Apr-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

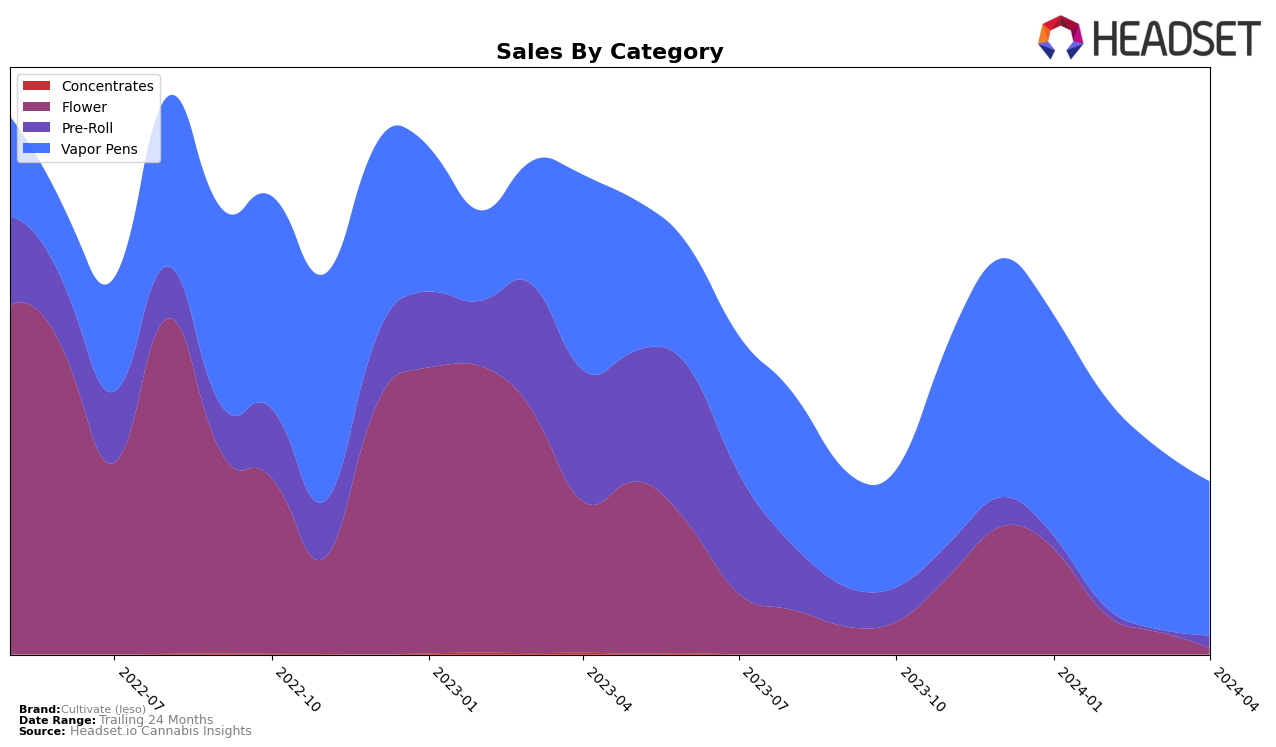

In the competitive cannabis market of Illinois, Cultivate (Ieso) has shown varied performance across different product categories. Notably, in the Vapor Pens category, the brand maintained a strong presence, ranking within the top 25 from January to April 2024. This consistency is impressive, especially considering the slight rank decrease from 20th in January to 25th in April, which suggests a stable demand for their vapor pens amidst growing market competition. However, the story is quite different in the Flower and Pre-Roll categories. For Flower, Cultivate (Ieso) experienced a significant drop, starting at rank 40 in January and falling out of the top 60 by April, which indicates a declining market position. Similarly, in the Pre-Roll category, the brand's visibility fluctuated, missing from the rankings entirely in March, yet managing a rank of 49 in April. This volatility highlights challenges in maintaining market share in these highly competitive categories.

Financially, the brand's performance offers insights into its market dynamics. In the Vapor Pens category, Cultivate (Ieso) saw a gradual decrease in sales from January to April 2024, starting at $451,700 and dropping to $315,198 by April. This downward trend in sales, despite maintaining a relatively stable ranking, could reflect broader market pressures or increased competition affecting pricing and consumer preferences. The significant sales drop in the Flower category, from $215,308 in January to just $12,454 by April, mirrors the brand's plummeting rank and suggests a critical need to reassess its strategy within this segment. Pre-Roll sales data, while incomplete, also indicates inconsistency, with a notable absence in March followed by a rebound in April. This mixed financial and ranking performance across categories underscores the importance of strategic flexibility and market responsiveness for Cultivate (Ieso) in the evolving Illinois cannabis landscape.

Competitive Landscape

In the competitive landscape of the vapor pens category in Illinois, Cultivate (Ieso) has experienced a fluctuation in its market position from January to April 2024, initially ranking 20th and then moving to 25th by April. This shift indicates a challenging environment, especially as competitors like Aeriz and Lula's have shown more stability in their rankings, with Aeriz maintaining a position closer to the top 20 throughout the same period and Lula's even improving its standing to 23rd by April. Notably, Superflux has made significant gains, jumping from a rank of 36th in January to 27th by April, showcasing a remarkable improvement in sales and market position. These movements suggest a highly competitive market where brands are closely contending for consumer attention and sales. Cultivate (Ieso)'s slight decline in rank, juxtaposed with the upward trajectory of Superflux and the relative stability of Aeriz and Lula's, highlights the dynamic nature of consumer preferences and the importance of strategic positioning within the Illinois vapor pens market.

Notable Products

In April 2024, Cultivate (Ieso) saw Selfies - Jungle Cake Pre-Roll (0.7g) as its top-selling product with a notable sales figure of 3161 units, marking its first appearance in the rankings. Following closely, CuraVape - Cherry Pie Distillate Cartridge (0.5g) maintained a strong performance, securing the second rank for the third consecutive month. The third spot was taken by CuraVape - Blue Dream Distillate Cartridge (0.5g), which saw a slight dip from being the top seller in the previous two months. CuraVape - Hippie Crasher BDT Distillate Cartridge (0.5g) and CuraVape - Outer Space Distillate Cartridge (0.5g) rounded out the top five, consistently holding their positions within the top rankings over the past months. This shift highlights a significant interest in pre-rolled products, disrupting the dominance previously held by vapor pens in Cultivate (Ieso)'s product lineup.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.