Sep-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

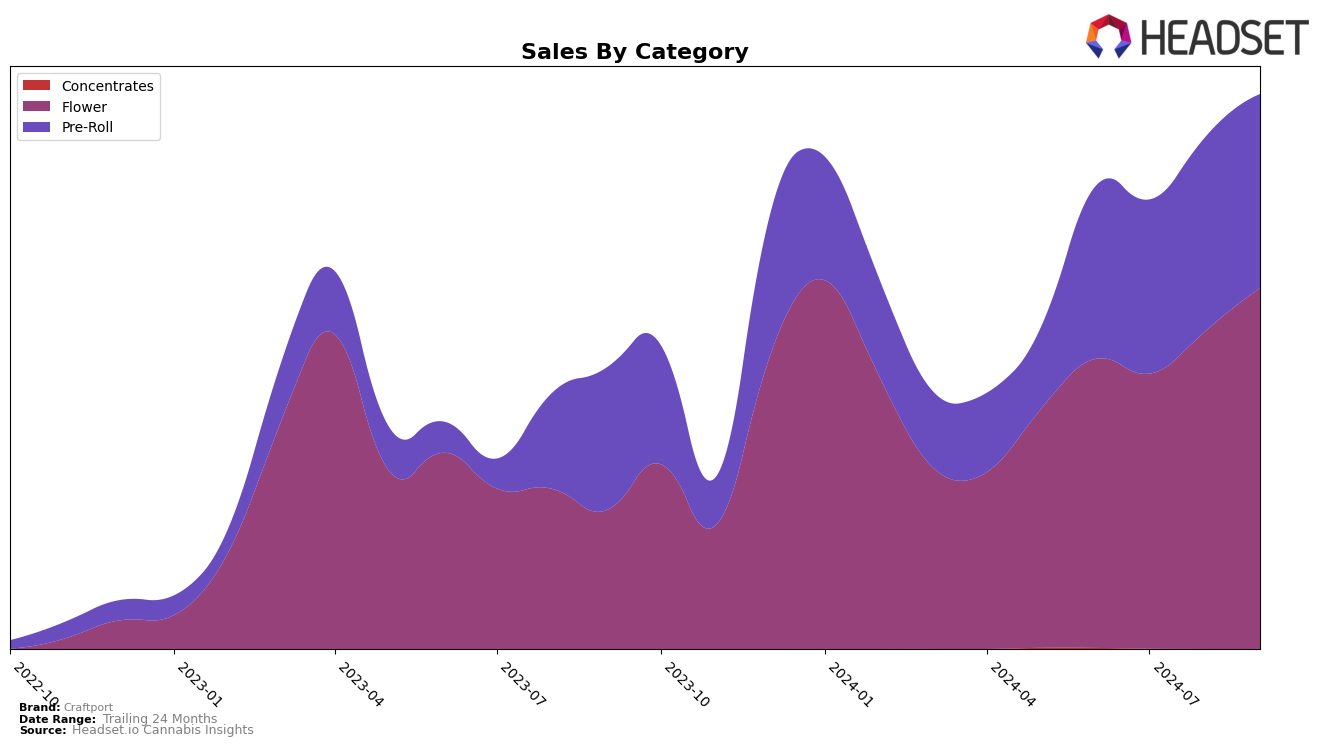

Craftport's performance in the Alberta market has shown noteworthy fluctuations across categories. In the Flower category, Craftport has maintained a presence within the top 30 brands, with a slight dip in August 2024 when it fell to 33rd position but rebounded to 28th in September 2024. This rebound is notable as it coincides with a significant increase in sales, suggesting effective strategies or product offerings that resonated well with consumers. On the other hand, the Pre-Roll category has been more challenging, with Craftport consistently ranking outside the top 30, peaking at 41st place in August 2024. This persistent lower ranking indicates potential areas for improvement or increased competition in the Pre-Roll segment.

In Saskatchewan, Craftport's presence in the Flower category has been less stable, with rankings falling outside the top 50. The brand did not make it into the top 30 in any of the months analyzed, which highlights the competitive nature of the market or possible gaps in Craftport's market penetration strategy. The absence of rankings in July and September 2024 may suggest that Craftport is facing challenges in maintaining consistent sales or visibility in this province. This could be a critical area for Craftport to address if they aim to strengthen their market position in Saskatchewan.

Competitive Landscape

In the competitive landscape of the flower category in Alberta, Craftport has demonstrated a dynamic performance over the past few months. Starting from June 2024, Craftport was ranked 27th but saw a dip to 30th in July, followed by a further decline to 33rd in August. However, Craftport made a notable recovery in September, climbing back to 28th place. This fluctuation in rank correlates with a significant increase in sales from July to September, suggesting a positive trend in consumer preference or market strategy adjustments. In contrast, competitors like Good Buds and MTL Cannabis have maintained relatively stable ranks, with MTL Cannabis consistently outperforming Craftport in sales. Meanwhile, Tribal and Endgame have shown varying performances, with Tribal improving its rank significantly by September. These insights suggest that while Craftport faces stiff competition, its recent sales growth indicates potential for further market penetration and rank improvement.

Notable Products

In September 2024, Craftport's top-performing product was the Silver Rhino Pre-Roll 2-Pack (1g), maintaining its number one rank consistently since June with impressive sales of 14,748 units. The Cherry Lime Kiss Pre-Roll (0.7g) also held steady at the second position across all months, showing a slight recovery in sales to 4,311 units from August. Fruity Explosion (28g) remained in third place, showing a notable increase in sales from previous months. The Fruity Explosion Pre-Roll 3-Pack (2.1g) climbed back into the rankings at fourth place, while Sweet Thang Pre-Roll (0.5g) made a notable entry at fifth place in September. Overall, Craftport's pre-roll category continues to dominate with consistent top rankings, while the flower category shows potential for growth.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.