Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

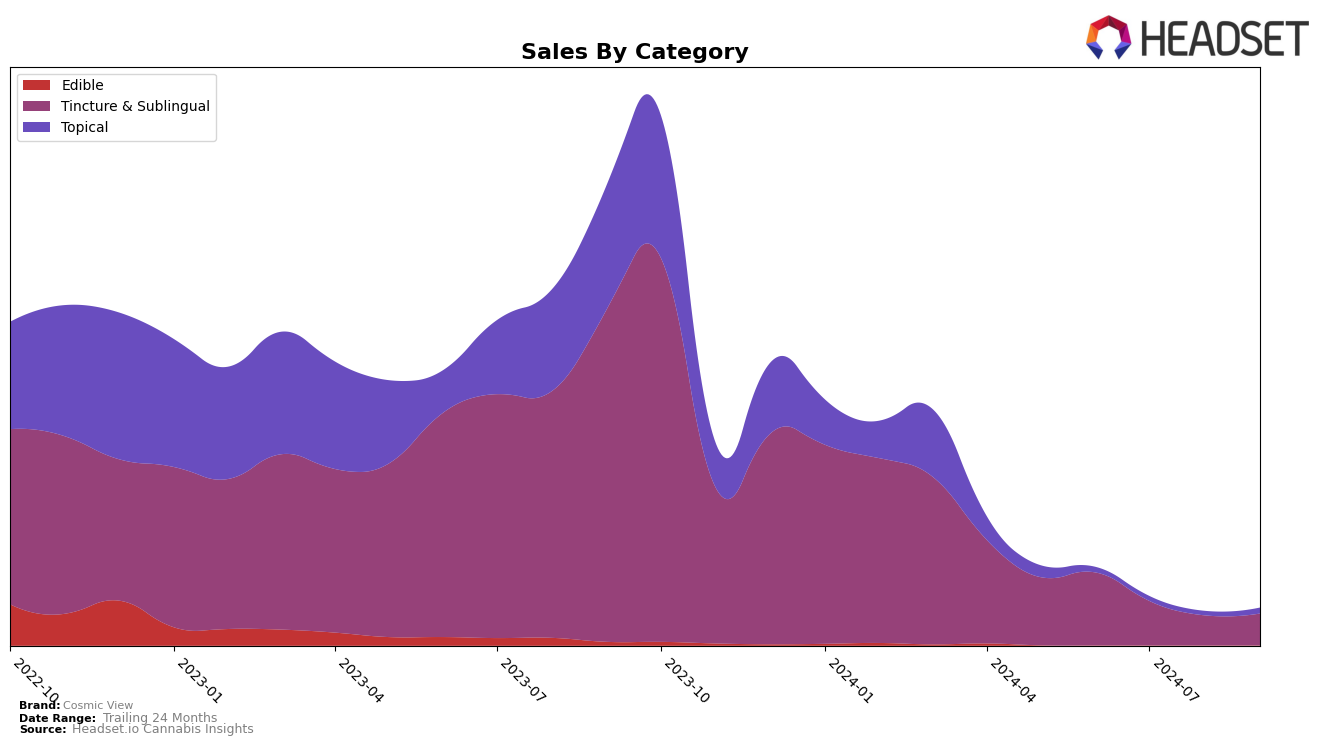

Cosmic View has shown a presence in the California market, specifically within the Tincture & Sublingual category. In June 2024, the brand was ranked 22nd, which indicates a respectable position among its competitors. However, the absence of rankings in the following months of July, August, and September suggests that Cosmic View did not maintain a spot in the top 30 brands within this category in California. This drop could imply either a decrease in sales or increased competition, which might have pushed the brand out of the spotlight.

The lack of data for the subsequent months could be concerning for Cosmic View, as maintaining visibility in a competitive market like California is crucial for sustained success. The initial ranking in June, supported by sales figures, suggests there was potential, but the brand's trajectory in the latter months indicates challenges that need addressing. Understanding the dynamics behind this shift could provide insights into consumer preferences or market saturation within the tincture and sublingual products category. Further analysis of these trends might reveal strategic opportunities for the brand to regain its standing in the market.

Competitive Landscape

In the competitive landscape of the Tincture & Sublingual category in California, Cosmic View has experienced notable shifts in rank and sales, which are crucial for understanding its market positioning. As of June 2024, Cosmic View was ranked 22nd, indicating a competitive but challenging position within the top 20 brands. However, it did not maintain this rank in the subsequent months, suggesting a drop out of the top 20, which could be due to increased competition or changes in consumer preferences. In comparison, Ole'4 Fingers held a stronger position, ranked 17th in June 2024, and Don Primo was ranked 23rd, just below Cosmic View. This suggests that while Cosmic View was ahead of Don Primo, it faced significant competition from Ole'4 Fingers, which may have impacted its sales and rank trajectory. Understanding these dynamics is essential for Cosmic View to strategize effectively and potentially regain or improve its market standing.

Notable Products

In September 2024, the top-performing product for Cosmic View was the CBD/THC 2:1 Restore Tincture from the Tincture & Sublingual category, maintaining its number one rank from July. The CBD/THC 1:4 Slumber Tincture also performed well, securing the second rank, consistent with its July performance, with sales reaching 38 units. The THC/THCV 2:1 Pink Boost Tincture, which was the leader in August, dropped to the third position in September. The CBD/THC 1:4 Cycle Soothe Women's Relief Balm remained in the fourth spot, showing a slight increase in sales compared to August. Notably, the CBD/THC 20:1 CBD Rich Tincture debuted in the rankings in August at the second position and maintained its strong presence in September.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.