Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

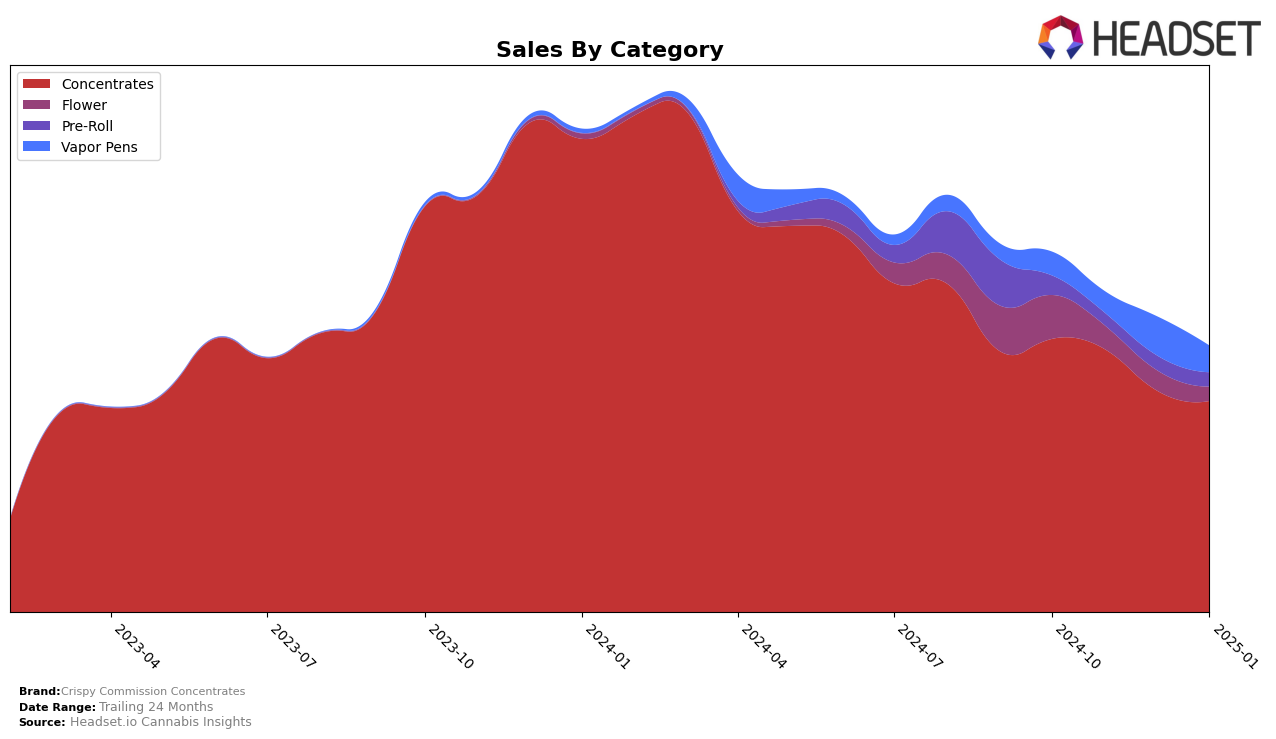

Crispy Commission Concentrates has maintained a strong presence in the Massachusetts concentrates market, consistently holding the number two spot from October 2024 through January 2025. Despite a gradual decline in monthly sales from $431,852 in October to $333,553 in January, their ranking stability indicates a robust brand loyalty or market positioning that keeps them at the forefront of this category. In contrast, their performance in the vapor pens category shows more variability with rankings fluctuating between 61st and 81st place, reflecting a competitive landscape or potential challenges in brand perception or product differentiation within this segment.

It's worth noting that Crispy Commission Concentrates did not make it into the top 30 brands for vapor pens in Massachusetts for most of the observed months, highlighting a significant opportunity for growth or a need for strategic realignment in this category. This absence from the top rankings could be seen as a gap in market penetration or consumer preference, which may warrant further exploration or targeted marketing efforts. The brand's consistent performance in concentrates suggests a solid foundation to potentially leverage in bolstering their presence in other product categories.

Competitive Landscape

In the Massachusetts concentrates market, Crispy Commission Concentrates has consistently maintained its position as the second-ranked brand from October 2024 through January 2025. Despite a steady decline in sales over these months, Crispy Commission Concentrates has managed to hold its rank, indicating strong brand loyalty or effective market strategies. The top competitor, Good Chemistry Nurseries, has consistently held the first position with a noticeable upward sales trend, suggesting a widening gap in market leadership. Meanwhile, Nature's Heritage and Cultivators Classic have shown fluctuations in their rankings, with Cultivators Classic climbing from fifth to third place by January 2025, potentially posing a future threat to Crispy Commission Concentrates if sales trends continue. This competitive landscape highlights the need for Crispy Commission Concentrates to innovate or enhance its market presence to sustain its rank amidst dynamic market shifts.

Notable Products

In January 2025, Northern Goat Cured Budder (1g) emerged as the top-performing product for Crispy Commission Concentrates, achieving first place with sales of 543 units. The North Star Cured Budder (1g) followed closely in second place, while Super Boof Live Sugar (1g) secured the third position. Pink and Blue Waffles Cured Budder (1g) and OG Cherry Berry Pie Cured Budder (1g) rounded out the top five, ranking fourth and fifth, respectively. Notably, these rankings represent a strong debut for these products, as they were not ranked in the previous months of October, November, or December 2024. This indicates a successful launch or increased popularity in January 2025 for these offerings.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.