Mar-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

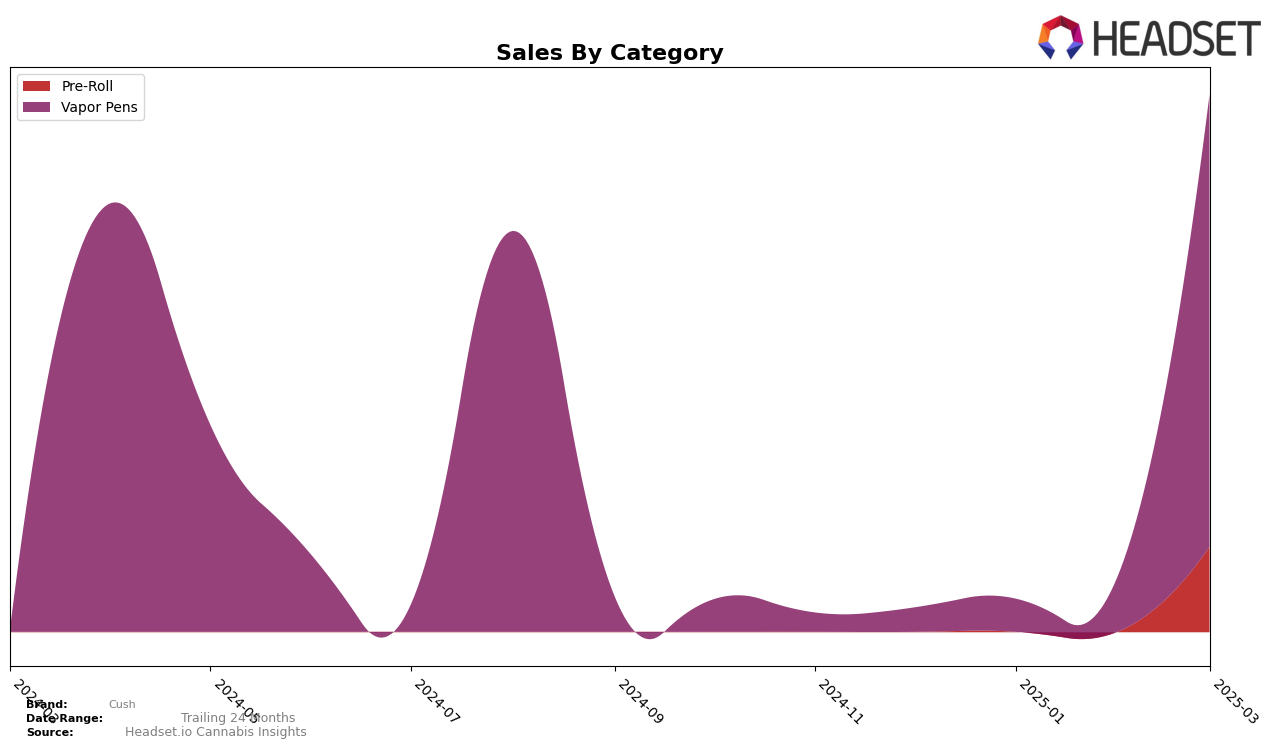

In the Arizona market, Cush has shown significant movements across different product categories. Notably, in the Vapor Pens category, Cush has made remarkable progress, jumping from being outside the top 30 to securing the 30th rank by March 2025. This upward trajectory indicates a substantial increase in consumer preference or successful strategic initiatives in this category. However, the brand did not make it into the top 30 for Pre-Rolls during the same period, which may suggest a need for improvement or a shift in focus towards more lucrative categories. The absence from the top 30 in Pre-Rolls could be seen as a missed opportunity in a state like Arizona, where competition is fierce.

The sales figures for Cush in the Vapor Pens category in Arizona have been impressive, with a notable increase from January to March 2025. This growth trajectory suggests that Cush's Vapor Pens are gaining traction among consumers, possibly due to product innovation or effective marketing strategies. While the data does not provide a complete picture of Cush's performance across all states, the trend in Arizona is promising. However, the lack of top 30 presence in the Pre-Roll category across the months indicates potential challenges or strategic decisions that may have impacted their market presence in this segment. This mixed performance highlights the dynamic nature of the cannabis market and the importance of category-specific strategies.

Competitive Landscape

In the competitive landscape of vapor pens in Arizona, Cush has demonstrated a remarkable upward trajectory from January to March 2025. Initially absent from the top 20 brands in December 2024, Cush surged to rank 76 in January and further climbed to rank 30 by March 2025. This impressive rise is indicative of a significant increase in sales, positioning Cush ahead of competitors like Session Farms, which saw a decline from rank 18 in December 2024 to 29 in March 2025, and Sauce Essentials, which fluctuated but remained outside the top 20 by March. Meanwhile, Cure Injoy and WZRD experienced varying ranks, with Cure Injoy improving to rank 27 by March, suggesting a competitive but dynamic market. Cush's rapid ascent highlights its growing consumer appeal and market penetration, setting a strong foundation for continued success in the Arizona vapor pen category.

Notable Products

In March 2025, Cush's top-performing product was the NYC 94 Sour Diesel Infused Pre-Roll 2-Pack, leading the sales charts in the Pre-Roll category with 1,150 units sold. Following closely was the Lemon Cherry Gelato Infused Pre-Roll 2-Pack, securing the second spot. The Lemoncillo Liquid Diamonds Disposable topped the Vapor Pens category, ranking third overall. The NYC 94 Sour Diesel Liquid Diamonds Disposable saw a slight decline, dropping from third to fourth place. Black Diamonds Infused Pre-Roll maintained a strong presence, rounding out the top five in March.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.