Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

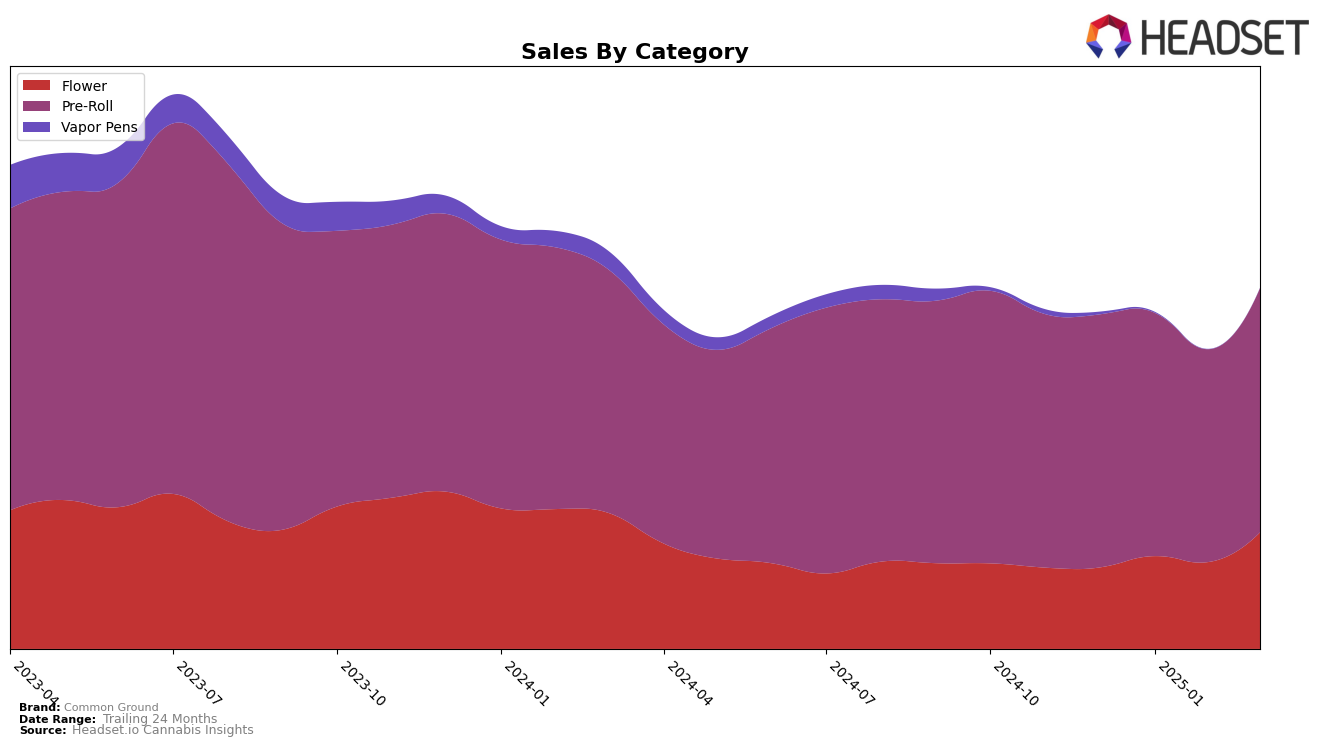

Common Ground has demonstrated notable progress in the Alberta market, especially within the Flower category. Their ranking improved significantly from 77th in December 2024 to 27th by March 2025, indicating a strong upward trajectory. This positive movement is corroborated by their sales figures, which more than tripled over the same period. In the Pre-Roll category, they maintained a steady climb, moving from 43rd to 31st, showing consistent growth and demand for their products in Alberta. However, it's worth noting that they did not break into the top 30 in the Pre-Roll category, highlighting room for further growth.

In British Columbia, Common Ground's performance in the Pre-Roll category has been slightly more volatile. While they maintained a position within the top 25, their rank slipped from 21st in both December and January to 25th in March. This suggests some competitive pressure or shifts in consumer preferences in the region. Meanwhile, in Ontario, the brand's Flower category ranking showed a positive trend, improving from 61st to 52nd by March, despite some fluctuations in sales. Their Pre-Roll category in Ontario remained relatively stable, hovering around the 38th position, indicating a steady but not dominant presence in the market.

Competitive Landscape

In the competitive landscape of the Pre-Roll category in Ontario, Common Ground has shown a relatively stable performance from December 2024 to March 2025, maintaining a rank in the high 30s. Despite not breaking into the top 20, Common Ground has slightly improved its position from 40th in December 2024 to 38th by March 2025. This stability is noteworthy when compared to competitors like Color Cannabis, which saw a decline from 22nd to 37th place over the same period, indicating a significant drop in sales. Meanwhile, The Loud Plug and GREAZY have fluctuated within the 30s, with The Loud Plug slipping from 30th to 36th and GREAZY dropping from 34th to 40th. This suggests that while Common Ground's sales are lower than some competitors, its consistent rank indicates a steady market presence, potentially appealing to consumers seeking reliability in their purchasing decisions. Additionally, DEBUNK has remained at the bottom of the rankings, only slightly improving to 39th by March 2025, highlighting Common Ground's relative strength in maintaining its position amidst fluctuating competitors.

Notable Products

In March 2025, the top-performing product for Common Ground was the Amherst Sour Diesel Pre-Roll 10-Pack (5g), maintaining its consistent first-place ranking from previous months with sales of 8369. The Pink Rozay Pre-Roll 2-Pack (2g) held steady in second place, showing a notable increase in sales. The Strawberry Pie Pre-Roll 5-Pack (2.5g) climbed to third place from fifth in February, indicating a significant rise in popularity. Lemon Pave Milled (7g) entered the rankings at fourth place, showcasing strong initial sales. The MAC Pack Pre-Roll 10-Pack (5g) slipped from third to fifth place, reflecting a decrease in its sales momentum over the past few months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.