Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

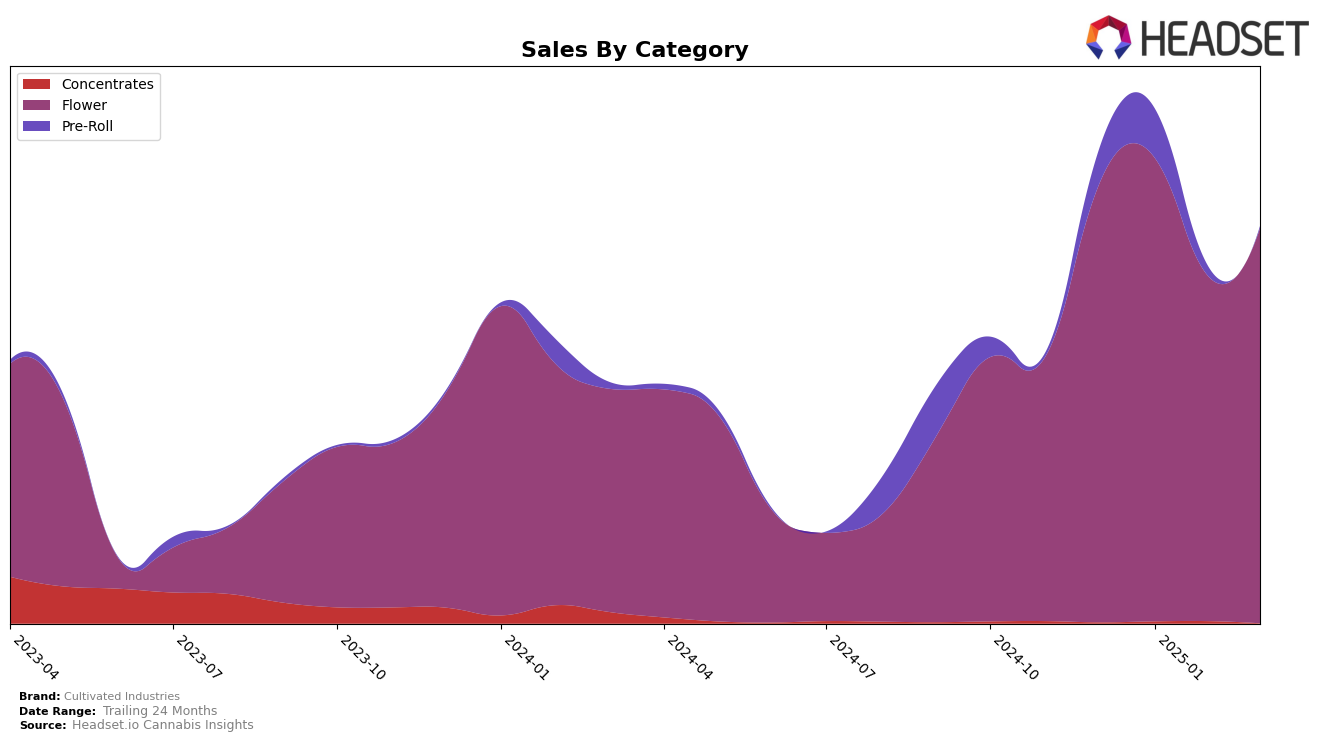

In Oregon, Cultivated Industries has demonstrated a fluctuating performance in the Flower category. The brand saw a notable improvement from December 2024 to January 2025, moving from 14th to 12th place, which coincided with a rise in sales from $373,668 to $395,124. However, by February, the brand's rank dropped to 17th, indicating potential challenges in maintaining momentum, although it rebounded to 14th place by March. This suggests that while Cultivated Industries has a strong presence in the Flower category, sustaining growth remains a critical challenge.

When examining the Pre-Roll category in Oregon, Cultivated Industries did not rank within the top 30 in February and March 2025, despite a promising start with ranks of 61 and 54 in December 2024 and January 2025, respectively. The absence from the top 30 in the latter months could point to increased competition or shifts in consumer preferences that the brand needs to address. This gap in performance highlights an area for potential strategic focus if Cultivated Industries aims to strengthen its market position within this category.

Competitive Landscape

In the competitive landscape of the Oregon flower market, Cultivated Industries has experienced notable fluctuations in its ranking over the past few months. Starting from December 2024, Cultivated Industries held the 14th position, improved to 12th in January 2025, but then dropped to 17th in February before rebounding to 14th in March. This volatility in rank is mirrored by its sales performance, which saw a dip in February but showed recovery in March. In comparison, Eugreen Farms consistently outperformed Cultivated Industries, maintaining higher ranks and sales, although it experienced a drop to 15th in March. Meanwhile, Deep Creek Gardens showed a strong comeback in March, surpassing Cultivated Industries by climbing to 12th place. Interestingly, PDX Organics demonstrated a significant rise from being outside the top 20 in December to securing the 13th spot by March, indicating a positive growth trajectory that could pose a future challenge to Cultivated Industries. Despite these competitive pressures, Cultivated Industries' ability to regain its rank in March suggests resilience and potential for strategic growth in the Oregon flower market.

Notable Products

In March 2025, the top-performing product for Cultivated Industries was Yuck Mouth (Bulk) in the Flower category, which moved from an unranked position in previous months to rank 1, with impressive sales of 9969 units. Frosty Gary B-Bud (3.5g), also in the Flower category, secured the second spot, having been unranked in the months prior. Permanent Marker (Bulk) maintained a strong presence by climbing from rank 4 in February to rank 3 in March. Lemon Cherry Gelato (Bulk) followed closely, improving its rank from 5 in February to 4 in March. GG #4 (Bulk) experienced a slight decline, dropping from rank 3 in February to rank 5 in March despite consistent sales performance.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.