Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

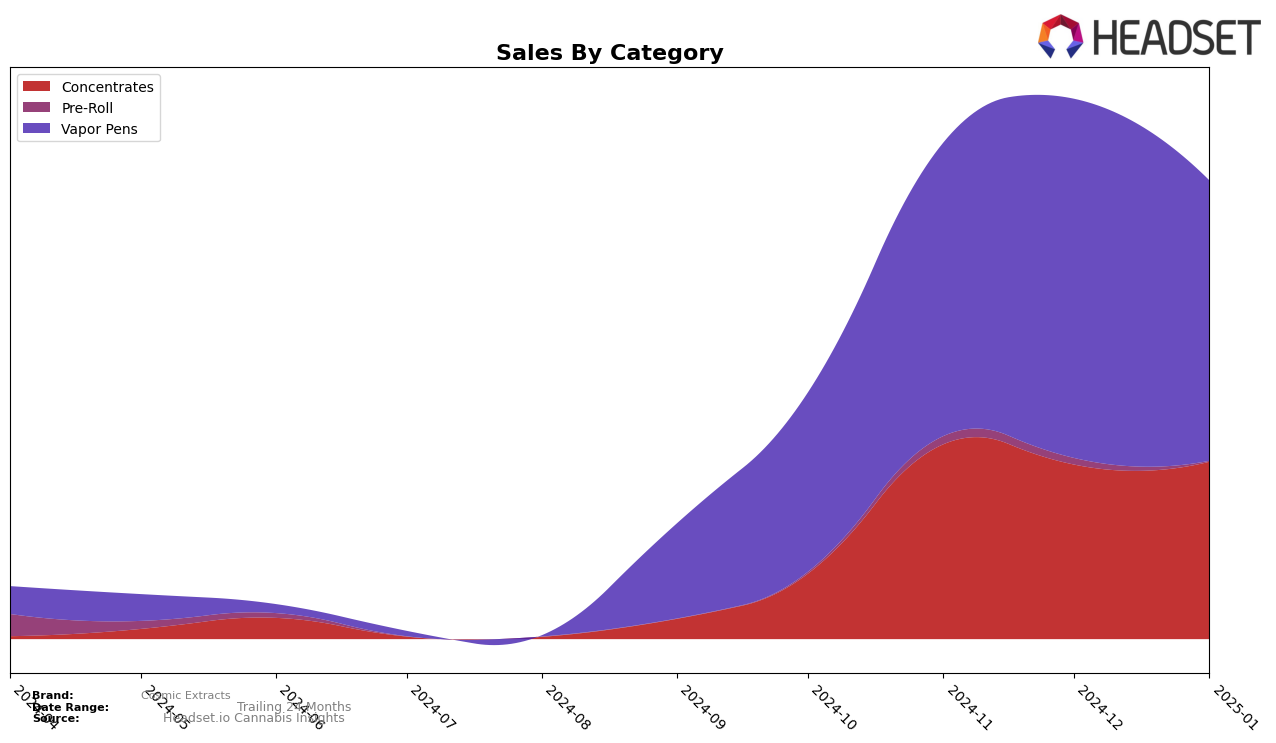

Cosmic Extracts has shown a strong performance in the Concentrates category within Saskatchewan. Notably, the brand improved its ranking from 9th in October 2024 to 4th by November and maintained this position through January 2025. This consistent top-tier ranking suggests a solid foothold in the market, indicative of a strong consumer preference and likely successful marketing strategies. The upward trajectory in sales from October to November signifies a significant boost in market presence during this period, although the sales figures slightly tapered off in the following months, maintaining a stable yet high performance.

In contrast, the Vapor Pens category presents a more fluctuating performance for Cosmic Extracts in Saskatchewan. Initially ranked 25th in October, the brand climbed to 17th in November and December, before slipping back to 21st in January 2025. This volatility suggests challenges in maintaining a consistent market position, possibly due to stiff competition or shifting consumer preferences. However, the increase in sales from October to December indicates a period of growth and potential opportunity if the brand can capitalize on the factors driving this demand. Despite the drop in January, the brand's presence in the top 30 highlights its relevance in the market, albeit with room for strategic improvements.

Competitive Landscape

In the competitive landscape of vapor pens in Saskatchewan, Cosmic Extracts has shown a notable fluctuation in its market position over recent months. Initially absent from the top 20 in October 2024, Cosmic Extracts made a significant leap to rank 17th in November and December 2024, before experiencing a slight decline to 21st in January 2025. This upward trajectory in late 2024 was accompanied by a substantial increase in sales, particularly from October to December, indicating a growing consumer interest. However, the brand faces stiff competition from RAD (Really Awesome Dope), which consistently maintained a higher rank, peaking at 12th in December 2024. Meanwhile, Kolab and JC Green Cannabis Company also pose competitive threats, with Kolab maintaining a presence in the top 20 and JC Green Cannabis Company showing resilience despite a dip in November. These dynamics suggest that while Cosmic Extracts is gaining traction, it must strategize effectively to sustain its growth and improve its competitive standing in the Saskatchewan vapor pen market.

Notable Products

In January 2025, the top-performing product from Cosmic Extracts was the Grape Live Rosin Cartridge (1g) in the Vapor Pens category, maintaining its number one rank from November 2024 with sales of 501 units. The Cereal Milk Live Rosin (1g) in the Concentrates category rose to second place from fourth in December 2024, showing a notable increase in popularity. The Gorilla Zkittlez Live Rosin Cartridge (1g) also improved its standing, climbing to third place from fifth in the previous month. The Cherry Distillate Cartridge (1g) dropped to fourth place, despite being a top contender in October 2024. Lastly, the Banana Distillate Cartridge (1g) fell to fifth place after leading in December 2024, indicating a shift in consumer preference.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.