Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

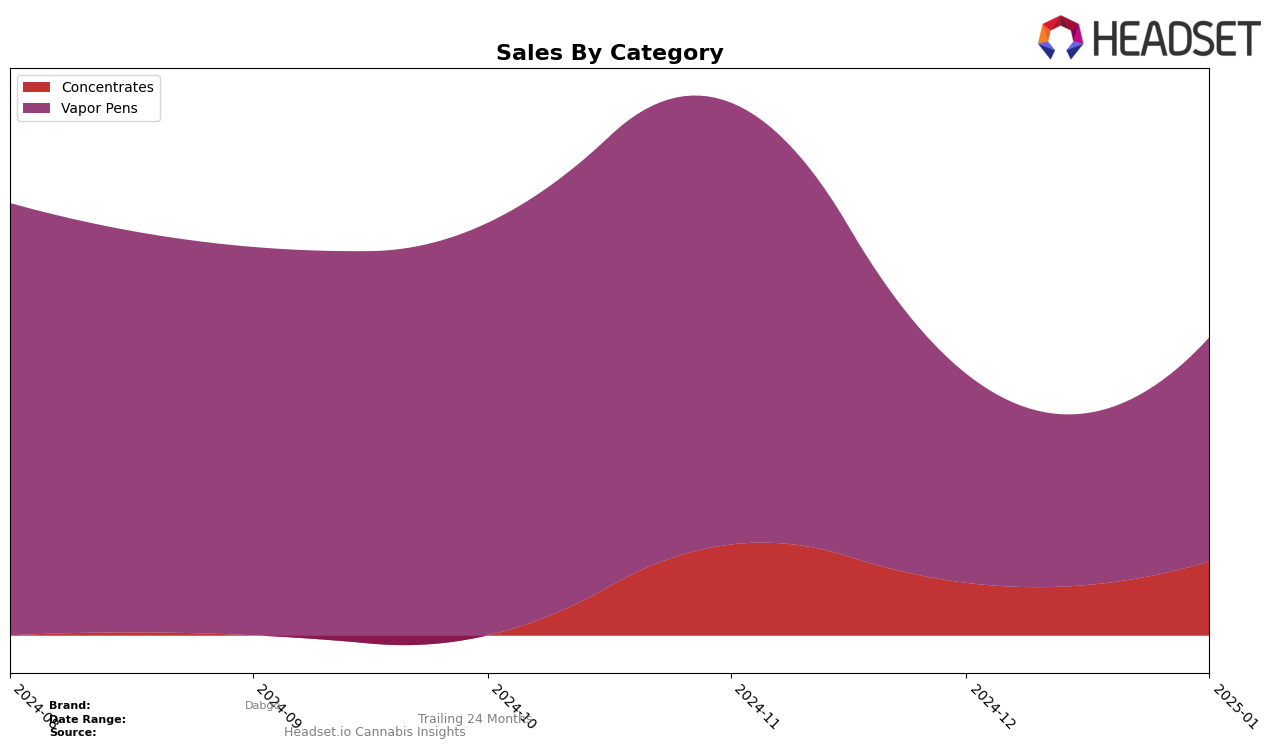

Examining Dabgo's performance in the Vapor Pens category in New York, it is evident that the brand has experienced a steady decline in its rankings over the recent months. Starting from a rank of 70 in October 2024, Dabgo slipped to 79 by January 2025. This downward trend is mirrored in their sales figures, which saw a significant drop from $29,357 in October to $15,936 by January. Such a trajectory suggests challenges in maintaining market presence or possibly increased competition in this category.

It is noteworthy that Dabgo has not appeared in the top 30 rankings for Vapor Pens in New York during this period, indicating a need for strategic adjustments to improve visibility and performance. The absence from the top 30 could be interpreted as a signal of either market saturation or insufficient brand differentiation. Further analysis would be required to understand the competitive landscape and consumer preferences that might be affecting Dabgo's market positioning.

Competitive Landscape

In the competitive landscape of vapor pens in New York, Dabgo has experienced a slight decline in rank from October 2024 to January 2025, moving from 70th to 79th place. This shift comes amidst varied performances from competitors. Notably, Snobby Dankins saw a significant rebound in January 2025, climbing to 73rd after being absent from the top 20 in December. Meanwhile, UMAMII showed a fluctuating trend, peaking at 75th in November before dropping to 82nd in January. Despite these changes, Dabgo's sales have remained relatively stable compared to Berkshire Roots and Blotter, both of which have maintained lower sales figures. This suggests that while Dabgo's rank has decreased, its market presence remains strong, indicating potential for strategic adjustments to reclaim higher positions in the upcoming months.

Notable Products

In January 2025, the top-performing product for Dabgo was Lucid Blue Live Resin Disposable (0.5g) from the Vapor Pens category, climbing to the number one rank with sales of 82 units. Berry Creamy Badder (0.5g) made an impressive debut in the Concentrates category, securing the second spot. Lucid Blue Badder Disposable (0.5g) dropped to third place from its previous top position in October 2024. Legend OG Badder Distillate Disposable (0.5g) and Watermelon Dreamz Live Resin Disposable (0.5g) tied for fourth place, both experiencing a decline from their higher ranks in prior months. This shift indicates a dynamic change in consumer preferences towards live resin products in January.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.