Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

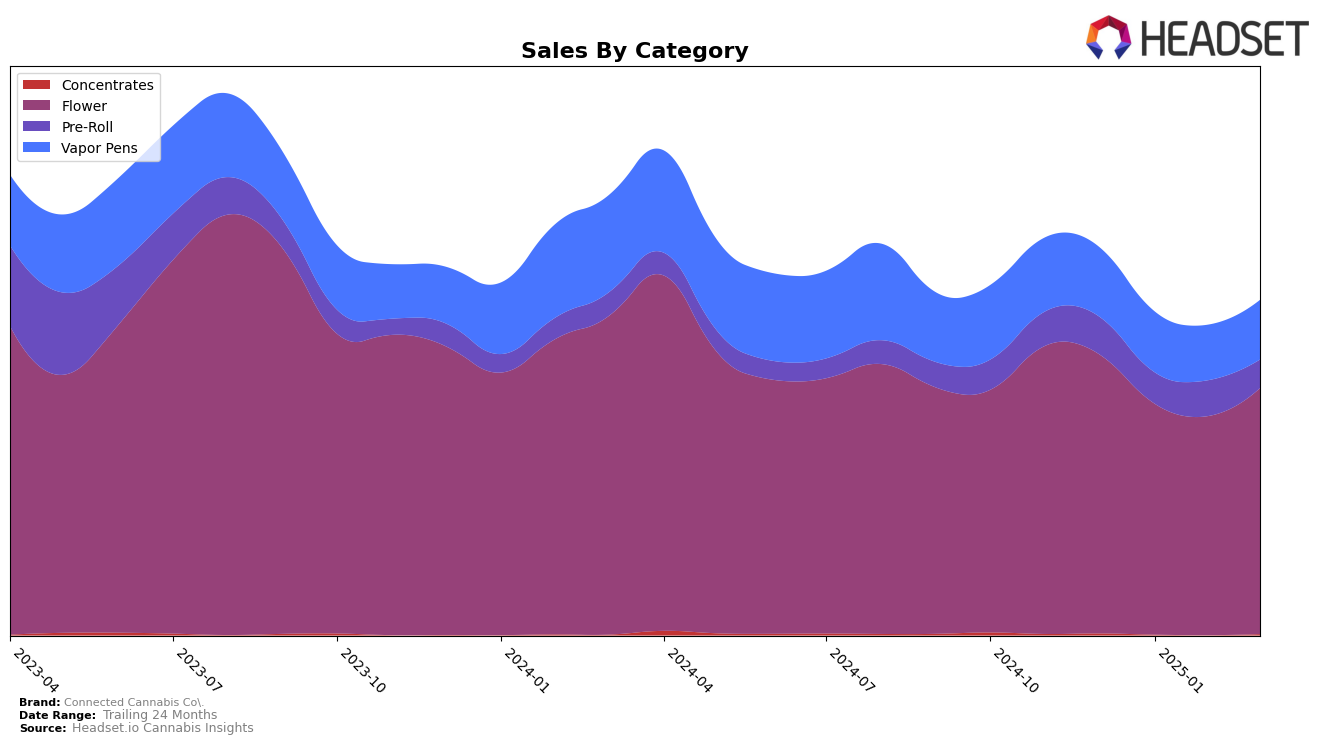

Connected Cannabis Co. has shown varied performance across different categories in Arizona. In the Flower category, the brand experienced a notable improvement, climbing from the 14th position in January 2025 to the 5th spot in February 2025, although it slightly dropped to 7th in March 2025. This upward movement suggests a strong consumer preference for their flower products. In contrast, their performance in the Vapor Pens category has been less impressive, with rankings hovering outside the top 30, peaking at 32nd in February 2025. This indicates a potential area for growth or reconsideration of strategy in this segment. The Pre-Roll category saw some fluctuations but maintained a presence within the top 30, which could be seen as a positive sign given the competitive nature of this product line.

In California, Connected Cannabis Co. faced challenges in maintaining its position in the Flower category, dropping from the 12th rank in December 2024 to 21st by March 2025. This decline in rank might reflect increased competition or shifts in consumer preferences. The Pre-Roll and Vapor Pens categories tell a similar story, as the brand did not secure a top 30 position in Pre-Rolls after December 2024 and barely maintained its rank in the Vapor Pens category, ending at 45th in March 2025. These trends suggest that while Connected Cannabis Co. has a strong foothold in Arizona, it may need to reevaluate its strategies in California to regain its competitive edge, especially in the Pre-Roll and Vapor Pens segments.

Competitive Landscape

In the competitive landscape of California's Flower category, Connected Cannabis Co. has experienced notable shifts in rank and sales over recent months. Starting from a rank of 12 in December 2024, Connected Cannabis Co. saw a decline to 21 by March 2025, indicating increased competition and market dynamics. During this period, West Coast Cure maintained a relatively stable position, ranking 20th in March 2025, while Coastal Sun Cannabis showed a slight improvement, moving from 20th in December 2024 to 19th in March 2025. Meanwhile, Jungle Boys experienced fluctuations, dropping out of the top 20 in February 2025 but recovering to 23rd by March. Despite these changes, Connected Cannabis Co. managed to maintain higher sales than its competitors, such as Originals, which, although improving its rank to 22 by March 2025, still reported lower sales figures. These dynamics suggest that while Connected Cannabis Co. faces stiff competition, its sales performance remains robust, highlighting the importance of strategic marketing and product differentiation to regain and sustain higher rankings.

Notable Products

In March 2025, Connected Cannabis Co.'s top-performing product was Permanent Marker (3.5g) in the Flower category, maintaining its number one rank for four consecutive months with a sales figure of 6135. Silver Spoon (3.5g) also remained steady at the second position, demonstrating consistent popularity among consumers. Biscotti (3.5g) climbed back to the third position after being unranked in February 2025, showcasing a resurgence in demand. Tropical Z (3.5g) improved its standing by one spot, moving from fifth in December and January to fourth in March. Nightshade (3.5g) re-entered the rankings in March at fifth place after being absent in January and February, indicating a renewed interest in this product.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.