Mar-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

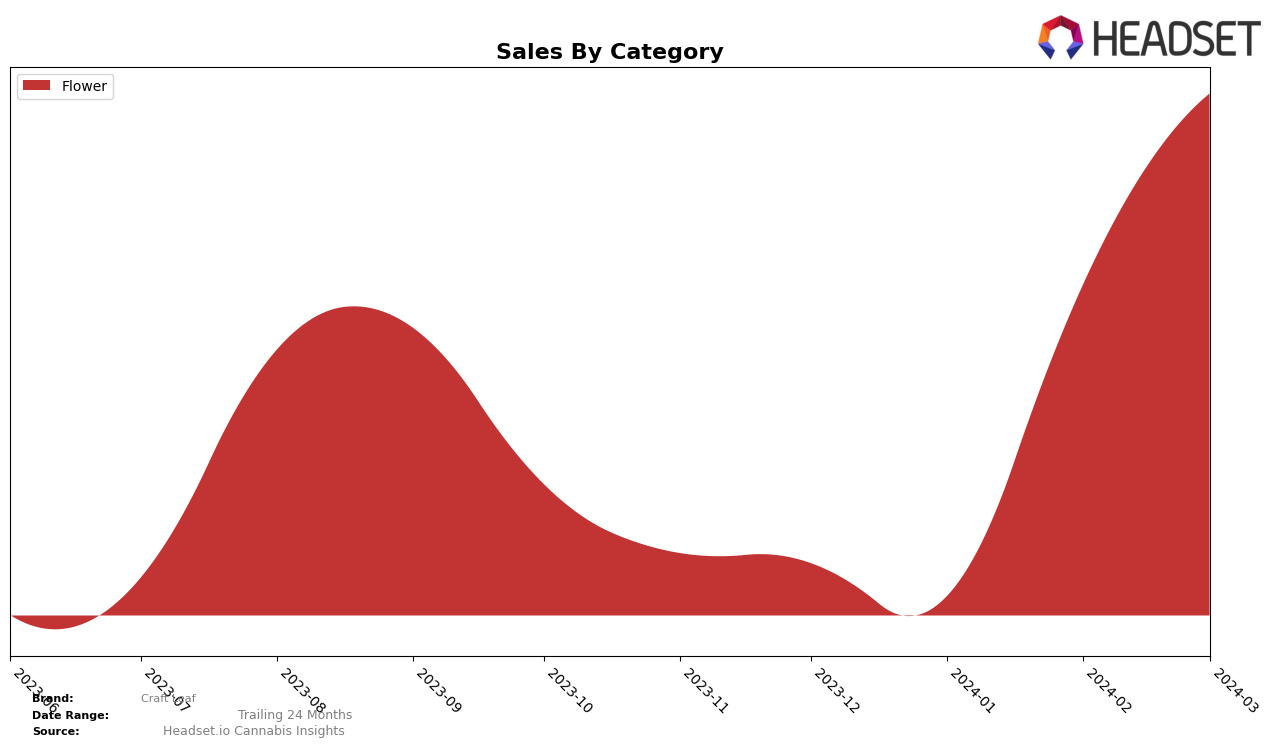

In the highly competitive cannabis market of Michigan, Craft Leaf has shown a notable performance in the Flower category. Starting the year without a rank in the top 30 brands for December 2023 and January 2024, Craft Leaf made a significant leap into the rankings by February 2024, landing at the 31st position. This upward trajectory continued into March 2024, where they further climbed the ladder to the 18th spot. This movement indicates a strong positive momentum for Craft Leaf in the Flower category within the Michigan market. The sales figures support this growth trajectory, with a substantial increase from February 2024's sales to March 2024's, hinting at an increasing consumer preference and market share for Craft Leaf's Flower products.

However, the absence of Craft Leaf in the top 30 rankings for both December 2023 and January 2024 in Michigan's Flower category suggests a period of either strategic repositioning or challenges that may have initially hindered their visibility and sales in this highly competitive segment. This gap in the rankings could be viewed as a setback or a recalibration period for the brand. The significant sales figure in March 2024, exceeding 1.2 million, underscores the successful rebound and suggests that whatever strategies were employed to overcome the initial hurdles have borne fruit. The precise factors contributing to this remarkable turnaround are not detailed here, but the data suggests that Craft Leaf has managed to significantly enhance its market presence and consumer appeal in a short period, a testament to the brand's resilience and strategic agility in the dynamic Michigan cannabis market.

Competitive Landscape

In the competitive landscape of the Michigan flower cannabis market, Craft Leaf has shown a notable trajectory in terms of rank and sales, despite not being ranked in the top 20 brands until February 2024. By March 2024, Craft Leaf secured the 18th position, illustrating a significant upward movement. This is particularly impressive when considering the performance of its competitors. For instance, High Life Farms experienced a steady rise from 55th to 16th position from December 2023 to March 2024, indicating a more aggressive growth in rank and sales. Similarly, Glo Farms and Everyday Cannabis have shown resilience in maintaining their positions within the top 20, with Glo Farms slightly ahead in March 2024 at 17th place, just above Craft Leaf. Notably, The Limit made a surprising entry directly into the 20th position by February 2024, bypassing the gradual climb seen by other brands. Craft Leaf's ascent in the rankings, amidst such dynamic competition, suggests a growing consumer interest and potential for further market penetration, making it a brand worth watching for future developments.

Notable Products

In March 2024, Craft Leaf's top-performing product was Golden Sundream (Bulk) in the Flower category, achieving the highest sales with a total of 45,387 units. Emerald Frostbite (Bulk) followed closely behind, securing the second position with a notable improvement from its previous rank in January as the third. Craft Cake (Bulk) also showed a consistent rise in popularity, moving up to the third rank in March from the fourth in January. Purple Haze Dream (Bulk), which was the leading product in January, experienced a slight dip, ending up in the fourth position for March. Lastly, Blueberry Dream Catcher (Bulk) made it to the top five, despite being ranked fourth in February, indicating a competitive and dynamic market for Craft Leaf's products.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.