Jun-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

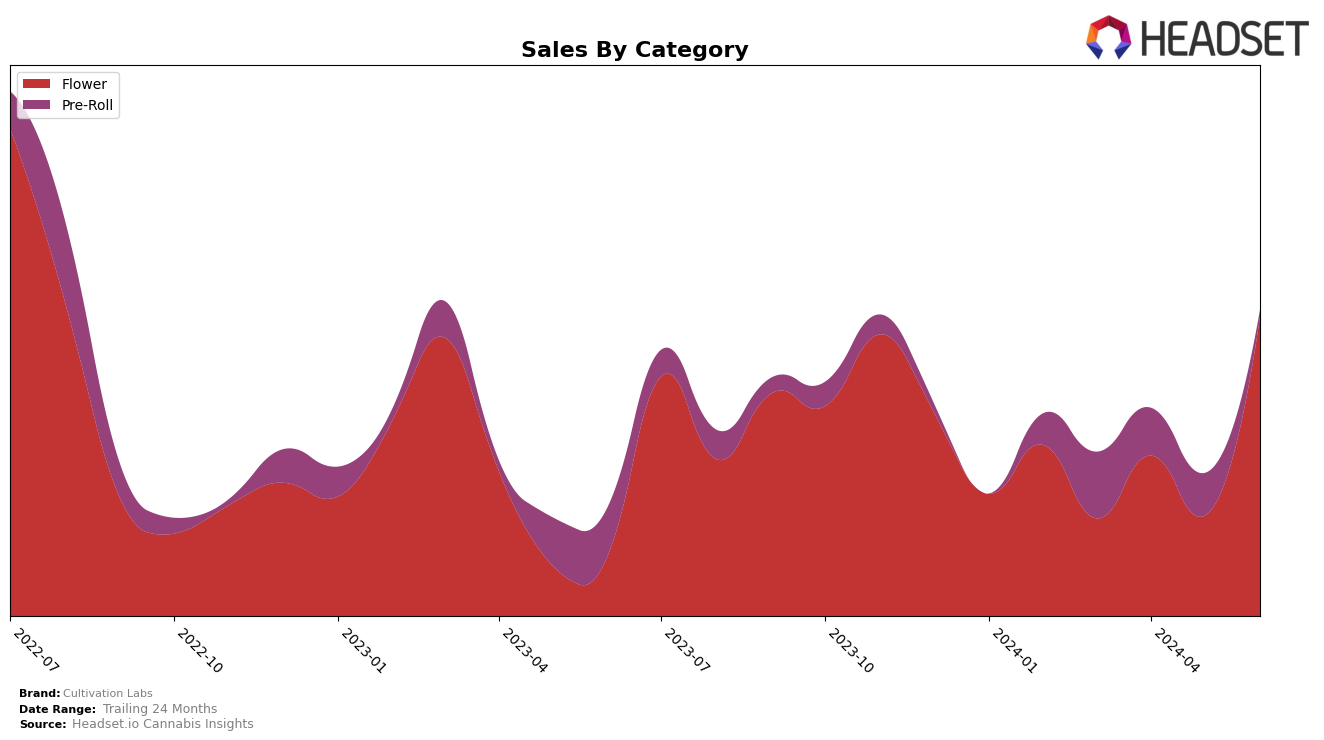

Cultivation Labs has shown significant variability in its performance across different categories and states over the past few months. In Nevada, the brand's ranking in the Flower category improved dramatically from 60th in March 2024 to 24th in June 2024, indicating a substantial upward trend. This positive movement is reflected in the sales figures, which saw a notable increase from $86,498 in March to $255,070 in June. However, the Pre-Roll category tells a different story, with the brand's ranking dropping from 37th in March to 64th in June. This decline is also evident in the sales, which fell from $60,296 in March to just $10,770 in June.

In terms of category performance, Cultivation Labs has seen mixed results. The Flower category in Nevada has been a strong point for the brand, with a notable improvement in ranking and sales over the past few months. On the other hand, the Pre-Roll category has struggled, with the brand failing to maintain its position within the top 30 brands in June. This indicates that while Cultivation Labs is gaining traction in certain areas, it faces challenges in others. These trends highlight the importance of focusing on category-specific strategies to sustain growth and market presence.

Competitive Landscape

In the competitive landscape of the Nevada flower category, Cultivation Labs has shown significant fluctuations in rank and sales over the past few months, indicating a volatile market presence. Notably, Cultivation Labs surged from a rank of 60 in March 2024 to 24 in June 2024, a remarkable improvement that suggests a strategic shift or successful marketing campaign. In contrast, competitors like Jasper Hill Farm and Polaris MMJ have experienced a decline in their rankings, with Jasper Hill Farm dropping from 22 to 23 and Polaris MMJ falling from 15 to 26 over the same period. This decline in competitor ranks could be attributed to various factors, including market saturation or changes in consumer preferences. Meanwhile, Redwood and Grassroots have shown mixed results, with Redwood improving its rank from 33 to 22 and Grassroots experiencing a drop from 17 to 25. These shifts highlight the dynamic nature of the Nevada flower market and underscore the importance of continuous innovation and customer engagement for Cultivation Labs to maintain and improve its market position.

Notable Products

In June 2024, Jenny Kush (1g) from Cultivation Labs topped the sales charts with a significant surge, achieving the number one rank with sales of 4,550 units. Super Mac (14g) made an impressive debut, securing the second position. Topanga Cake (14g) also performed well, coming in third. Headband Pre-Roll (1g) maintained a consistent presence, ranking fourth, though its sales saw a decline compared to previous months. Grand CRU (3.5g) entered the rankings at fifth place, showcasing a strong performance in its first month on the list.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.