Jul-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

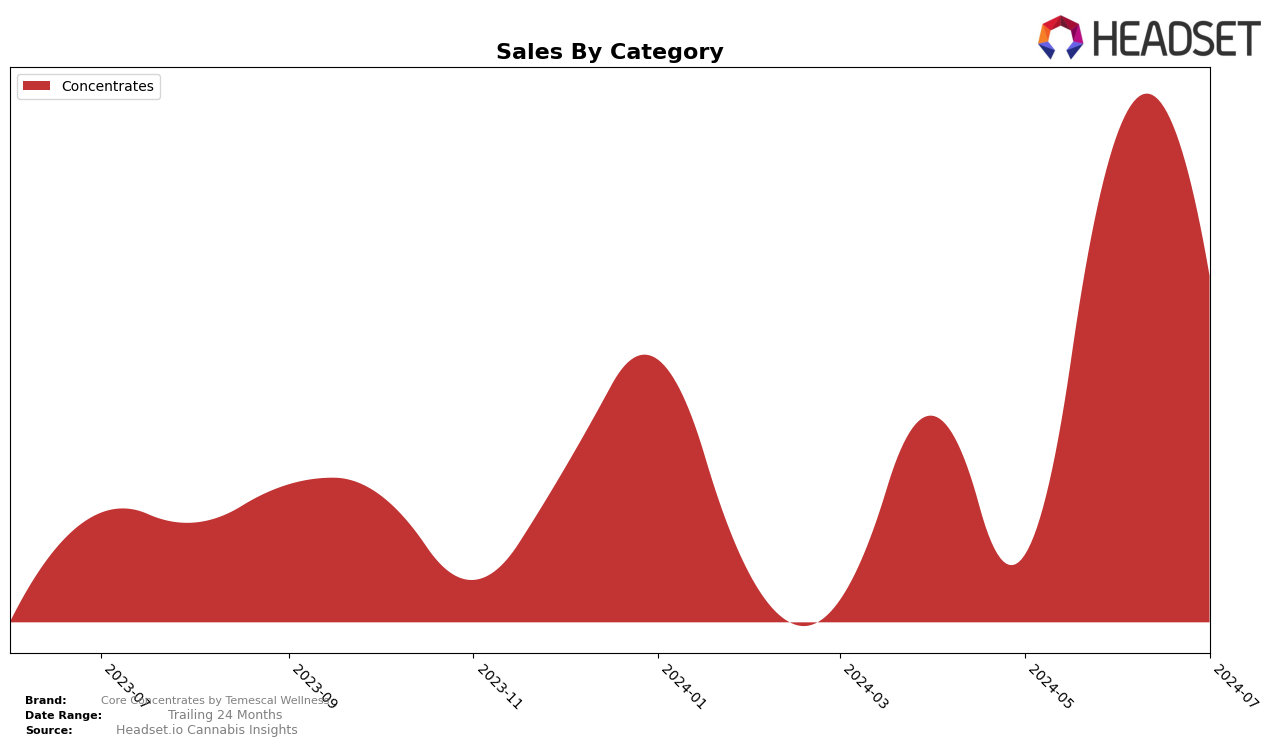

Core Concentrates by Temescal Wellness has shown a dynamic performance across categories and states, with notable fluctuations in ranking and sales over recent months. In Massachusetts, the brand started outside the top 30 in April 2024 but made a significant leap to the 14th position by June 2024. This upward movement indicates a strong market reception and increasing consumer preference for their products. However, by July 2024, the brand's ranking had slipped to 23rd, suggesting potential challenges in maintaining consistent growth or increased competition in the state.

Despite the fluctuations in ranking, Core Concentrates by Temescal Wellness experienced a substantial increase in sales from April to June 2024, peaking in June with a notable figure before declining in July. This trend highlights the brand's capability to capture market attention but also underscores the volatility and competitive nature of the concentrates category. The absence of a ranking in May 2024 suggests that the brand was not among the top 30, which could be viewed as a setback or a temporary dip in performance. These movements provide insights into the brand's market dynamics and potential areas for strategic improvement.

Competitive Landscape

In the Massachusetts concentrates market, Core Concentrates by Temescal Wellness has experienced notable fluctuations in its rank over recent months, which could impact its market positioning and sales trajectory. In April 2024, Core Concentrates was ranked 35th, but it did not appear in the top 20 in May, indicating a potential dip in market presence. However, the brand made a significant comeback in June, climbing to 14th place, before settling at 23rd in July. This volatility contrasts with more stable competitors like Haze Extracts, which maintained a relatively consistent rank, fluctuating between 17th and 24th, and Green Gold Group, which showed a gradual improvement from 27th to 21st. Meanwhile, Mile 62 demonstrated a steady upward trend, moving from 59th to 27th over the same period. These dynamics suggest that while Core Concentrates has the potential for rapid gains, it faces stiff competition from brands with more stable or improving market positions, which could influence consumer preferences and sales in the long term.

Notable Products

In July 2024, the top-performing product from Core Concentrates by Temescal Wellness was CORE x Good Chem- Elmar's Purple Posion Cured Resin (1g), maintaining its number one rank from the previous month with notable sales of 841 units. Following closely, CORE x Good Chem-Strawberry Daze Cured Resin (1g) remained steady at the second position with consistent sales growth. Bahama Mamba Live Resin (1g) debuted at third place, showing promising performance. Kush Crusher Live Resin (1g) and GMO Live Resin (1g) entered the rankings for the first time at fourth and fifth positions, respectively. This shift suggests a growing interest in a variety of live resin products from Core Concentrates by Temescal Wellness.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.