Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

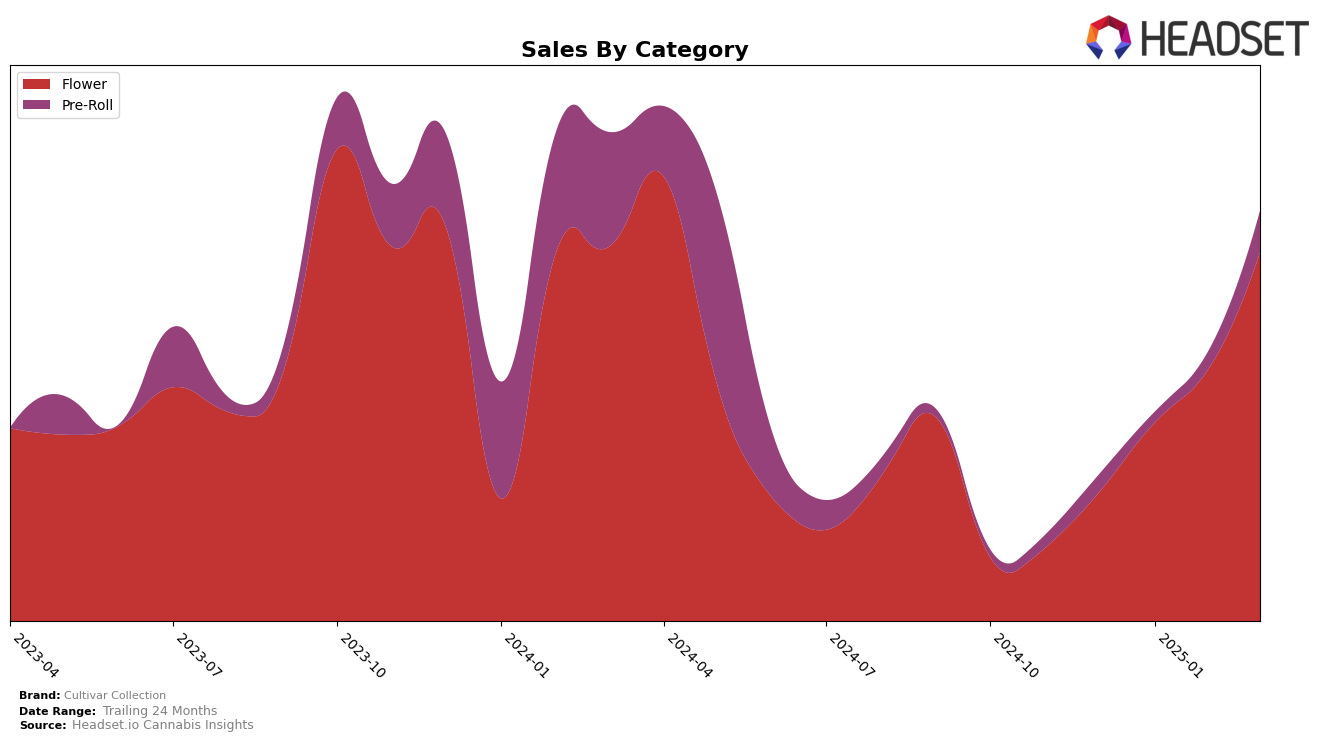

In the state of Maryland, Cultivar Collection has shown a notable upward trajectory in the Flower category. Starting from the 40th position in December 2024, the brand climbed its way to the 30th position by March 2025. This consistent improvement indicates a growing acceptance and popularity of their Flower products among consumers. The sales figures corroborate this trend, with a significant increase from $104,599 in December to $276,283 by March. However, it is important to note that the brand was not in the top 30 in December, which suggests there was a considerable effort to enhance their market presence in the following months.

In contrast, the Pre-Roll category in Maryland presented a more stable yet less dynamic performance for Cultivar Collection. The brand maintained the 42nd position from December 2024 through February 2025, before making a modest rise to the 35th position by March. Despite this improvement, the brand's absence from the top 30 throughout the observed period highlights the competitive nature of the Pre-Roll market. Nonetheless, the sales figures show a positive trend, with sales more than doubling from $25,451 in December to $42,146 by March, indicating potential for further growth in this category.

Competitive Landscape

In the competitive landscape of the Flower category in Maryland, Cultivar Collection has demonstrated notable progress in its rankings over the past few months. Starting from a rank of 40 in December 2024, Cultivar Collection climbed to 30 by March 2025, showcasing a consistent upward trajectory. This improvement is significant when compared to competitors like Khalifa Kush, which fluctuated between ranks 28 and 37, and Legend, which saw a decline from 23 to 32. Meanwhile, Small A$$ Bud maintained a relatively stable position, ending at rank 29 in March. Cultivar Collection's sales growth is also noteworthy, with a substantial increase from January to March, indicating a strengthening market presence. This upward trend suggests that Cultivar Collection is effectively capturing market share and could continue to rise in rank if the current momentum is maintained.

Notable Products

In March 2025, Firecracker (3.5g) emerged as the top-performing product for Cultivar Collection, securing the number one spot in the rankings with notable sales of 1944 units. Whoopie Pie Pre-Roll (1g) maintained its strong position, staying steady at second place with an increase from 1102 units in February to 1625 units in March. Earthquake (3.5g) slipped from its previous leading position in January and February to third place in March. Smiley Face (3.5g) moved down one spot to fourth place, despite an increase in sales compared to February. Colonial Kush (3.5g) entered the rankings at fifth place, showing a strong performance for the month.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.