Aug-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

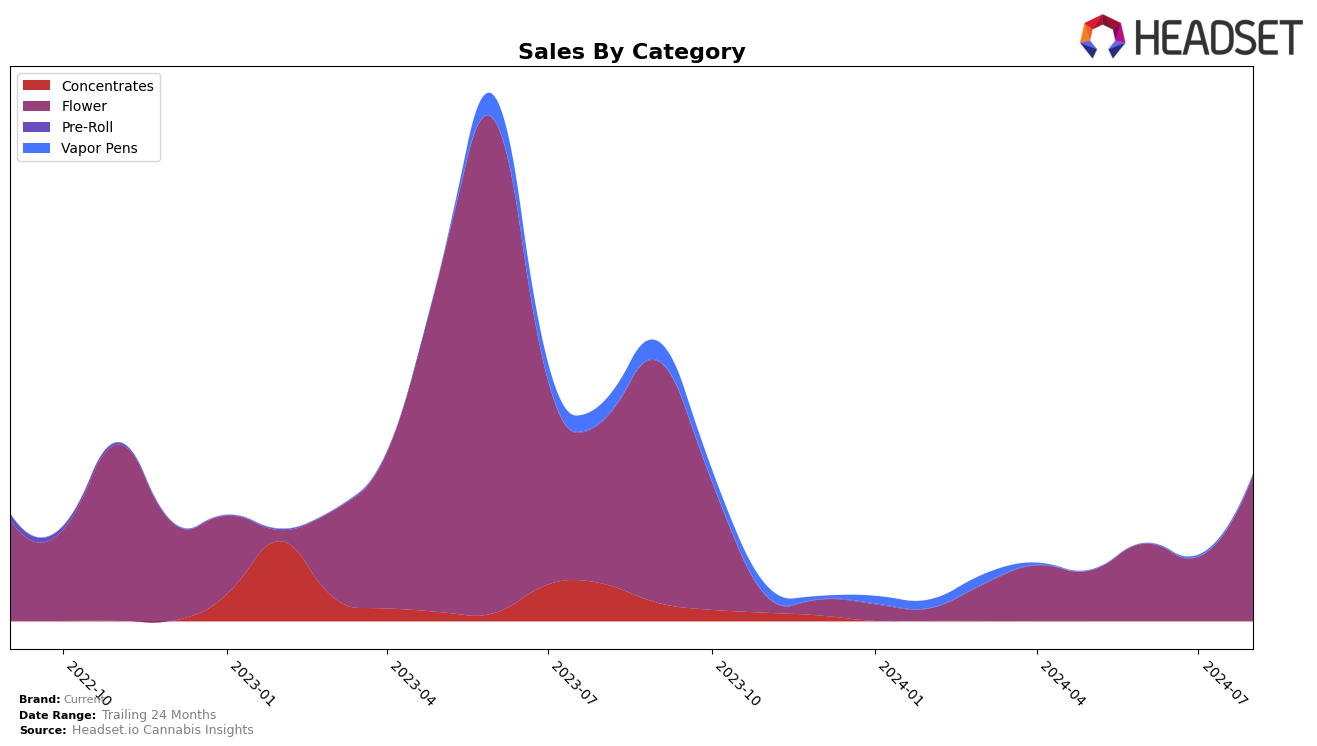

Current has shown a noteworthy performance in the Flower category across various states and provinces. In Saskatchewan, the brand made a significant leap from being ranked 58th in May 2024 to breaking into the top 30 by August 2024, securing the 29th position. This upward trajectory indicates strong market penetration and growing consumer acceptance. The sales figures support this trend, with a remarkable increase from $13,480 in May to $39,358 in August. Such movements are indicative of effective strategies and possibly an expanding product line that resonates well with the consumers in Saskatchewan.

While the performance in Saskatchewan is commendable, it's important to note that Current did not make it into the top 30 brands in other states and provinces for the Flower category during the same period. This absence from the rankings could be seen as a missed opportunity or a sign of highly competitive markets in those regions. However, the brand's ability to climb the ranks in Saskatchewan suggests potential for similar success in other markets if the right strategies are employed. Observing these trends can provide insights into where the brand might focus its efforts next to replicate its success in Saskatchewan.

Competitive Landscape

In the competitive landscape of the Flower category in Saskatchewan, Current has demonstrated significant fluctuations in rank and sales over recent months. Notably, Current's rank improved from 58th in May 2024 to 29th by August 2024, indicating a strong upward trend. This improvement is particularly significant when compared to competitors such as Bold, which saw a decline from 29th to 31st over the same period, and Encore, which dropped from 8th to 28th. Meanwhile, Catch Me Outside maintained a relatively stable position, fluctuating slightly but remaining within the top 30. The absence of Holy Mountain from the top 20 in May and June, followed by its appearance in July and August, suggests a late but notable entry into the competitive arena. These dynamics highlight Current's potential for growth and resilience in a competitive market, making it a brand to watch closely.

Notable Products

In August 2024, the top-performing product from Current was Grower's Pick Indica Milled (7g) in the Flower category, leading the sales with 496 units sold. Following closely was Grower's Pick Sativa Milled (7g), which moved up to the second position from its previous first-place ranking in July, with 450 units sold. Legendary Larry (3.5g), also in the Flower category, dropped to third place but still maintained strong sales figures. Banana Live Resin Cartridge (1g) held steady in fourth place within the Vapor Pens category, showing a slight increase in sales. Notably, Citral Glue (3.5g) did not rank in August, despite being in the top five in previous months.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.