Nov-2023

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

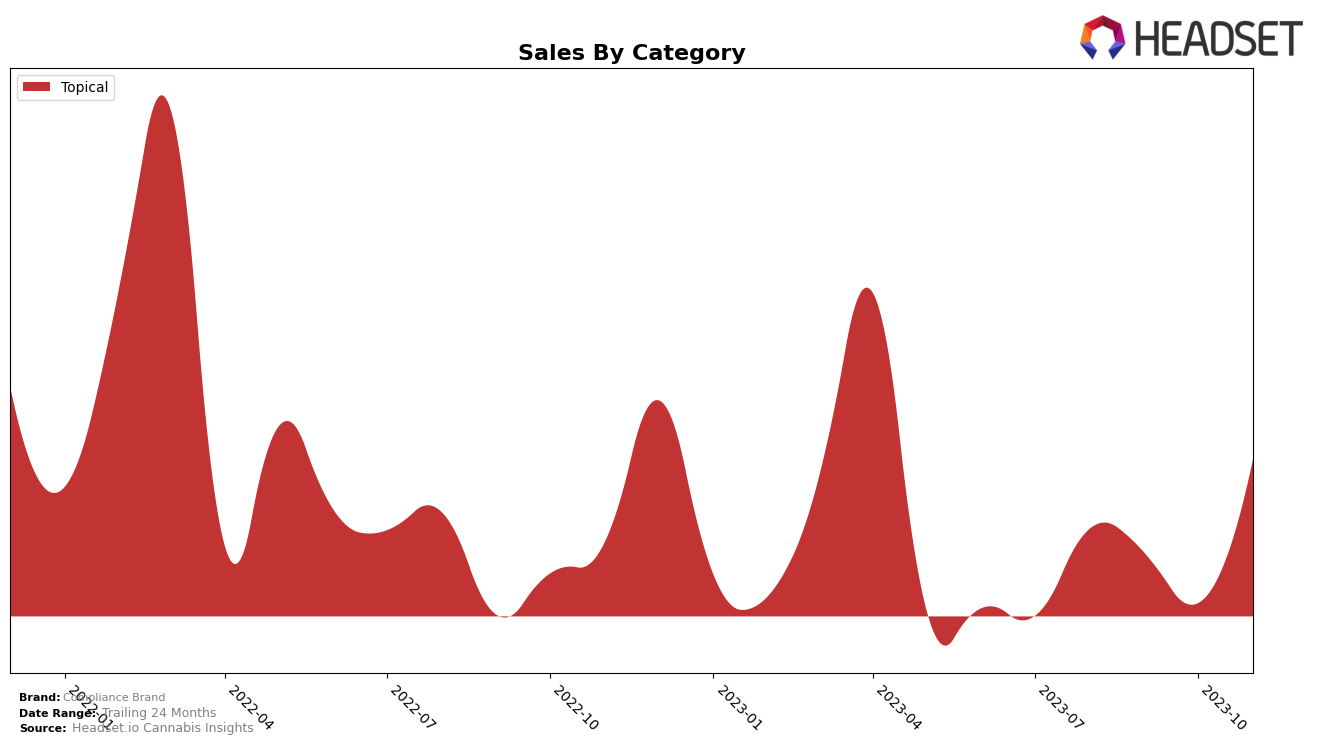

In the topical category, Compliance Brand has shown varied performance across different states. In Alberta, the brand did not make it to the top 20 in the months of October and November 2023, indicating a potential decrease in popularity or sales. However, it's important to note that this does not necessarily signify a negative trend, as the brand could be focusing on other strategies or categories. The sales in August and September 2023 were 212.0 and 141.0 respectively, showing a downward trend during this period.

On the other hand, in British Columbia, Compliance Brand consistently ranked in the top 20 from August to November 2023. The brand experienced a slight dip in ranking in October, moving from 14th to 17th place, but bounced back in November, securing the 11th position. This shows a promising upward movement, especially considering the significant increase in sales from 198.0 in October to 1487.0 in November. This suggests that the brand is gaining traction in the British Columbia market.

Competitive Landscape

In the Topical category within British Columbia, Compliance Brand has seen a significant fluctuation in its ranking and sales over the months of August to November 2023. Starting from a rank of 13 in August, it dropped to 17 in October before making a notable recovery to 11 in November. This recovery is reflected in its sales, which after a dip in September and October, saw a substantial increase in November. In comparison, Apothecary Labs was not in the top 20 brands from August to October, but entered the ranking in November. Emprise Canada and feelgood have maintained a relatively stable presence in the top 10, with feelgood consistently ranking higher than Compliance Brand. Transit, despite a higher rank in August, saw a drop in September and has been ranking close to Compliance Brand since then. The trends suggest a highly competitive market with Compliance Brand making a strong comeback in November.

Notable Products

In November 2023, the top-performing products from Compliance Brand were dominated by topicals. The THC Infused Bath Oil (120mg) held the top spot, with notable sales figures reaching 120 units. This product has shown a consistent performance, having ranked 1st in October and 3rd in August. The second best-seller was the THC-infused Multi-use Balm (6.58mg), which sold 6 units. This product has consistently ranked in the top two since August, although it has seen a slight decrease in sales over the months. The THC-Infused Face Serum (213.95mg), which had previously held the 2nd rank in August and September, did not feature in the top rankings for November.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.