Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

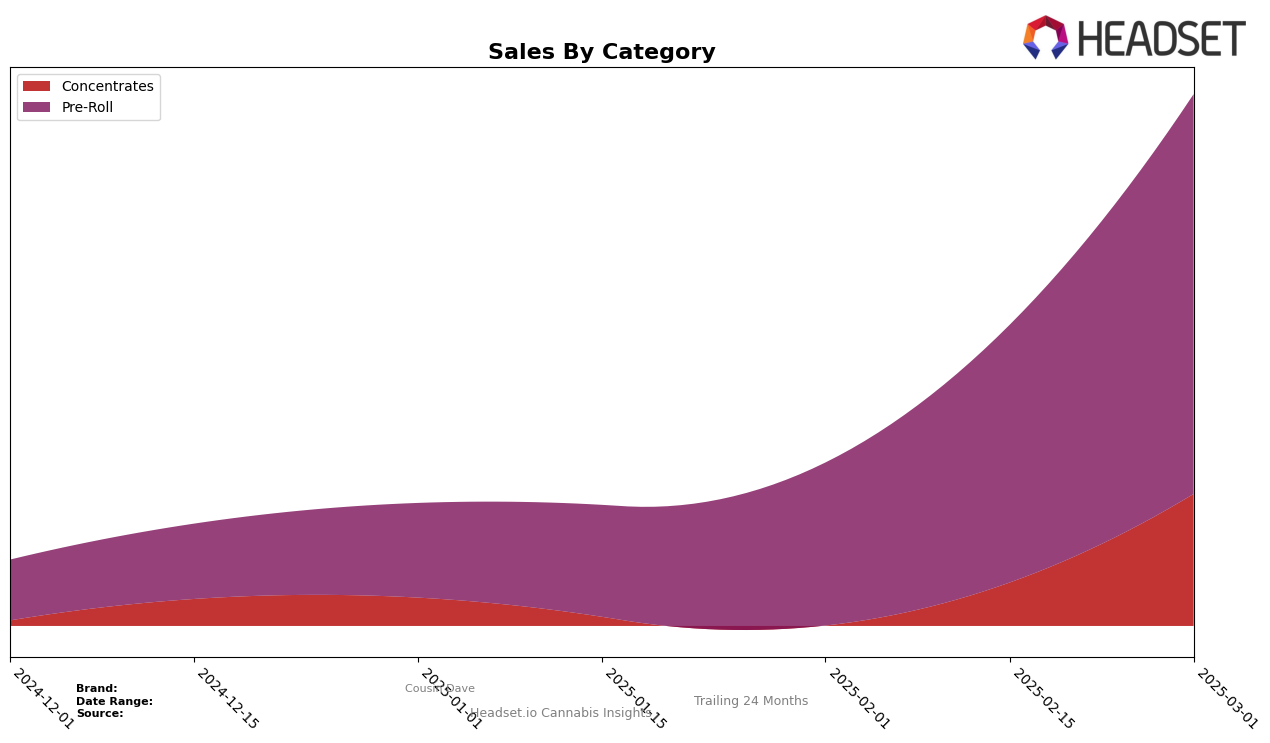

Cousin Dave has shown a notable upward trajectory in the Missouri market, particularly in the Pre-Roll category. Starting from a rank of 54 in December 2024, the brand has consistently climbed the ranks, reaching 27 by March 2025. This improvement is indicative of a strong market presence and growing consumer interest in their Pre-Roll products. The shift from not being in the top 30 in December to securing a spot by March is a significant achievement, highlighting the brand's potential to capture more market share in the coming months.

In the Concentrates category, Cousin Dave's performance in Missouri also reflects positive momentum. Although they did not make the top 30 in December 2024 and February 2025, their re-entry into the rankings at 27 in March 2025 suggests a resurgence in consumer demand. This reappearance in the rankings could be attributed to strategic marketing efforts or product innovations that resonated well with consumers. The absence from the top 30 in certain months, however, indicates potential volatility or competition in this segment, which Cousin Dave may need to address to maintain consistent growth.

Competitive Landscape

In the Missouri Pre-Roll category, Cousin Dave has shown a remarkable upward trajectory in rankings from December 2024 to March 2025. Initially ranked 54th in December, Cousin Dave climbed to 27th by March, indicating a significant improvement in market presence and consumer preference. This rise in rank is particularly notable when compared to competitors like TRIP, which fluctuated between 23rd and 44th, and Sublime, which showed a more stable but less dynamic movement from 37th to 29th. Meanwhile, Sundro Cannabis and Cubano maintained relatively stable positions in the top 30, with Cubano slightly edging out Sundro Cannabis by March. Cousin Dave's sales growth trajectory aligns with its improved ranking, suggesting a successful strategy in capturing market share and consumer interest in the Missouri Pre-Roll market.

Notable Products

In March 2025, Cousin Dave's top-performing product was the Ice Cream Cake Pre-Roll (1g) in the Pre-Roll category, maintaining its number one position from February with sales reaching 1220 units. The La Bomba Pre-Roll 5-Pack (2.5g) also climbed to the top spot, sharing first place with the Ice Cream Cake Pre-Roll, showing a significant rise from its fourth position in February. Orange Cookie Chem Pre-Roll 5-Pack (2.5g) held steady in second place, demonstrating consistent performance since December 2024. Member Berry Sugar Wax (1g) made a notable entry into the top ranks, reaching third place in March, indicating growing popularity in the Concentrates category. Super Lemon Haze Pre-Roll 5-Pack (2.5g), which was previously unranked in recent months, returned to the top five, securing fourth position.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.