Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

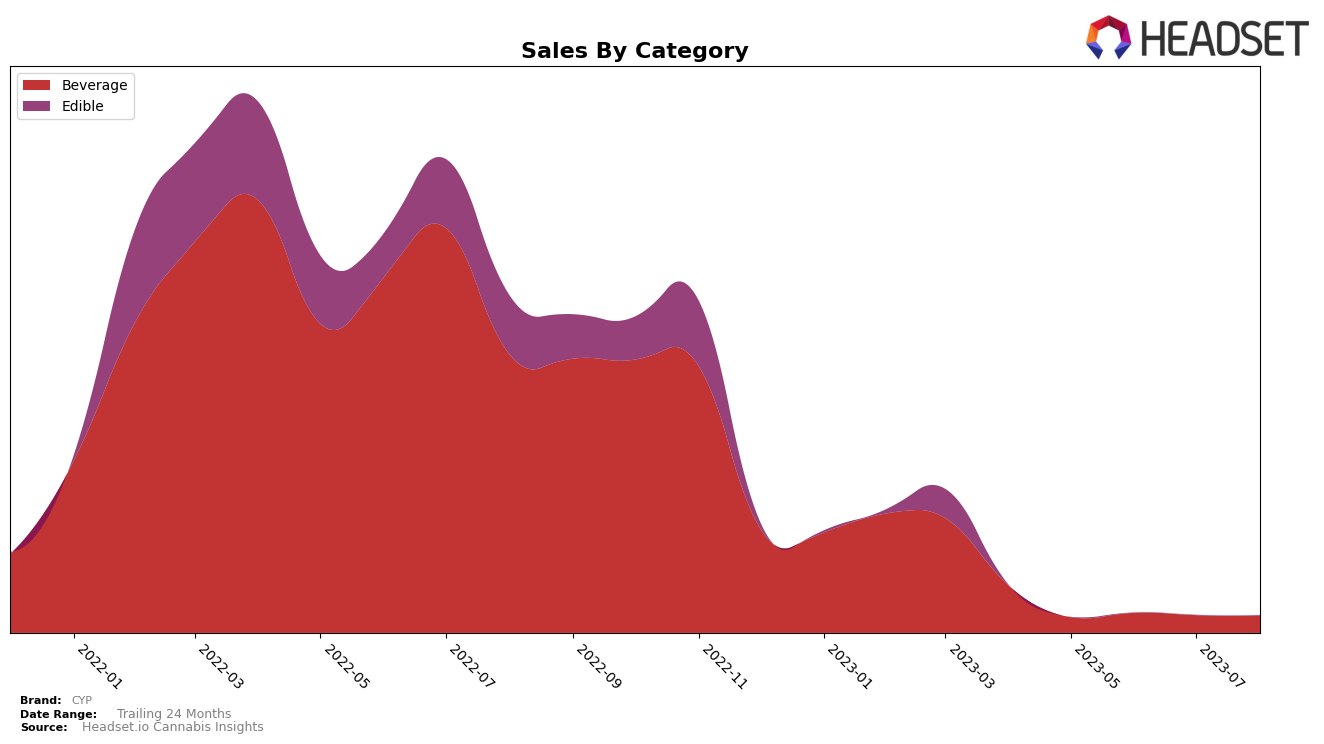

The cannabis brand CYP has been consistently maintaining its position in the Beverage category in the state of Michigan. It is noteworthy that from May 2023 to August 2023, CYP has held the 18th rank among the top 20 brands in this category. This consistency indicates a stable consumer base and demand for CYP's beverage products within the state. However, it also implies that the brand has not managed to climb up the ranks during these months, suggesting potential room for growth and improvement.

Looking at the sales, there is an interesting trend. CYP's sales in May 2023 were at 1366.0, which then saw a significant jump to 1758.0 in June 2023. However, the sales have slightly dipped in July and August, with 1549.0 and 1530.0 respectively. Despite the slight decrease, the sales figures are still higher than what they were in May. This indicates that while the brand has been successful in increasing its sales since May, it has been facing challenges in maintaining that growth rate. The brand might want to investigate the factors causing this fluctuation and address them to ensure steady growth.

Competitive Landscape

In the Beverage category in Michigan, CYP has maintained a steady rank of 18th over the past four months, showing a consistent performance amidst its competitors. Detroit Edibles / Detroit Fudge Company has shown a slight decrease in rank from 13th to 16th, indicating a potential decline in sales, while Cannavis Syrup has seen a fluctuation in rank, moving from 15th to 21st and back to 17th, suggesting an unstable market position. Cannashine has held a steady rank of 19th, just below CYP, but with a lower sales trend. Earthbound Remedies has had missing ranks for some months, indicating it was not in the top 20 brands, which could be a sign of lower sales. These trends suggest that CYP has a stable position in the market, but there is potential for growth and improvement.

Notable Products

In August 2023, the top-performing product from CYP was the Cherry Low Calorie Drink Powder 10-Pack (100mg), which held its top position from July and improved from the 2nd rank in June and 3rd in May. This product recorded 76 sales in August, maintaining its performance from July. The Lemonade Low Cal Rehydration Mix Powder (200mg) also showed significant improvement, rising to the 2nd rank in August from the 1st in June, despite not being in the top three in May. Notably, the Cherry Low Calorie Powdered Drink Mix 10-Pack (100mg) and the Grape Oral Rehydration Mix Solution 10-Pack (100mg) dropped out of the top three in August after being in the 4th and 3rd positions respectively in May. On the other hand, the Grape Low Calories Oral Rehydration Solution Powder Drink Mix (10mg), which was the top product in May, did not make it to the top three in August.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.