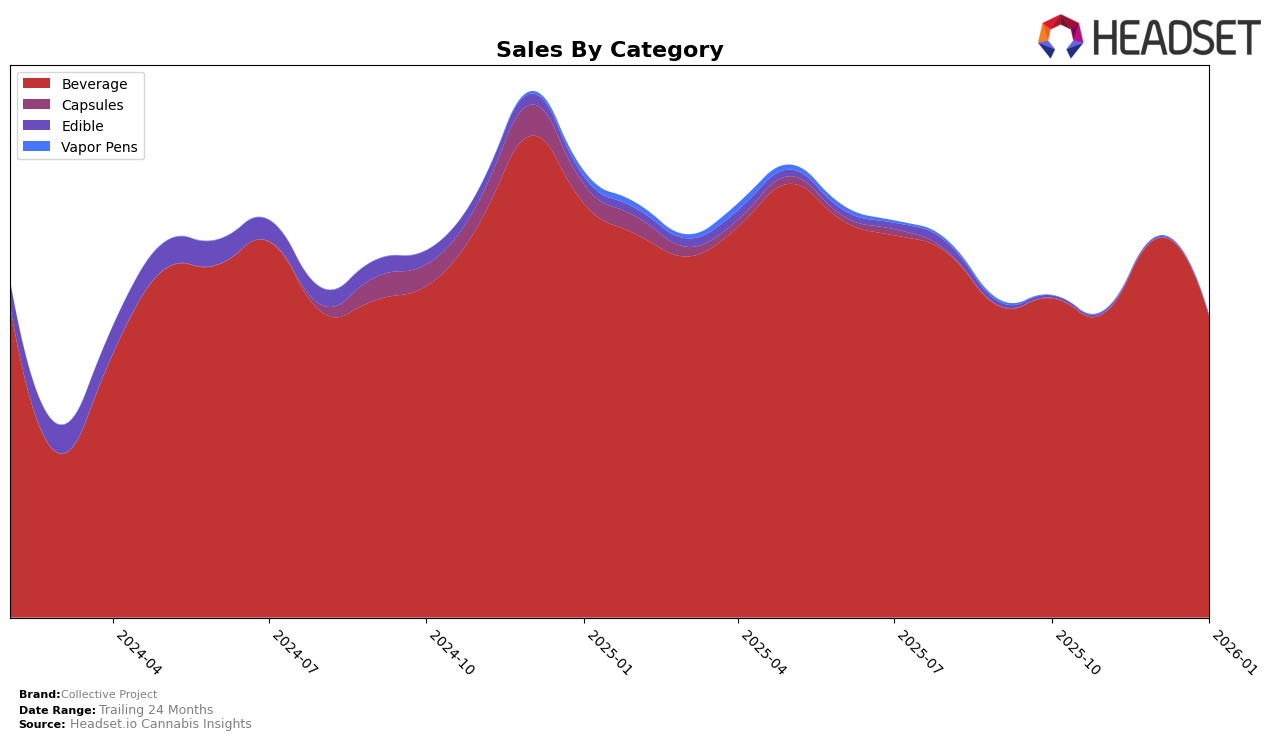

Collective Project has demonstrated varying performance across different Canadian provinces in the beverage category. In Alberta, the brand maintained a steady presence, ranking 7th in both October and November 2025, before climbing to 6th in December and dropping to 8th by January 2026. This fluctuation coincided with a peak in sales during December, suggesting a potential seasonal impact or successful promotional efforts during the holiday season. In contrast, in British Columbia, Collective Project showed a consistent upward trajectory, moving from 14th in October to 9th by December, where it held steady into January. The brand's ability to break into the top 10 in British Columbia could indicate growing consumer interest or effective market penetration strategies in this region.

Meanwhile, in Ontario, Collective Project consistently performed well, maintaining a position within the top 7 throughout the observed period. Despite a slight dip from 5th in December to 7th in January 2026, the brand's sales figures remained robust, with December marking a high point. This performance suggests that Ontario remains a stronghold for Collective Project, possibly due to established brand recognition or favorable market conditions. The absence of rankings outside the top 30 in any of these provinces underscores the brand's competitive presence in the Canadian beverage market, though the nuances of their performance in each region offer insights into their strategic positioning and potential areas for growth.

Competitive Landscape

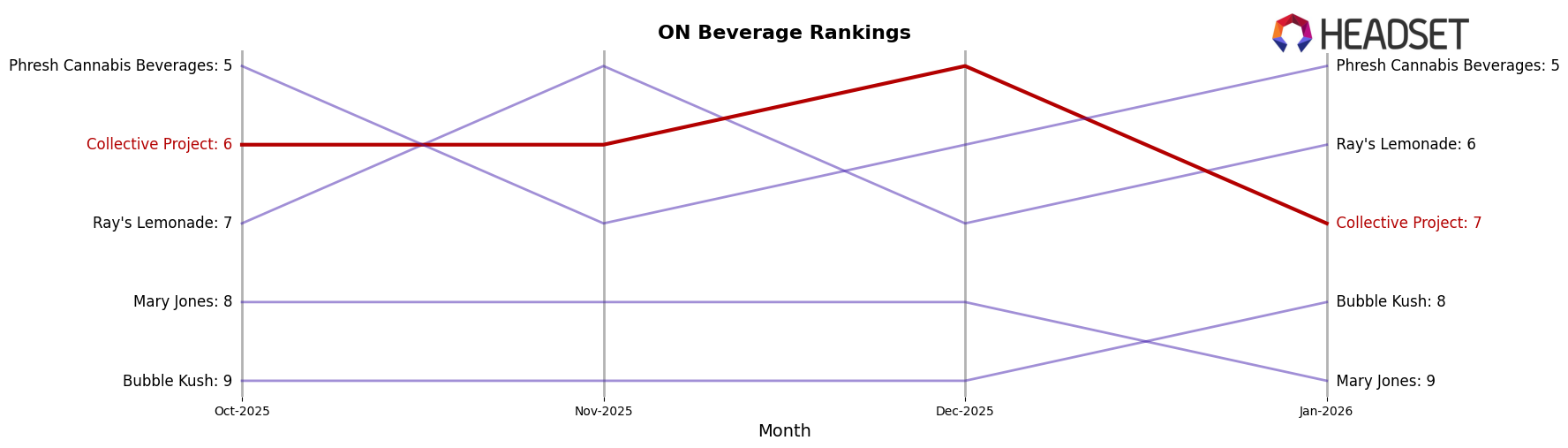

In the competitive landscape of the Ontario beverage category, Collective Project has experienced notable fluctuations in its ranking, reflecting dynamic shifts in market positioning. From October 2025 to January 2026, Collective Project's rank varied between 5th and 7th place, indicating a competitive tussle with brands like Ray's Lemonade and Phresh Cannabis Beverages. While Collective Project secured a higher rank than Ray's Lemonade in December 2025, it slipped below both Ray's Lemonade and Phresh Cannabis Beverages in January 2026. Despite these rank changes, Collective Project's sales figures show a general downward trend from October 2025 to January 2026, which could be a concern as competitors like Phresh Cannabis Beverages managed to increase their sales in January 2026. This competitive environment highlights the need for Collective Project to strategize effectively to maintain and improve its market position amidst the fluctuating dynamics of the Ontario beverage market.

Notable Products

In January 2026, Collective Project's top-performing product was the CBD/THC 1:1 Original Blood Orange, Yuzu & Vanilla Sparkling Juice, maintaining its consistent first-place ranking since October 2025, with sales reaching 18,966 units. The Squeezed- THC/CBG 1:2 Heat Wave Strawberry Lemonade Sparkling Beverage remained in second place, showing steady demand. Notably, the Happy Place - CBG/THC 2:1 Mango Peach & Yuzu Juice Sparkling Beverage rose to third place from fourth in December 2025, indicating growing popularity. Meanwhile, the Happy Place - CBG/THC 1:2 variant dropped to fourth place, suggesting a shift in consumer preference. Botany - CBD/THC 1:1 White Peach & Cardamom Sparkling Botanical Water entered the rankings at fifth, marking its debut in January 2026.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.