Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

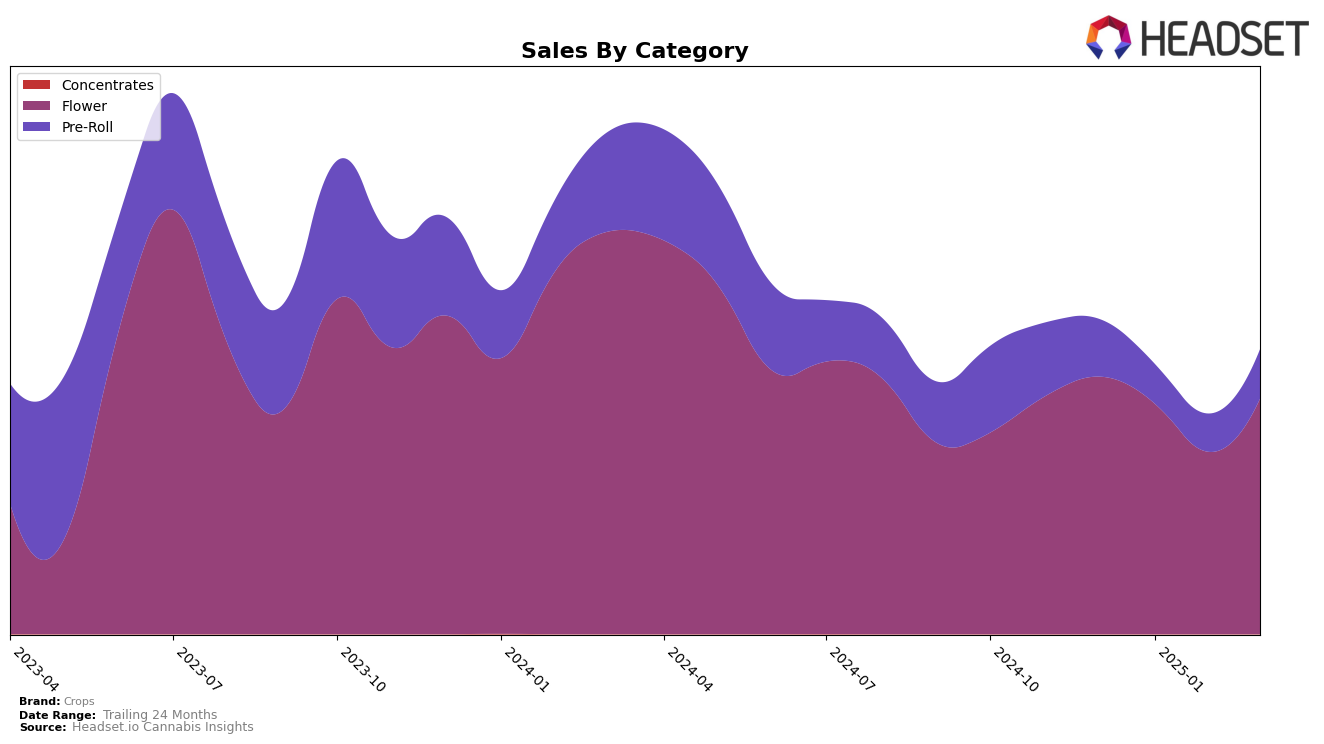

In the state of Illinois, Crops has faced challenges in maintaining a strong presence in the Flower category. Throughout the months from December 2024 to March 2025, the brand has consistently ranked outside the top 30, indicating a struggle to capture significant market share in this competitive state. Despite this, there was a notable uptick in sales from February to March, suggesting potential for recovery or a strategic shift that could improve their standing in the future. The brand's absence from the top ranks highlights the competitive nature of the Illinois market, where other brands might be dominating consumer preferences.

Conversely, Crops has demonstrated a more robust performance in New Jersey, particularly in the Flower category, where it consistently ranks within the top 10. Although there was a dip in its ranking from January to February 2025, Crops quickly rebounded in March, maintaining its competitive edge. In the Pre-Roll category, the brand has shown steadiness, holding its rank at 9th place for most of the period, except for a slight drop in January. This consistency in New Jersey reflects Crops' strong brand presence and consumer loyalty, which could be attributed to effective marketing strategies or a popular product lineup.

Competitive Landscape

In the competitive landscape of the New Jersey flower category, Crops has experienced notable fluctuations in its ranking and sales performance over the past few months. Starting from a strong position at 5th place in December 2024, Crops saw a dip to 8th place in February 2025 before recovering slightly to 6th place in March 2025. This fluctuation is indicative of a competitive market where brands like Simply Herb and Savvy have shown more stable or improving trends. Simply Herb, for instance, improved its rank from 9th in December to 5th by February, maintaining that position in March, while Savvy consistently held a top 4 position throughout the period. Crops' sales trajectory reflects these rank changes, with a decline from December to February, followed by a rebound in March. This suggests that while Crops remains a strong contender, it faces stiff competition from brands that are either maintaining or improving their market positions, highlighting the need for strategic adjustments to regain and sustain higher rankings.

Notable Products

In March 2025, Wizard's Staff Pre-Roll (1g) maintained its position as the top-performing product for Crops, with sales reaching 3177 units, marking a return to the number one spot after leading in January. Watermelon Mouthwash Pre-Roll (1g) held steady at the second position, showing consistent performance since its introduction in February. Blue Dream (1g) emerged in March as the third-ranked product, indicating a strong entry into the market. Velvet Lushers (3.5g) debuted in fourth place, contributing to the Flower category's presence in the top ranks. Animal Mint Cake (3.5g), which was the top product in February, fell to fifth, suggesting a shift in consumer preferences or seasonal demand changes.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.