Jan-2025

Sales

Trend

6-Month

Product Count

SKUs

Overview

Market Insights Snapshot

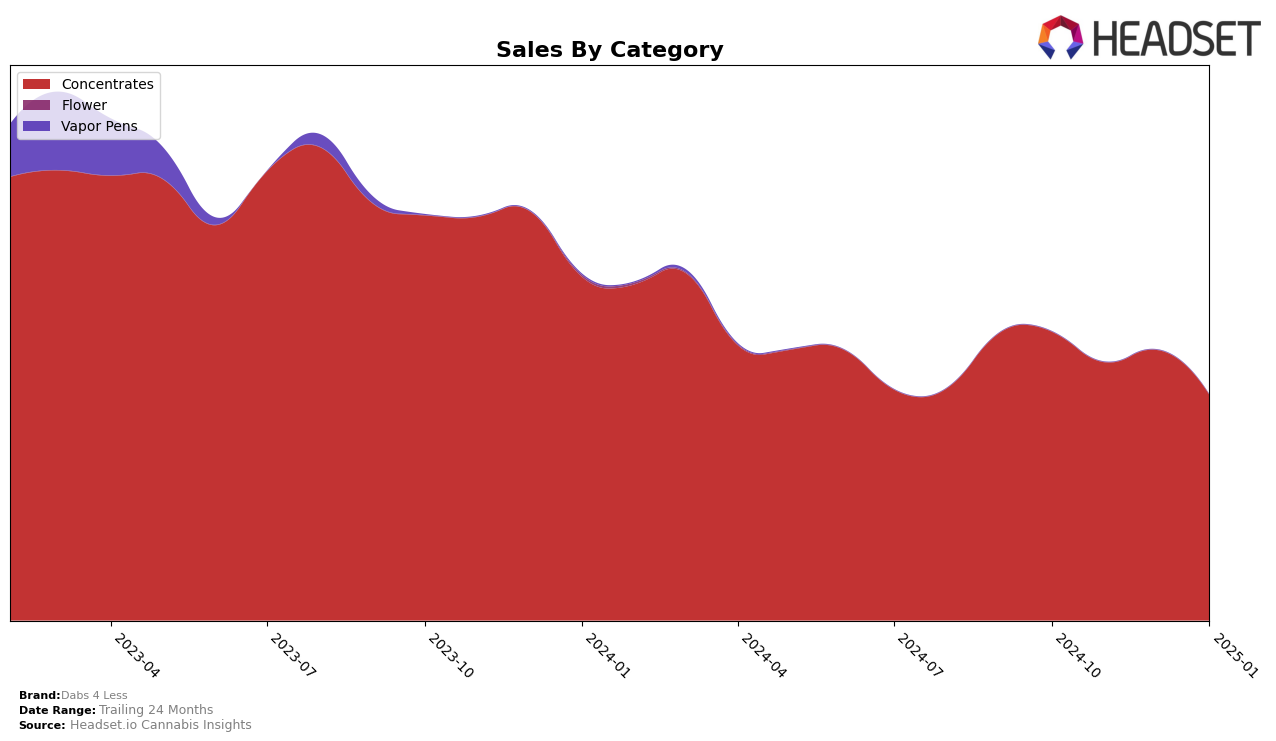

Dabs 4 Less has shown a dynamic performance across various states and product categories. In the state of Washington, the brand has consistently maintained a presence within the top 30 for the Concentrates category. However, there has been some fluctuation in their ranking over the months, with a notable drop from 11th place in October 2024 to 15th in January 2025. This decline in rank is accompanied by a decrease in sales, which suggests potential challenges in maintaining market share or increased competition within the state. The brand's ability to remain in the top 15 indicates a strong foothold, though the downward trend could be a cause for concern if it continues.

Interestingly, the absence of Dabs 4 Less in the top 30 rankings for other states or categories might signal areas where the brand could focus on expanding its presence. Being outside the top 30 can be seen as a missed opportunity in those markets, suggesting that there is room for growth and improvement. Such insights into state-specific performance and category rankings are crucial for understanding the brand's overall market strategy and identifying potential areas for development. By analyzing these trends, stakeholders can better strategize on how to enhance their market position and capitalize on untapped opportunities.

Competitive Landscape

In the Washington concentrates market, Dabs 4 Less has experienced notable fluctuations in its competitive positioning from October 2024 to January 2025. Initially ranked 11th in October, Dabs 4 Less saw a dip to 13th in November, regained its 11th position in December, but fell to 15th by January. This volatility in rank reflects a competitive landscape where brands like Crystal Clear and Bodega Buds have shown more stable or improving trajectories. For instance, Bodega Buds climbed from 18th to 13th, while Crystal Clear maintained a relatively stable presence, ending January in 14th place. Despite Dabs 4 Less's higher sales figures compared to competitors like Hitz Cannabis and Constellation Cannabis, its rank decline suggests a need for strategic adjustments to maintain its market position against brands with rising momentum.

Notable Products

In January 2025, Orange Creamsicle BHO Wax (1g) emerged as the top-performing product for Dabs 4 Less with sales reaching 2414 units. It was followed by PB & J Wax (1g) and Mendo Crush Wax (1g), which held the second and third positions respectively. Wedding Crashers BHO Wax (1g) and Biscotti Wax (1g) rounded out the top five, ranking fourth and fifth. Notably, all these products maintained consistent positions from previous months, indicating stable demand. The Concentrates category dominated the sales chart for January, showcasing a strong preference among consumers.

```Top Selling Cannabis Brands

Data for this report comes from real-time sales reporting by participating cannabis retailers via their point-of-sale systems, which are linked up with Headset’s business intelligence software. Headset’s data is very reliable, as it comes digitally direct from our partner retailers. However, the potential does exist for misreporting in the instance of duplicates, incorrectly classified products, inaccurate entry of products into point-of-sale systems, or even simple human error at the point of purchase. Thus, there is a slight margin of error to consider. Brands listed on this page are ranked in the top twenty within the market and product category by total retail sales volume.