Dec-2024

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

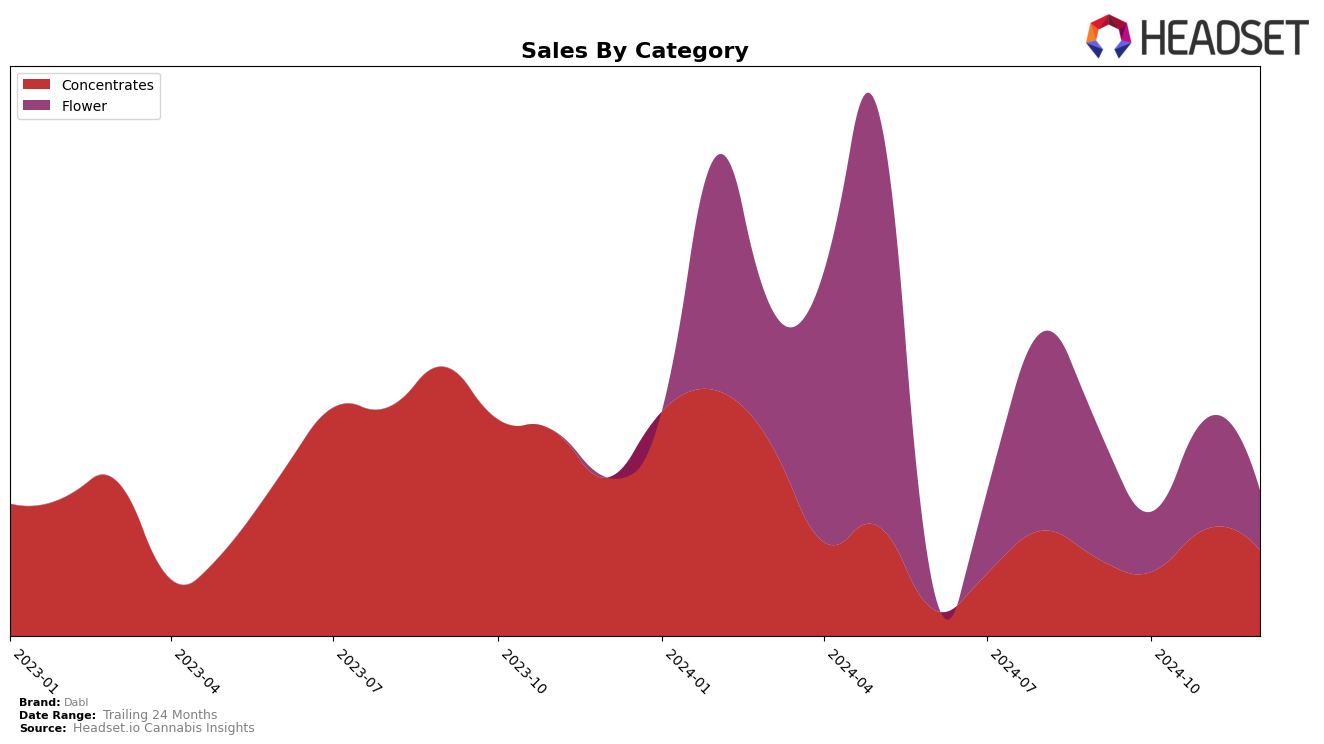

Dabl's performance in the Massachusetts concentrates category has shown significant fluctuations over the past few months. Starting from a position outside the top 30 in September 2024, Dabl made a notable leap to rank 26th in November, indicating a strong upward trend. However, this momentum was slightly tempered in December as the brand slipped back to the 30th position. This movement suggests that Dabl is gaining traction in the Massachusetts market, although the brand's position remains somewhat volatile. The sales figures corroborate this trend, with a notable increase in November, which aligns with their peak ranking for the period.

The data highlights the challenges and opportunities Dabl faces in solidifying its position within the concentrates category in Massachusetts. The absence from the top 30 in September and October suggests initial struggles, but the subsequent entry into the rankings indicates a potential turnaround. The brand's ability to climb into the top 30 and maintain a position, albeit fluctuating, could be seen as a positive development. The overall movement suggests that Dabl is making strategic adjustments that are beginning to pay off, though the December dip indicates that there is still work to be done to achieve consistent growth and maintain a stable rank.

```Competitive Landscape

In the Massachusetts concentrates market, Dabl has demonstrated a dynamic shift in its competitive standing over the last few months of 2024. Notably, Dabl's rank improved significantly from 44th in October to 26th in November, indicating a substantial boost in market presence and sales performance during that period. This upward trajectory was momentarily tempered as the brand settled at 30th in December. In comparison, Sticky Fish maintained a relatively stable position, consistently ranking within the top 32, with a slight improvement to 28th in December. MPX - Melting Point Extracts and Belushi's Farm also experienced fluctuations, with Belushi's Farm notably climbing from 45th in October to 27th in November, before dropping to 32nd in December. Meanwhile, Avexia maintained a steadier performance, hovering around the mid-30s rank. These shifts highlight Dabl's potential for growth and increased competitiveness, especially when compared to brands like Belushi's Farm and MPX, which have shown more volatility in their rankings.

Notable Products

In December 2024, Booberry Cookies (28g) from the category Flower emerged as the top-performing product for Dabl, climbing from a previous rank of 5 in November to 1 with sales of 157 units. Devil's Dust THCA Isolate (1g) maintained a strong presence, although it slipped from its consistent top position from September to November to rank 2 in December. Mandarin Zkittles Live Resin Sugar (1g) made a notable entry at rank 2, sharing the spot with Devil's Dust THCA Isolate. Planet of the Grapes Live Resin Batter (1g) held steady at rank 3, showing a slight increase in sales. Apples and Bananas Live Resin Batter (0.5g) debuted at rank 4, marking its presence in the competitive concentrates category.

Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.